I love to write, but I often don’t know what to write about. My goal is to write about things that I have learned that other people could use. So, I try to put myself in your shoes and determine what it is you would want to learn from me if we could sit down and talk. With my extensive years working for an FX broker, I learned a lot about trading, trading mentality, controlling emotions when trading, and other similar things.

Today, I’d like to discuss fx hedging, but I’m guessing I will stray into trading in general and maximizing your trading dollar.

What Hedging Is and Is Not

Let’s start with what hedging is. I will use investopedia.com for a definition:

A hedge is an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

I like to think of hedging as purchasing insurance. I have health insurance, auto insurance, home owner’s insurance and even life insurance. I believe that gold and silver act as a hedge against the US dollar and the stock market. All of these things are insurance, and I would also consider all of these things hedging.

Some people consider hedging to be taking the opposite position. So, if I am short 10,000 EURUSD, I would buy 10,000 EURUSD. My question here is what kind of protection does this provide me? Most people would say that it eliminates the risk of the original position, and it does…temporarily.

My concern with doing this is what do I do now? Now, I have two positions in EURUSD. Am I hoping the market goes up or down? When do I get out of these positions? If the market goes up, I can exit the long position, but I’m sitting on a big loss in the short position. What is the end goal here? Does this really provide me protection on my original short position, or does it create more risk and more chance to lose money?

Making a Plan to Hedge and Reduce Risk

The best traders in the world spend a lot of time making a plan for their trade. They don’t just jump into a trade. Their goal is to eliminate as much risk as they can before entering a position. I would encourage you to make a plan of how to eliminate risk before you even trade. While not technically hedging, a plan is the best way to reduce risk.

What should be part of your plan? These things are a minimum of what should be included:

- Your opinion for what the market is going to do and why? Includes technical and fundamental analysis.

- Stop and limit price with why you selected the prices.

- Hedging possibilities

- Worst case scenario””what is the worst thing that could go wrong with your trade?

It can be quite revealing when you write down your reasons for entering a trade or selecting stop and limit levels. Over time, it will help you decrease risk by showing you times when you are making poor decisions when entering positions.

Types of Hedging

If we look at hedging like insurance, we want to find the best insurance for the cheapest price. Well, what is best for you might not be what I think is best for me. So, I cannot tell you what the best hedge for you and your trading strategy. What I can tell you is what other people do to hedge, and what I do to hedge.

So, when it comes to trading, what kind of insurance can you purchase to protect you, your position, and your account?

When I worked on an FX trading desk, we had customers that had whole algorithms on taking positions in GBPUSD, USDCHF, and EURUSD in different position sizes to reduce risk. For a time, this was a very good hedge. Eventually it went against the customers. Some were prepared and some were not. I remember receiving calls from customers saying their IB (introducing Broker) said this was a risk free trade.

There is no such thing as a risk free trade. If somebody tells you they have a risk free trading strategy, run away.

To get more specific to Forex hedging strategies, there are a few primary ways to reduce risk with the purchase of insurance type protection: futures, forwards and options.

So, looking back at the definition for hedging, we will be “taking an offsetting position in a related security…” If you are long EURUSD, selling Euro futures in a similar volume would count. This is an easy way to eliminate risk, but it almost takes price movement out of your trade. If the market goes up in EURUSD, you make money on the spot fx trade but lose money on the futures trade.

My favorite way to hedge is with options. Options are great for hedging so lets quickly define a couple things:

1.) When you buy a call or put, you pay money to buy protection.

If you buy a call, you are buying the right to buy the underlying, at the strike price, if the underlying is above the strike price.

If you buy a put, you are buying the right to sell the underlying, at the strike price, if the underlying is below the strike price.

2.) Buying a put, and buying a call, is like buying insurance on your position. When you buy a put, you are buying protection on a long position, and when you buy a call, you are buying protection on a short position.

An Example FX Option Hedge

Let me give you an example at the current market prices:

Let’s say you go long 10,000 EURUSD from the current rate of 1.1422. I took a screenshot this morning from Bloomberg EURUSD price.

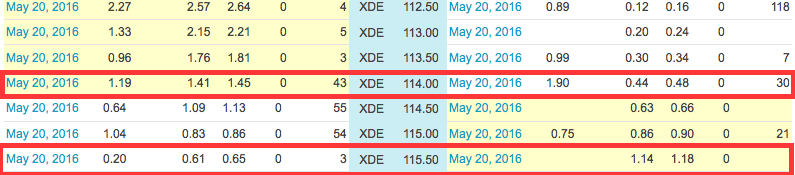

To hedge your position, you can buy a May 20, 2016 Put on EURUSD with a strike price of 1.1400.

Your risk is 22 pips in your spot position and the cost of the put option, which is .48 or $48. Let’s say that the EURUSD closes at 1.1200 on May 20. You will be closed out of your spot position at 1.1450 and will have saved yourself 175 pips.

I am using Option pricing from the NASDAQ on Euro currency. Working with an FX broker that offers options would be required in this scenario.

Why not just work a stop order at 1.1400 and save $48 on the option cost?

The problem is that you aren’t always guaranteed your stop price when your order is filled. If you leave your stop working over the weekend and the market opens up at 1.1200, will your broker slip your stop order to the current market? Most do.

Your option will still be filled at 1.1400 on expiration. No slippage.

Concerned about the cost of the option?

A way to offset the cost of the option is by selling a call (would be considered a covered call since you have a position in the underlying).

In this case, selling a call will work like a limit order, but it will only fill if the price of the EURUSD is trading above the strike price at expiration.

Let’s say we sell a May 20, 2016 Call on EURUSD with a strike price of 1.1550. We would receive .61 or $61. So, on May 20, if EURUSD is trading above 1.1550, you would be taken out of your EURUSD position at 1.1550.

Let’s do the math:

You bought 10,000 EURUSD at 1.1422.

You bought one put at 1.1400 for $48 and sold a call at 1.1550 for $61. Just on the option trade, you made $13. So, really, you are only risking $9. 1.1422 – 1.1400 is 22 pips, or $22, but you are making $13 from the options trades.

Say, the EURUSD closes at 1.1501. In this scenario, you are still long EURUSD from 1.1422 (a 79 pip profit), and you made $13 on the option trade. If you want to do another option trade, you can. If you want to exit your position, you can. At this point, you go with what plan you set at the beginning of the trade.

In Closing

There are also some other ways of hedging that people use, like forwards, other related currencies and more complex options strategies. You have to find what is right for you.

No matter how you choose to hedge your fx position, you need to get comfortable with your choice and know that things can still go wrong. Before entering a trade, make a good plan and look for ways your trade could go differently than you expect. Then, make some contingency plans for those worst case scenarios. Good trading and good hedges start with good planning.

Guest post by Steve Nauta of Daticks