- FTX Token jumps to new record highs following US expansion news.

- FTX US completes a deal to acquire LedgerX in a move to access the rapidly growing crypto derivatives US market.

- A sustained bullish momentum could see FTT discover new highs above $80.

The FTX Token price skyrockets to record new all-time highs (ATH) following news that FTX US is acquiring LedgerX for its for its Regulated Derivatives. The FTT crypto has risen by more than 53% from Wednesday’s low at $47.110 to set new record high’s today around $72.04. Meanwhile, the market cap jumped from $6,149,711,774 at the close of day Wednesday to the current value at $6,304,944,193 representing a 26% increase.

Meanwhile, the daily trading volume on all crypto trading platforms has increased by approximately 190% to $2,08 billion over the last 24 hours. At press time, FTT/USD price stands at $67.55.

FTX Exchange Adds LedgerX To Its Ballooning List of Acquisitions and Partnerships

Brand awareness and widespread use in the real world is one of the best ways a blockchain project can validate its utility. This increases its value which not only attracts new users to the platform but also increases investor appetite.

FTX, a crypto derivatives trading platform founded by Gary Wang and Sam Bankman-Fried, has recorded tremendous growth over the past year. This has been largely attributed to its increasing public adoption fueled by exciting partnerships and ecosystem developments.

In the latest development, FTX US, the American branch of the exchange announced that it would be acquiring LedgerX, a fully licensed, U.S.-based options and futures trading platform. In a Tuesday press release sent to media platforms, the organisation behind the FFT crypto indicated that it had completed the LedgerX acquisition deal and was focused on expanding its derivatives trading in the US. LedgerX is a Commodity Futures Trading Commission (CFTC) regulated platform operating under the name LedgerX Holding’s Inc.

To the exchange, this is a key development in enhancing expansion into the rapidly growing US market. This acquisition will play a vital role in FTX offering regulated crypto futures and options trading to its US customers. Brett Harrison, the FTX.US President said:

“… it is incumbent upon the industry to be proactive and to seek out working relationships with regulatory groups like the CFTC to help shape the future of our industry.”

The company, however, made it clear that the deal would not affect LedgerX’s daily operations. In addition, it has plans of using the platform to offer options and futures contracts on major crypto assets like Bitcoin (BTC) and Ethereum (ETH) to its customers.

The deal with LedgerX is just one amongst FTX’s growing list of strategic partnerships and publicity measures. Earlier this year, the company purchased the naming rights to several stadiums and became the official cryptocurrency exchange sponsor of the Major League Baseball. However, acquiring LedgerX has been touted as the most significant development for the crypto exchange because it gives FTX US a competitive edge as it offers a unique product to the US market.

These news have been behind the sudden burst in the FTT crypto’s price over the last couple of days.

FTX Token Price Skyrockets To Areas Above $70

The FTX Token price had been uneventful between August 10 and August 31 as it was stuck in a horizontal price movement. During this time, it was trading in a specific range between the $42.25 support wall and the $55.62 resistance area coinciding with the May 18 high. The price range for the FTT crypto had reduced significantly which was the reason for the massive and rapid breakout following the LedgerX news.

FTT/USD price achieved a new ATH at around $72.04 earlier today.

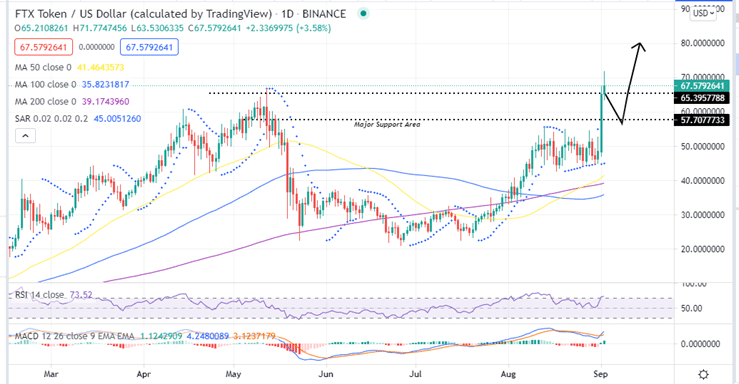

Even though the FTX Token price has since retreated from this high to the current price at $67.55, the FTT short-term price prediction is strongly bullish as accentuated by the technical indicators.

FTT/USD Daily Chart

For example, the Moving Average Convergence Divergence (MACD) indictor’s upward movement and position above the zero line in the positive region points to a strong bullish momentum. Also note that the MACD sent a buy crypto signal Wednesday when the 12-day Exponential Moving Average (EMA) crossed above the 26-day EMA as buyers tightened their grip on FTT price.

Moreover, the position of the Relative Strength Index (RSI) at 76 and its entry into the overbought zone shows that the buyers are in control of the FTX Token price. Furthermore, the upsloping moving averages and the golden cross that took place on August 26 when the 50-day Simple Moving Average (SMA) crossed above the 200–day SMA reinforces the bullish narrative. Therefore, the FTT crypto can carry on with the price discovery mission above $80 in the near term.

On the flipside, if the FTX Token closes the day below the $70 mark, the bullish mission to $80 will be invalidated and the asset might drop towards the $57.70 immediate support area. A massive correction could take FTT towards the $50 psychological level or the $41.70 area embraced by the 50-day SMA.

Where To Buy FTT

If you want to buy FTT, you can register and start trading on capital.com. Capital.com is the best cryptocurrency exchange with lowest fees. It is an international CFD and forex broker that was established in 2016. It is regulated by the UK’s FCA, CySEC, and NBRB.

Looking to buy or trade crypto now? Invest at Capital.com!

Capital at risk