The British pound enjoyed a Super Thursday, with the good data, the court ruling and the hawkish BOE. The team at BTMU sees more reasons to favor the upside:

Here is their view, courtesy of eFXnews:

We have laid out a number of compelling factors that point to the potential for an extended short GBP positioning squeeze (see here). IMM data on GBP positions held by leveraged funds showed the largest short GBP position in the week ending 18th October since April/May 2013. ‘Hard’ Brexit sentiment is likely to be questioned in the wake of the UK court decision today compelling the government to seek the consent of parliament before invoking Article 50.

But we believe there are other factors pointing to an increased risk of a reversal in GBP selling sentiment:

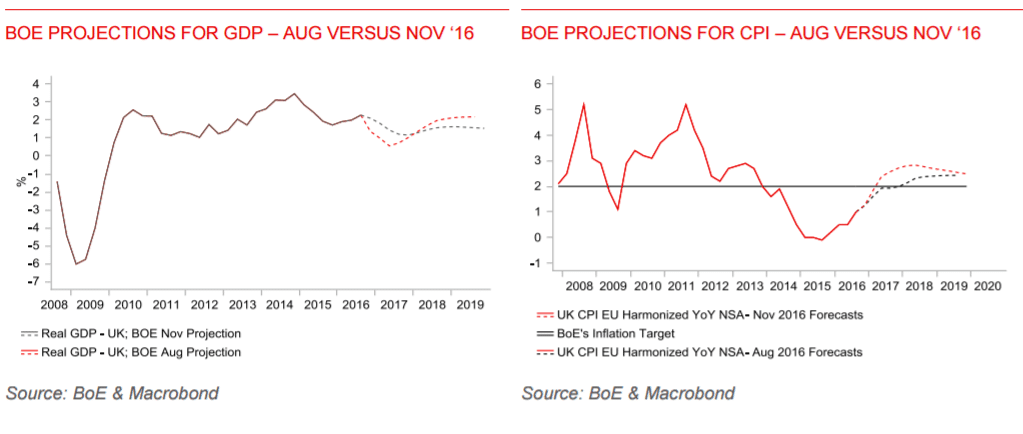

1. Better economic growth outlook. We’ve already had the stronger than expected Q3 real GDP print of 0.5% Q/Q and this week we saw one key economic think tank alter their view on the outlook, which is more important. NIESR announced on Tuesday that it was revising higher its growth projections for this year from 1.7% to 2.0% and next year from 1.0% to 1.4%. Today, the BoE in its Quarterly Inflation Report did the same, revising its 2016 and 2017 projections by 0.2pt and 0.6pt to 2.2% and 1.4% respectively. The CBI cut its pre-Brexit forecast for 2017 growth of 2.0% to 1.3% but both the NIESR and CBI revised levels are higher than current market estimates. The UK Treasury’s compilation of independent forecasts reveals a 2017 growth forecast of 1.0%, up from 0.5% immediately following Brexit. The Bloomberg UK GDP growth consensus is 0.9% for 2017. Market consensus estimates are now likely on the rise and that will gradually help reduce appetite for selling the pound.

2. Nissan makes long-term commitment. The fact that a key automaker (Nissan) has decided to make a long-term investment commitment by investing now for increased auto production on two models from 2019 onwards must also be viewed as an indication that fears over a ‘hard’ Brexit may well be overdone. We do Nissan’s long-term commitment to remaining in the UK, but it must have been pretty compelling. Of Nissan’s total production, the majority (55%) is exported to the EU. Would Nissan have made that long-term commitment if ‘hard’ Brexit seemed plausible? PM May no doubt feels confident that the 10% tariff charged on non-EU auto imports would not apply to the UK. Comments from German businesses and the Six Wise Men this week would suggest that confidence is justified.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

3. Surge in foreign demand for UK Gilts. Data last week released by the Bank of England revealed a sharp jump in foreign investor buying of UK Gilts in September. One of the arguments for pound depreciation has been the prospect of foreign investors shunning UK securities investments due to the risks surrounding Brexit and the potential for further sharp declines in the pound. However, the BoE data revealed GBP 13.3bn worth of foreign investor purchases of Gilts in September, the largest total since November last year. Debt securities inflows have been the main source of foreign investor inflows that has resulted in the UK’s current account deficit being financed with ease. In the year to the end of Q2, debt securities inflows totalled GBP 207bn. The September data – the strongest so far in 2016 – suggests this demand has in fact continued post-Brexit.

4. EU budget contributions = softer Brexit than feared. One reason why we see the potential for ‘hard’ Brexit speculation easing going forward is the potential for greater credibility being given to the idea that the government will indeed seek a deal that involves continued payments into the EU budget. PM May and other senior government officials have been very consistent in describing what the UK electorate voted for. First; to “take back control” of sovereignty by removing the European Court of Justice’s power of legislating in the UK; and second of course to “take back control” of UK borders and immigration. Paying into the EU budget has never been mentioned. The BBC last month ran a report concluding that the government’s plan includes continued payments to the EU while last week, former Lib Dem leader, Nick Clegg, stated that any Brexit plan would have to include some form of budget payment. Given the Leave campaign lies about this money going to fund the NHS, it might not prove such a divisive strategy.

5. Banking sector recovery is GBP supportive The pound is also set to derive support from the ongoing improvement in banking sector stocks. There has been a strong positive correlation between the performance of UK and European banking stocks and the direction of the pound. With the UK financial services sector a much larger portion of UK GDP than any financial services not know exactly what the UK said or did to ensuresectors across Europe, the recovery of banking sector shares is relatively pound supportive. In addition, smooth financing of the UK’s current account deficit is helped by a stable banking sector and hence helps to reassure investors over continued smooth external financing flows to the UK.

6. Court decision against the government. This morning’s court decision against the government triggering Article 50 without parliamentary consent adds another element to this debate over the scale of recent pound selling and whether current levels are justified based on the outlook. We are not surprised with the rebound of the pound on the decision although making a concise judgement on what this means going forward is complicated. We do not think this decision derails Brexit (although it may have timing implications on triggering Article 50). Firstly, the government is to appeal the decision with the Supreme Court setting aside a period between 5th -8 th December to hear the appeal. Secondly, every sitting MP in parliament fully understands the fundamental factor in them being there – their constituents voted for them. We are a little surprised with the statement from No.10 on the court decision. “The country voted to leave the European Union in a referendum approved by Act of Parliament. And the Government is determined to respect the result of the referendum. We will appeal this judgement.” Surely this decision should be viewed more about including parliament in the process toward Brexit, not derailing Brexit. The government appears to assume parliament would be against triggering Article 50. A large number of MPs have stated they would vote as their constituents voted. Furthermore, how great an incentive does Labour has for voting down a triggering of Article 50? That would no doubt trigger an early general election and with Labour’s polling in the doldrums would no doubt result in a larger Tory majority.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.