While the dollar is showing some renewed strength, tension remains high towards the Jackson Hole Symposium. Will Yellen provide some clarity? Here is what we can expect, according to Barclays:

Here is their view, courtesy of eFXnews:

This week monetary policymakers will convene in Jackson Hole, Wyoming, for the Federal Reserve Bank of Kansas City’s annual Economic Policy Symposium. This year the topic is “Designing Resilient Monetary Policy Frameworks for the Future.” Based on recent communications by San Francisco Federal Reserve President John Williams, Board Governor Jay Powell, and former Fed Chair Bernanke, we believe the discussion at Jackson Hole will take place amid greater acceptance that potential growth has slowed, and the neutral rate of interest has fallen (Figure 3).

We agree with these conclusions and estimate potential growth at about 1.5% and believe the real equilibrium policy rate in the US – and much of the developed world – is approximately zero (Figure 4). We detail our views on what a low-growth, low-interest rate environment could mean across two dimensions. First, what it means for the near-term path of monetary policy in the current cycle and, second, what it means for the conduct of monetary policy in future downturns.

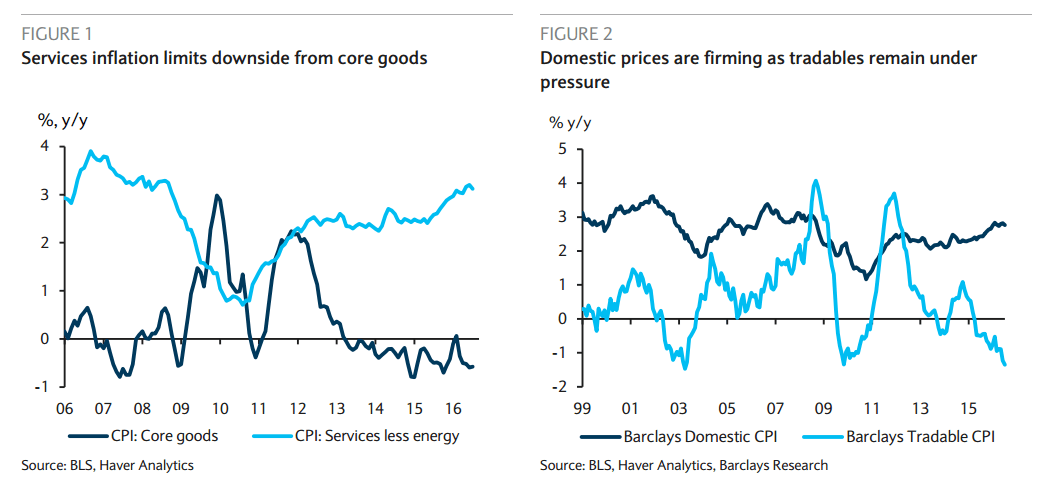

Regarding the near-term path of policy, downward revisions to FOMC estimates for potential growth, the neutral rate of interest, and the natural rate of unemployment imply more dovish policy outcomes as evidenced by the flattening in the anticipated policy path since the FOMC first raised its policy rate last December. That said, we believe Chair Yellen will use the opportunity to signal the FOMC’s growing confidence in the outlook for activity and inflation given the rebound in labor markets since June and the solid rise in household spending in Q2 GDP. FOMC worries about the labor market have been dispelled, and a third straight solid employment report in August should reduce lingering concerns about inflation.

We expect Yellen to deliver a stronger signal about the likelihood of a near-term rate hike and retain our view that the next increase will occur in September. A low growth, low interest rate environment may imply more frequent zero lower bound episodes. Hence, we expect debate at Jackson Hole about alternative approaches to monetary and fiscal policy that could better support the economy during future downturns, including automatic fiscal stabilizers, a higher inflation target, and nominal GDP targeting, among other items. We believe these discussions are about prudent planning for the future and do not imply that the Fed is actively considering changing its inflation targeting framework.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.