GBP/USD rose and fell on the twists and turns in the Brexit negotiations in a volatile week. The focus returns to the regular events, which are top-tier ones: the inflation report, jobs, retail sales and of course the BOE decision. Here are the key events and an updated technical analysis for GBP/USD.

An agreement on the Irish border was very close and the pound jumped only to tumble down as the DUP derailed it. A “regulatory alignment” on the Island of Ireland would have also opened the door to a softer Brexit.Yet later in the week, a compromise was reached on the wording of the text related to the Irish border. However, the British government is still on the path to a hard Brexit and the pound also sold the fact. In the US, the greenback continued enjoyed the progress on tax reform and seemed to ignore mixed data ahead of the Fed decision.

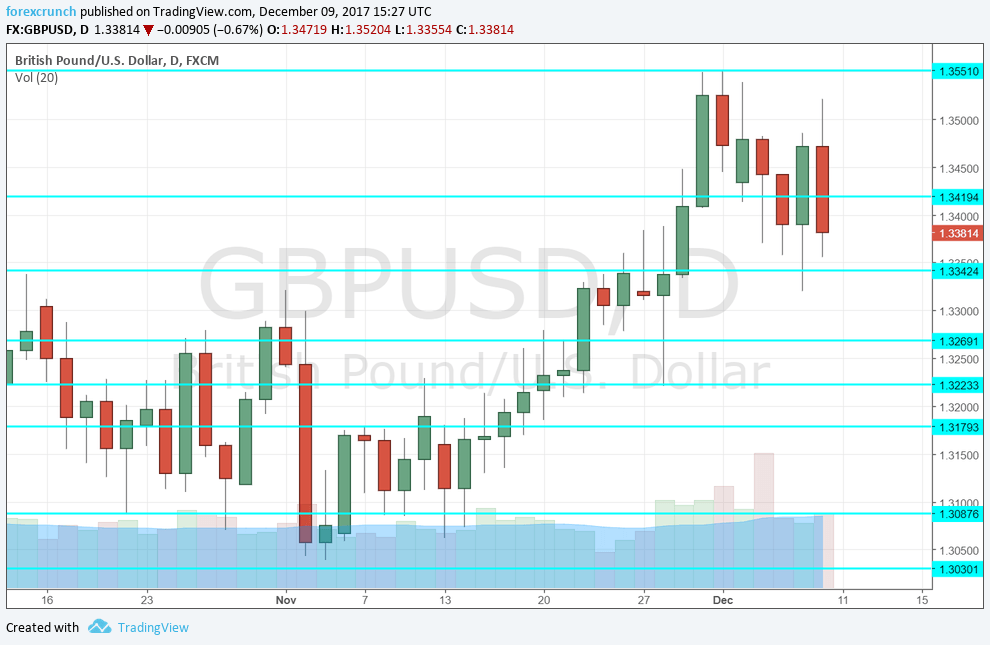

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Inflation report: Tuesday, 9:30. Inflation touched the upper end of the range, at 3% y/y and is now expected to remain at this level. This is the forecast by the Bank of England that is reasoned by the fluctuations in the pound: Sterling reached its low point back in October 2016 and since then has stabilized on higher ground. Core CPI reached 2.7% in October and is now expected to stay at the same level. The Retail Price Index hit 4% and could tick up to 4.1%. PPI Input is also worth noting after jumping by 1% m/m last time and is forecast to rise by 1.6% in November.

- Jobs report: Wednesday, 9:30. The number of jobless claims rose by 1.1K in October, and this was not a shocker. A minor rise of 0.4K is on the cards now. All in all, the labor market looks good with the unemployment rate standing at 4.3% in September and is expected to remain unchanged. The focus is on wages, which were up 2.2% y/y in September, slightly better than expected. Any slide in salaries will be of worry, especially as inflation is running ahead, eroding standards of living. The expectations stand at a significant rise to 2.5% y/y.

- RICS House Price Balance: Thursday, 00:01. The Royal Institution of Chartered Surveyors showed a deterioration in house price development, with their diffusion index sliding to 1% in October. We will get fresh figures for November and a negative number is projected: -1%.

- Retail Sales: Thursday, 9:30. The British consumer has been slightly affected by the rise in inflation but retail sales continued rising in October, by 0.3%. A similar advance is predicted now 0.4%.

- Rate decision: Thursday, 12:00. In November’s “Super Thursday” meeting, the Bank of England raised the interest rate back to 0.50%, citing the rise in inflation. However, it was a very “dovish hike”: they forecast only two more rate hikes in the span of three years. So, no change is expected now. This time, we will receive the meeting minutes but no new forecasts. It will be interesting to see if some members support a further hike to curb the still-high inflation, or if some regret the hike and want to cut it back to 0.25%. A unanimous “no-change” vote is more likely among the 9-member Monetary Policy Committee ahead of the holidays.

- CB Leading Index: Thursday, 14:30. The Conference Board uses 7 economic indicators for its compound leading indicators. A drop of 0.2% was seen in September. An increase could be soon now.

- BOE Quarterly Bulletin: Friday, 12:00. The Bank of England’s report provides another insight into their views on the economy. In this case, it works as another look into their thinking but it is somewhat overshadowed by the rate decision and the meeting minutes on the previous day.

- Andy Haldane speaks Friday, 13:15. The Bank of England’s Chief Economist will be speaking at a conference in Palermo and could provide a response to the latest data and the rate decision. In the past, Haldane has been relatively dovish.

BP/USD Technical Analysis

Pound/dollar jumped and challenged resistance at 1.3550 (mentioned last week) before tumbling back to the range.

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.3550 was the November peak.

1.35 was the original post-Brexit high and also a round number. The top of the previous range is 1.3340, capping the pair in both early October and late November.

Close by, 1.3270 worked in both directions. 1.3225 was the high point of September. It is followed by 1.3180, which capped the pair in July.

1.3080 worked as support in mid-October and also was weak support during November. 1.3030 is the bottom of the range, cushioning cable in October and also in early November.

I remain bearish on GBP/USD

Our latest podcast is titled A December to remember for EUR/USD

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!