After Trump’s shock victory the US dollar roller-coasted. Will markets remain volatile? The greenback could have different reactions to different currencies:

Here is their view, courtesy of eFXnews:

Trump’s victory in the US presidential election clearly has the potential to catalyse major longer-term shifts in FX markets. For many months we have flagged the possibility of “Trumpxit” – in its most extreme form a US economy break with the global economy – as a potential source of uncertainty.

For us, Trumpxit meant USD strength against currencies like MXN and CAD (clear losers if NAFTA is potentially in the firing line) and weakness against defensive currencies like EUR, CHF and JPY (winners if the USD’s role as the ultimate global ‘safe-haven’ comes under threat).

Matters are complicated though by the fact that the Republicans have emerged not just with the presidency but also the House and Senate too. This leaves room for the market to try to see the glass as half full and focus instead on the possibility of fiscal easing, tax reform and other pro-growth policies.

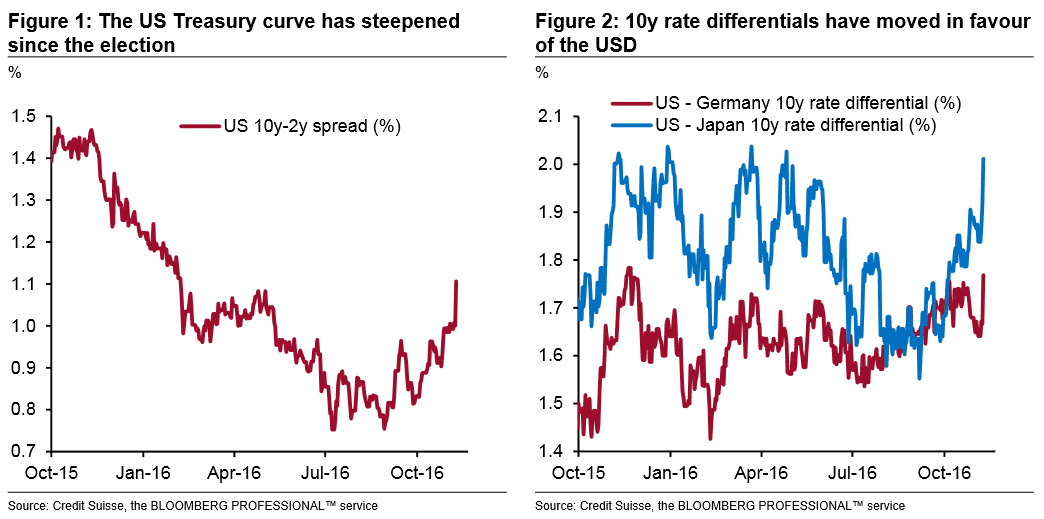

This line of thinking has dominated today and led to a sharp rebound in US equity futures from their lows as well as: 1) A jump higher in US Treasury yields; 2) Steepening in the US Treasury curve (Figure 1 below); 3) Rate differentials moving in favour of the USD, especially vs. defensive currencies like JPY and EUR.

These pro-risk interpretations have both put a floor under emerging market currencies generally and also allowed room for the greenback to bounce back after its early losses against the defensive major currencies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.