One of the drivers of the euro since mid April came from the bond market: the sell off in German bunds as well as other euro-zone bonds squeezed out shorts and made the euro more attractive.

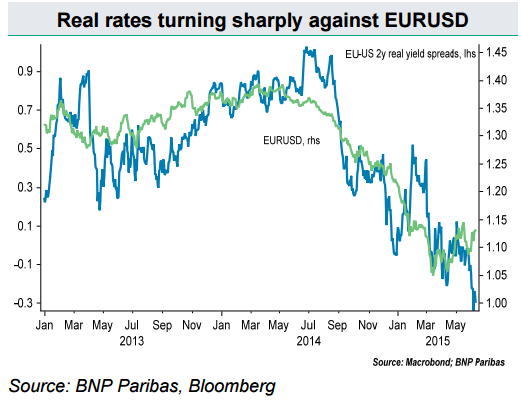

The team at BNP Paribas examines the situation and focuses on real rates vs. EUR/USD and this points to significant vulnerability for the pair:

Here is their view, courtesy of eFXnews:

Real rate spread is flashing red for EUR/USD, argues BNP Paribas.

“European bond markets still remain in the spotlight with the 10y bund yield rising to a new high on Wednesday and contributing to the ongoing firm tone in EURUSD,” BNPP clarifies.

“We note however that real rate differentials have turned sharply against EURUSD, mainly driven by raising US nominal yields and eurozone inflation expectations,” BNPP notes.

“This suggests that once bond market conditions normalize, EURUSD would be vulnerable to significant downside,” BNPP projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.