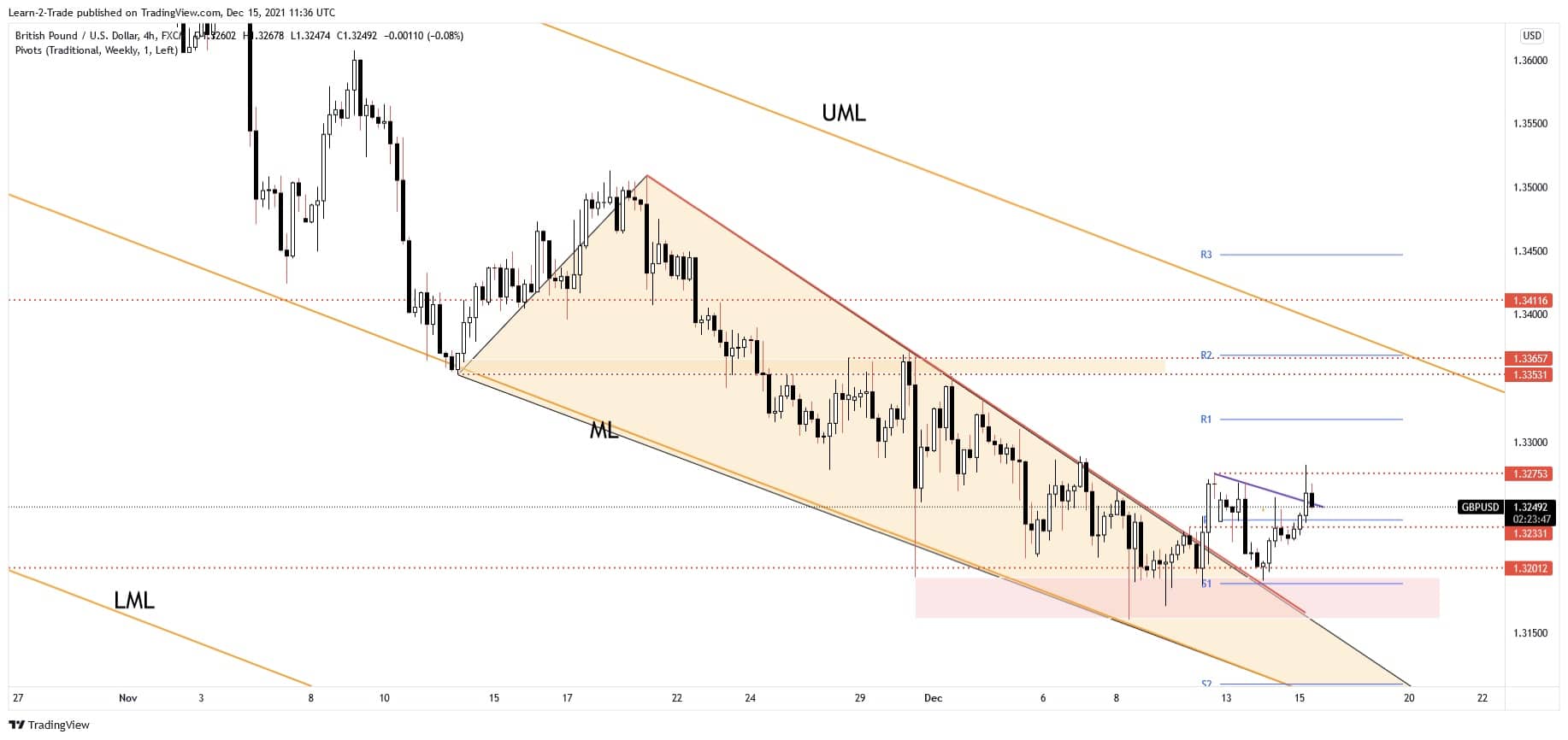

- The GBP/USD pair is trapped within a range pattern, a valid upside breakout could confirm an upside continuation.

- A minor retreat was natural after its rally, consolidation above the pivot point could announce a new upside momentum.

- Escaping from the Falling Wedge pattern announced a new leg higher.

The GBP/USD forecast sees the pair trading in the red at 1.3251 level at the time of writing. It’s located far below 1.3282 today’s high. It has slipped lower after the UK inflation data was released. Still, the current drop could be only a temporary one.

The pair could come back to test and retest the immediate support levels before jumping higher. The price will be driven by fundamentals these days, so you have to be careful as anything could happen.

If you want to know more about how to make money with forex, check out our guide.

3 Free Forex Every Week – Full Technical Analysis

The UK Consumer Price Index reported a 5.1% growth in November versus 4.8% expected and compared to 4.2% in October, while the Core CPI rose by 4.0% versus 3.7% expected and compared to 3.4% in the previous reporting period. The PPI Input, PPI Output, and the RPI increased more than expected.

The pressure remains high as the Dollar Index tries to extend its upwards movement ahead of the FOMC. The Federal Reserve is to release its Federal Funds Rate tonight. The FOMC Economic Projections, FOMC Statement, and the FOMC Press Conference could bring sharp movements.

Also, don’t forget that the US Retail Sales is expected to report a 0.8% growth, while the Core Retail Sales could rise by 0.9% in November.

GBP/USD Forecast: Price Technical Analysis – Range Formation

The GBP/USD pair registered only a false breakout with great separation through 1.3275 level signaling strong supply around that former high.

It has slipped lower to retest the broken minor downtrend line. In the short term, it’s trapped between 1.3275 and 1.3201 levels. An upside breakout from this range formation could activate an upside continuation.

Technically, after escaping from the Falling Wedge pattern and after retesting 1.32 psychological level, the currency pair was somehow expected to develop an upwards movement.

The upside pressure remains intact despite a minor retreat. Actually, a minor drop was somehow expected after the most recent rally.

Moving sideways above the weekly pivot point of 1.3239, a minor consolidation, could announce a new bullish momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.