Better than expected inflation data in the euro-zone: headline CPI dropped to 1.3% but beat projections at 1.2%. More importantly, core inflation is bouncing back up to 1.1%, up from 0.9% and better than 1% predicted.

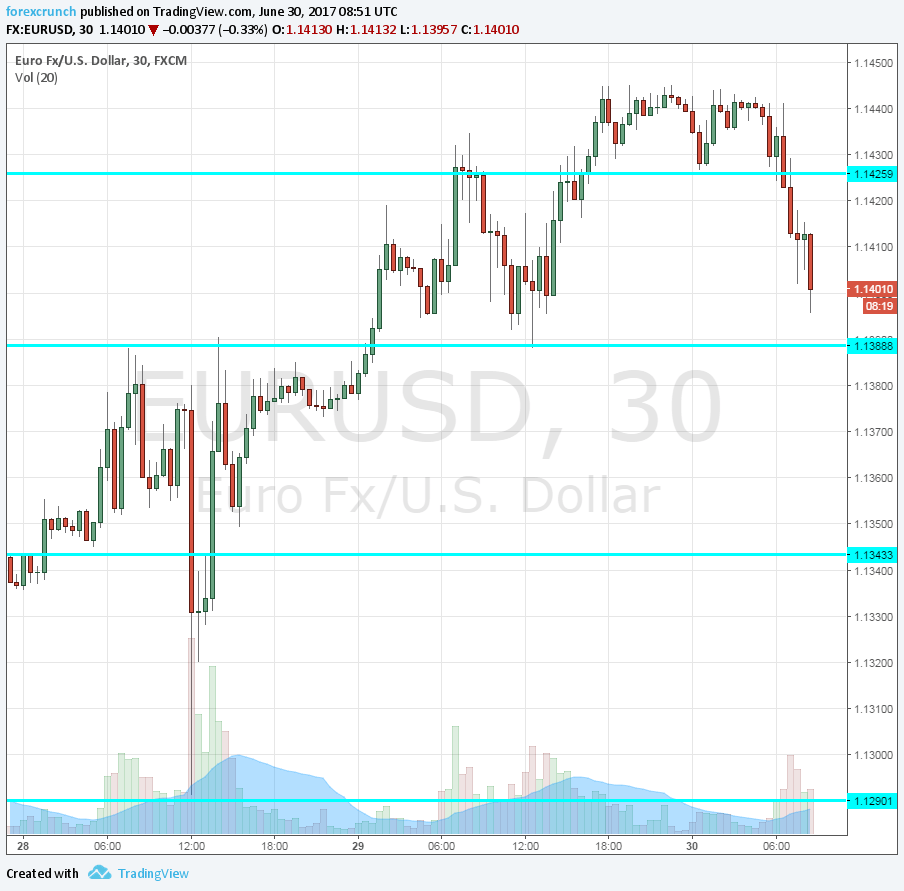

EUR/USD initially advanced but then resumed its correction to the downside.

Is this a buying opportunity on EUR/USD?

The preliminary inflation report for June was expected to show a slowdown in headline CPI from 1.4% to 1.2%. Core inflation was predicted to recover from 0.9% to 1%.

Early indications were mixed: Spain’s measure missed expectations while Germany’s figure beat expectations. The French figures met estimates.

EUR/USD was trading lower, just around 1.14. It had already reached a new 14-month high of 1.1445. Preview: EUR/USD: Inflation data could start the next rally

Earlier in the day, we learned that German retail sales jumped by 0.5% against 0.3% expected. However, the number of the unemployed rose by 7K, a rarity in Germany, where jobless claims were in the fall for a long time.

More: