The US elections are just around the corner (see our full guide) and the team at Bank of America Merrill Lynch leads us to the final countdown.

Here is their view, courtesy of eFXnews:

The US election will continue to dominate markets in the coming week; narrower polls suggest markets aren’t priced for tail risk outcomes.

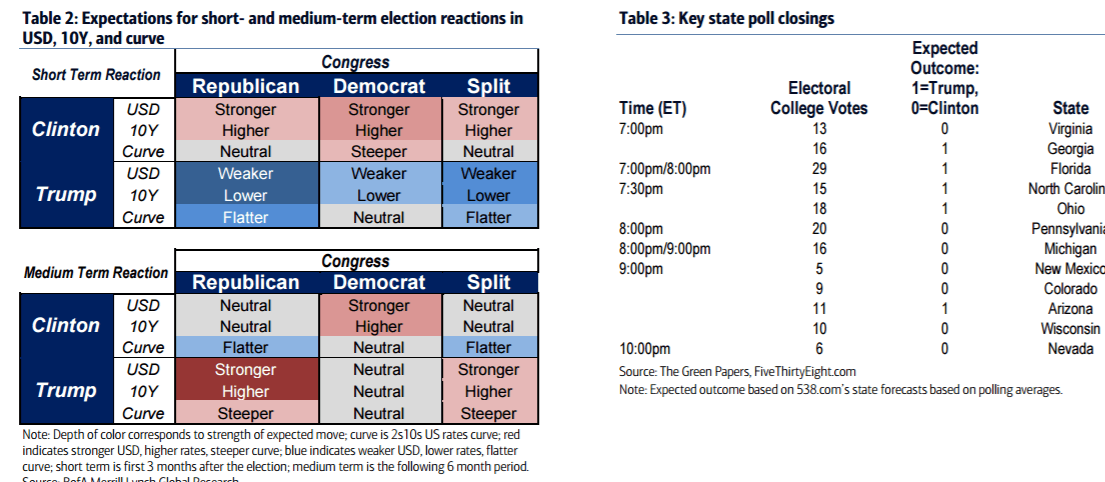

The timing of poll closings on election night will be important for investors as markets adjust expectations in real-time. Exit polls will start rolling in from 7pm ET (perhaps a bit earlier), and will be staggered until around midnight .The outcome could be apparent much earlier in the evening with key battleground states like Florida, Ohio, North Carolina, Virginia, Georgia, and Pennsylvania all likely to release results by around 8pm. Conversely, a closer race implies a longer timeframe until the winner is known, and therefore, higher volatility on election night. Each of Trump’s viable paths to the White House include winning Florida, Ohio, North Carolina, Georgia and Arizona.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

As such, we think success or failure in these states early in the evening could give a good sense of the eventual outcome. We explore two possible scenarios:

Trump wins FL, OH, NC, GA; Buy JPY, CHF, sell CAD.

Trump success in each of these states early on would likely be negative for risk and weigh on the USD against the JPY, CHF, and EUR as the market would need to materially re-price his chances of winning. CAD and AUD would underperform as they are not materially pricing a risk premia for a Trump win, in our view. The hit to risk sentiment and increased volatility could last for a few hours until we get the results of other key states like Michigan, Colorado, Arizona, Wisconsin, Nevada and New Mexico after 9-10pm. Trump needs to win at least AZ, NV, and NM to have a shot at winning the Electoral College vote.

Trump loses FL, NC, OH, or GA; Buy USD (except versus MXN and CAD)

If Trump were to lose FL, NC, OH, or GA, his chances of victory could fall towards zero unless states which are now firmly Democratic in the polls (like Pennsylvania) vote Republican. As such, we will know the outcome relatively early in the evening even before the many other states are called. In this scenario, we would recommend buying USD (except versus CAD and MXN) as volatility falls and the market prices out the risk premia for a Trump victory.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.