GBP/USD had an excellent week, playing catch up with its peers amid optimism about Brexit and a very weak US dollar. PMIs stand out as we turn the page into February. Here are the key events and an updated technical analysis for GBP/USD.

A hint towards a softer Brexit by French President Emmanuel Macron and hopes that the British public is also leaning in that direction stirred optimism. UK GDP came out at 0.5% q/q. While 2017 saw weak growth in absolute terms and in comparison to other developed economies, the figure came out above expectations. US dollar weakness was a big story that began a few weeks ago but got another push by Mnuchin’s endorsement of a weak dollar. His comments were somewhat taken out of context and his boss, Trump, later cheer-leadered a strong dollar.Nevertheless, the pound was a big winner and not only against the greenback.

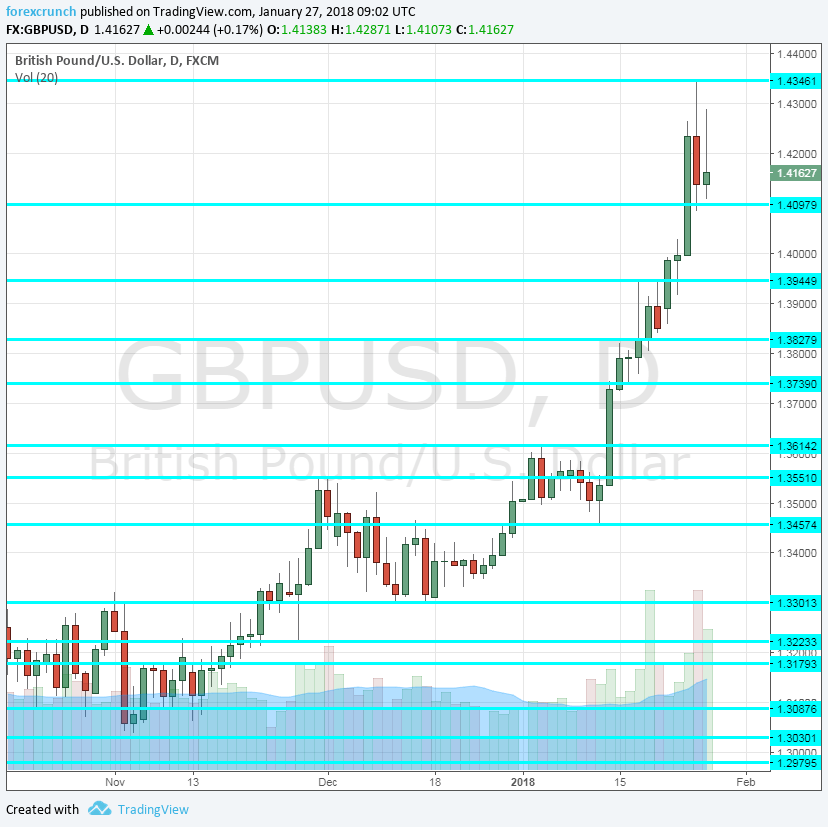

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Tuesday, 9:30. Higher lending to individuals implies increased economic activity. In November, net borrowing stood at 4.9 billion pounds, a bit higher than beforehand. A similar figure of 4.8 billion is expected.

- Mortgage Approvals: Tuesday, 9:30. The official number of mortgage approvals stabilized in November and remained at 65K after a few months of drops. A similar figure is likely now. A small rise to 66K is predicted.

- M4 Money Supply: Tuesday, 9:30. This measure of money in circulation ticked by 0.1% in November, lower than expected. The BOE monitors these numbers as an indication of inflation. A marginal tick up to 0.2% is forecast.

- BRC Shop Price Index: Wednesday, 00:01. The British Retail Consortium’s measure same-store sales has been dropping for quite a while but the fall in December was more significant: 0.6%. We later learned that retail sales were indeed worse than expected. This leading indicator now provides the first insight into 2018.

- GfK Consumer Confidence: Wednesday, 00:01. According to this survey of 2000 consumers, confidence is eroding: a score of -13 was seen in December, reflecting deepening pessimism. A repeat of the same score is on the cards.

- Manufacturing PMI: Thursday, 9:30. The UK manufacturing sector has been enjoying the weaker pound: exports have become more attractive. This was also reflected in Markit’s forward-looking purchasing managers’ index for the sector. However, December saw a drop from 58.2 to 56.3 points, but this is significantly above the 50-point threshold that separates contraction from expansion. A score of 56.6 is on the cards now.

- Construction PMI: Friday, 9:30. The second PMI coming out is for the construction sector, which hasn’t been doing that well. The figure dropped to 52.2 points in December. A minor drop to 52.1 is forecast.

BP/USD Technical Analysis

Pound/dollar settled above the 1.3950 level (mentioned last week) and continued to much higher ground, reaching a peak of 1.4345.

Technical lines from top to bottom:

1.4745 capped the pair ahead of the Brexit referendum in 2016 is our high point. Further below, we find 1.4665 which capped the pair early in that year. 1.4520 is also a resistance line from that period.

1.4345 is the January 2018 swing high that is worth watching. The round number of 1.41 held the pair up after falling from that level. In the middle, we can point out to the veteran line of 1.4240, but volatility is somewhat wild here.

1.3945 was a swing high in January 2018. 1.3830 served as support after the break of the financial crisis.

1.3743 was a peak early in January and should be watched. The previous cycle high of 1.3620 serves as strong resistance.

1.3550 was the November peak. 1.3460 capped the pair in mid-December and serves as resistance.

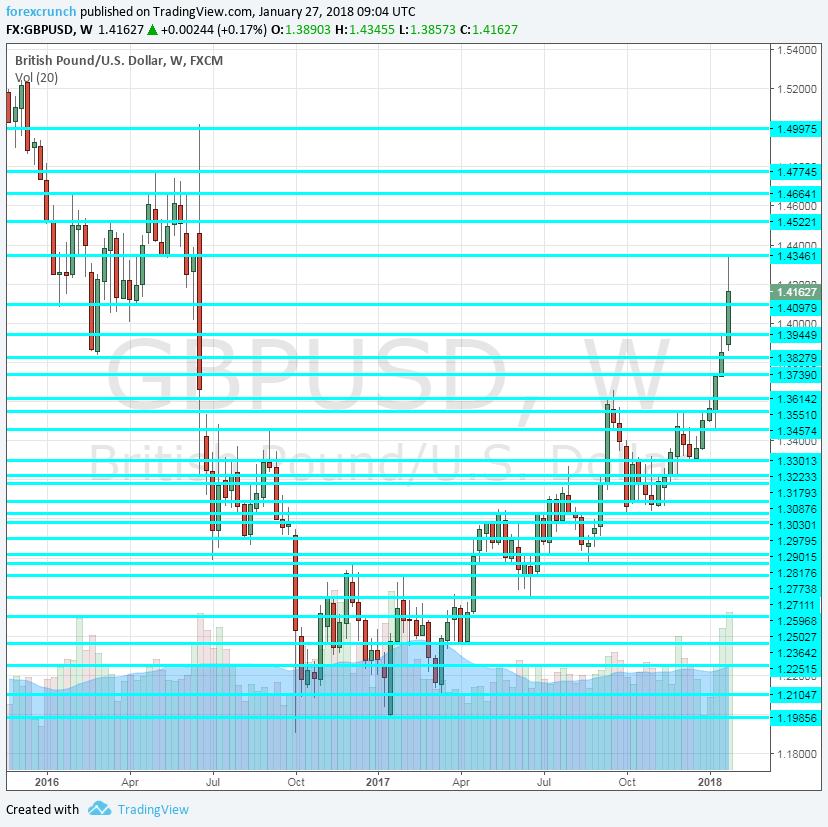

Here is the bigger picture of GBP/USD, using the weekly chart:

I am bearish on GBP/USD

The rise of the pound, given a weak economy and realistically, not-so-great Brexit prosepects, is quite surprising. At these highs, after five consecutive weeks of rises and an extended move in the past week, the move seems stretched and calls for a correction.

Our latest podcast is titled Dollar downfall and America’s economy

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!