GBP/USD was almost unchanged, after two weeks of strong gains. The upcoming week has five events, including GBP and key employment data. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, Manufacturing PMI remained in expansion territory, with a reading of 53.6. The reading confirmed the initial estimate. It was a similar story for Services PMI, as the second read of 56.5 was very close to the initial reading. There were no surprises from the Bank of England, which held rates at 0.10% in a unanimous decision. As well, the bank’s QE remained at 745 billion pounds. Construction PMI improved to 58.1, up from 55.3 beforehand. Back in April, the index was in deep-freeze, at 8.2.

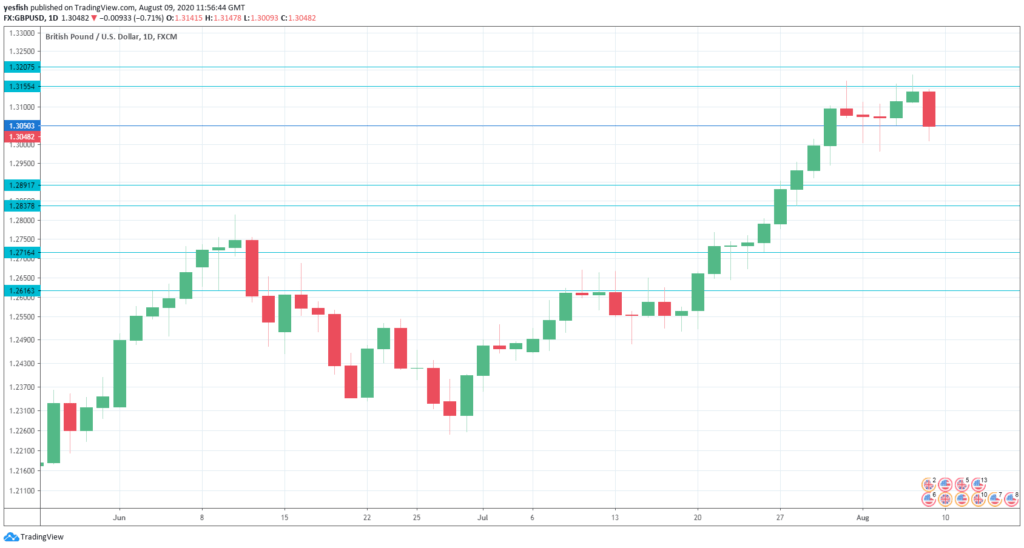

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:01. This indicator is limited to data from BRC stores. The indicator has accelerated for three straight months, improving to 10.9% in June. Will the upswing continue in the July report?

- Employment Report: Tuesday, 6:00. Unemployment rolls fell by 28 thousand, after a huge gain of 528.9 thousand beforehand. We now await the July data. Wage growth has fallen for four successive months and declined by 0.3% in May. Analysts are braced for another decline, with an estimate of -1.2%. The unemployment rate has been pegged at 3.9% for three straight readings, but is projected to rise to 4.2%.

- GDP: Wednesday, 6:00. The UK releases both quarterly and monthly GDP releases. In Q1, GDP declined by 2.0%, reflecting the economic toll from Covid-19. Investors are braced for a huge drop of 20.5% in Q2, which could rattle the British pound. In May, the economy gained 1.8%, well shy of the forecast of 5.5%. The estimate for June stands at 8.1%.

- Manufacturing Production: Wednesday, 6:00. Manufacturing Production rebounded in May, with a gain of 8.4%. This followed a plunge of 24.3% in April. Another strong gain is projected in June, with an estimate of 10.0%.

- RICS House Price Balance Wednesday, 23:01. The housing market has been hit hard by Covid-19. The Royal Institution of Chartered Surveyors June survey showed that 15% more surveyors reported a decrease in prices over those reporting an increase. In July, 5% more surveyors are expected to show a decrease.

Technical lines from top to bottom:

1.3312 has held in resistance since December 2019.

1.3207 is next.

1.3154 was tested in resistance throughout the week.

1.3049 is fluid. Currently, it is an immediate resistance line.

1.2891 is providing support. This is followed by 1.2838.

1.2718 (mentioned last week) in mid-July, since July 24.

1.2616 is the final line for now.

I am bearish on GBP/USD

Both the UK and the US are struggling to control Covid-19, and the road to recovery will be a long one. WIth analysts bracing for Q2 British GDP to nosedive over 20%, the pound may have a rough week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!