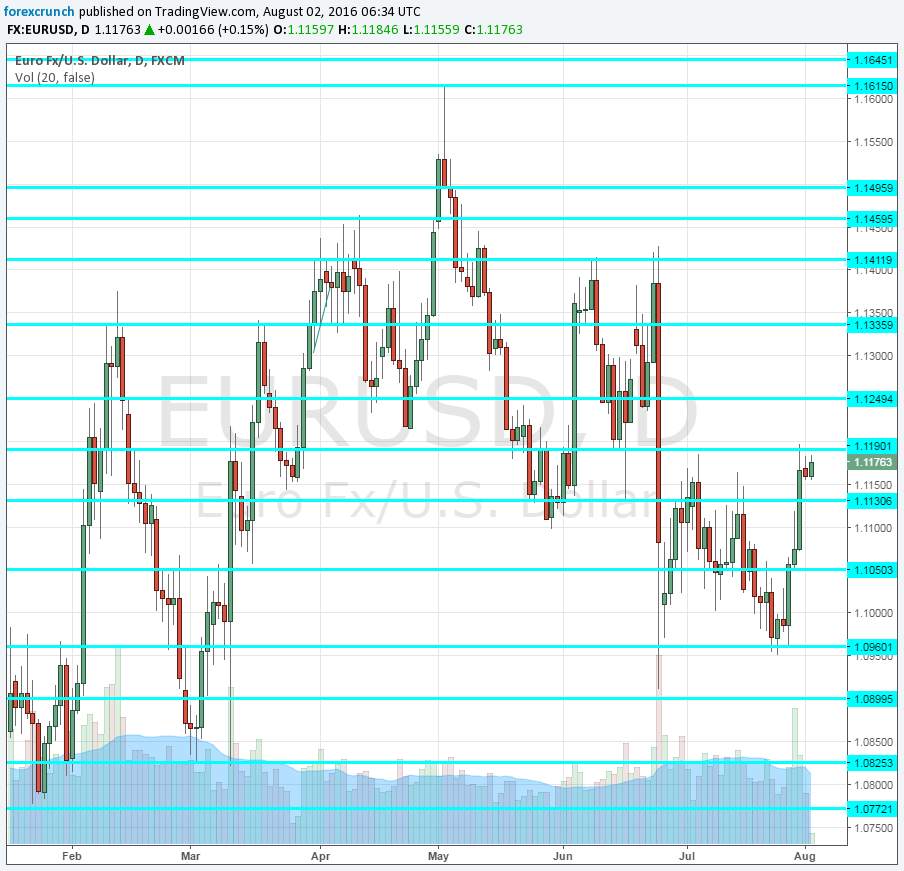

The world’s most popular pair must be losing some of its popularity. For a long period of time, EUR/USD is trading in a relatively narrow range. And this is not the first time this happens in recent memory. While some like range trading, the scarce number of pips to be made and the choppy nature make the pair unattractive for trading.

Euro/dollar suffers long periods of tight trading, and when it makes a move, this does not develop into a trend but rather yet another prolonged period of listless trading.

The magic is gone

The phenomenon has perhaps reached its extreme on a classic event that should have rocked the common currency. Since 2015, the European Central Bank convenes only once every 6 weeks (or 8 times a year). The rate decisions and especially ECB President Mario Draghi’s press conferences used to create a lot of commotion.

Whether decisions were taken or not, or whether Draghi provided big hints of upcoming moves or not, the volatility used to be high. In the recent event, the range was hardly 100 pips – more than in other days, but far from satisfactory.

Draghi had his share of dramatic pauses, uneasy smiles and basically everything he said or did not say managed to move markets. He has been banging on the “governments need to do more” mantra, which is true, but also means that the ECB does less, and when it does less, markets don’t listen that much.

EUR/USD come from overseas

In general, the pair seems more tuned to the American side of the equation. US data, which rocks the greenback across the board, has more influence than European events. Yet also here, we are witnessing bigger dollar moves against other currencies. USD/JPY, which used to suffer from long periods of narrow ranges and short moments of panic, has become a very active and volatile pair, leaving EUR/USD behind.

The biggest move seen in EUR/USD came from a non-euro-zone and non-US event. It came from Brexit. The global shock that sent the pound 10% lower against the dollar, also had an impact on the euro. EUR/USD traded in an impressive range of 500 pips.

Yet also here, after a handful of spasms as the pair adjusted to a lower range, it was back to the narrow range.

What could shake the pair?

There is no dearth of problems and uncertainty in Europe. Uncertainty should fuel volatility, at least that’s what happened in the past. The issues with Italian and German banks, Greece’s ongoing depression, political uncertainty in Spain this year and next year in France and Germany and also Brexit of course, should all add up to more significant movements.

These movements could certainly be bi-directional and not necessary to the downside. We have seen the euro behave as a safe haven currency, attracting flows when the going gets tough, even if the trouble is home grown.

Can the pair get going?

More: Beware Of A Spike Higher In EUR/USD – SocGen