Well, the team at Credit Suisse had the vision, foreseeing the GBP flash crash. Cable crashed under 1.20 before bouncing to 1.24, but it certainly isn’t over.

Here is their view, courtesy of eFXnews:

Theresa May’s weekend decision to set an end-March 2017 target for triggering Article 50 sent shockwaves through markets and has propelled GBPUSD to new multi-decade lows.

The earlier-than-expected announcement compels us to revise our 3m target* to 1.22 from 1.34 previously, while leaving our 12m target unchanged.

Our initial and unchanged 12m target had always been based on the idea that a) at some point over the next 12 months Article 50 would be triggered and b) there would be a poor GBP reaction given the high likelihood that this would happen before there are any certainties about the UK’s future economic arrangements. We stick to this view. But previously we had not expected this announcement over a 3m horizon, and instead were concerned that fears about US politics ahead of November’s presidential election would instead dominate the discourse.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

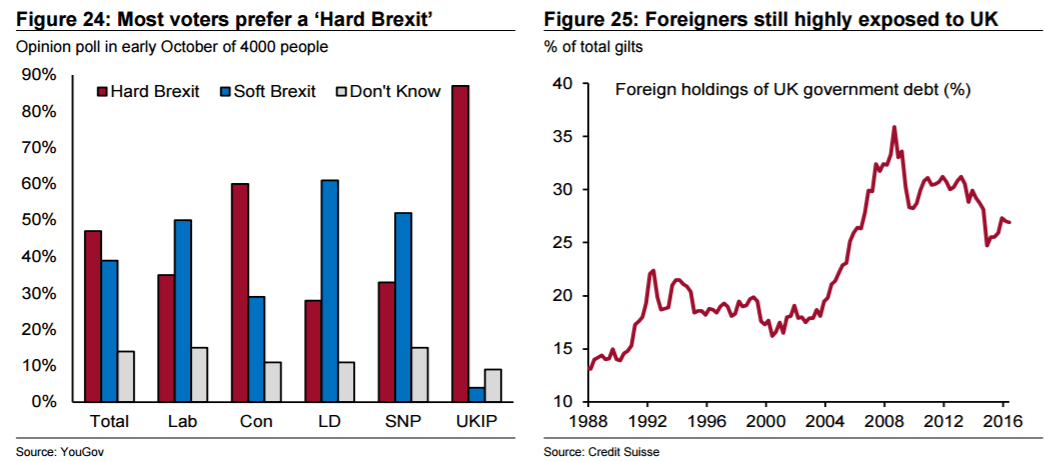

May’s announcement brings matters to a head ahead of schedule and we are changing our 3m forecast to reflect this. What is especially bad from an FX perspective is that the decision to emphasise freedom of movement limits and legal sovereignty raises the probability that markets and business interpret the UK government’s decisions as a step towards “hard Brexit”. In our view this acts as a possible supply shock to the UK economy, with very negative implications for medium-term investment.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.