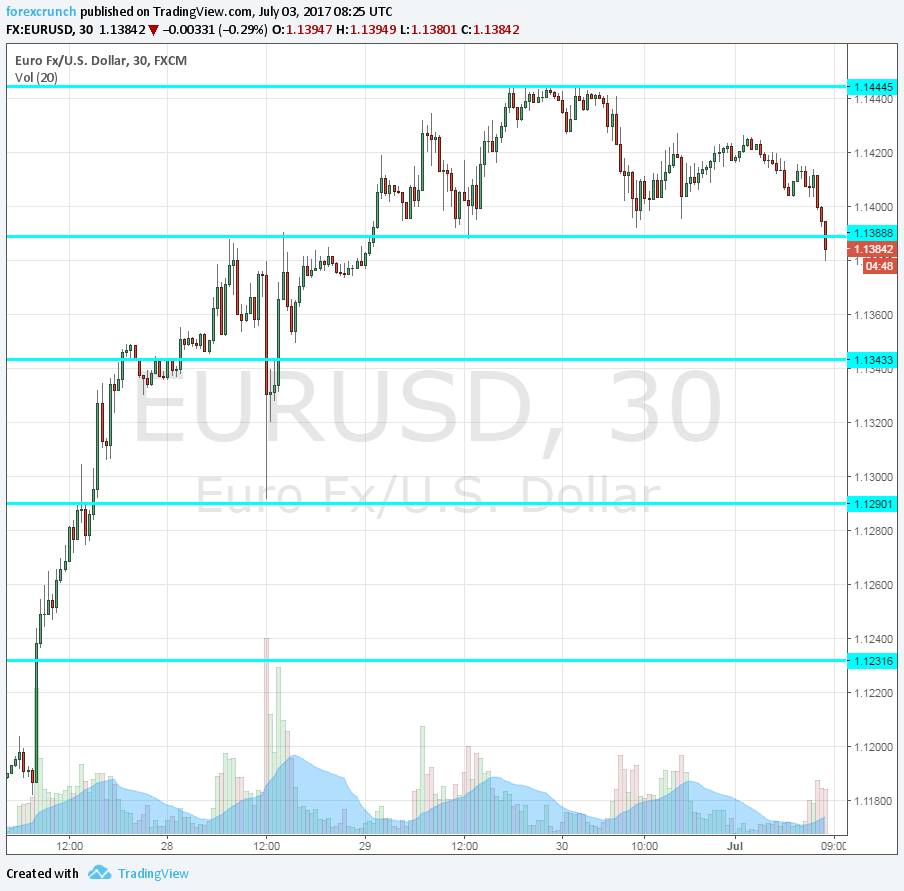

EUR/USD is trading around 1.1380, already over 60 pips below the peak of 1.1445 seen last week and some 35 pips down on the day.

The move is related to a recovery in the US dollar. The greenback is correcting some of its losses across the board. GBP/USD is also lower and USD/JPY is higher.

There was no specific news item that can be attributed to the rise of the dollar. Trump is in trouble over more offensive tweets over the weekend. After attacking the TV hosts at Morning Joe, Trump published a video showing him punching CNN.

The juvenile tweets by the President of the USA could delay tax reform and thus hurt the dollar. However, markets got used to these musings and are ignoring it.

It seems to be simple profit-taking.

In the euro-zone, manufacturing PMIs did not provide huge surprises: Spain’s manufacturing PMI missed expectations but the German number was revised to the upside.

EUR/USD – correction before the next move up?

A more important figure came out on Friday: euro-zone inflation. It showed a smaller than expected drop in headline CPI and a surprising rise in core CPI.

The ECB has one mandate: inflation and the Hawks are now reinforced. Draghi was moving towards the hawkish side last week, sparking the rally.

So, the current correction seems like an opportunity to buy the dip rather than a change of direction.