GBP/USD extended its gains once again, riding higher on the weak US dollar and ignoring the worrying signs from the British economy. For how long can this continue? The jobs report and GDP stand out in a busy week. Here are the key events and an updated technical analysis for GBP/USD.

Inflation slipped back to 3% as expected, easing some pressures from the BOE. UK retail sales plunged by 1.5% in December and it wasn’t only a Christmas sales issue: November’s numbers were revised down. However, pound/dollar enjoyed another significant rally on top of the US dollar’s weakness, as money flows to other economies which are now picking up steam and even before the government shutdown which happened after markets had closed.

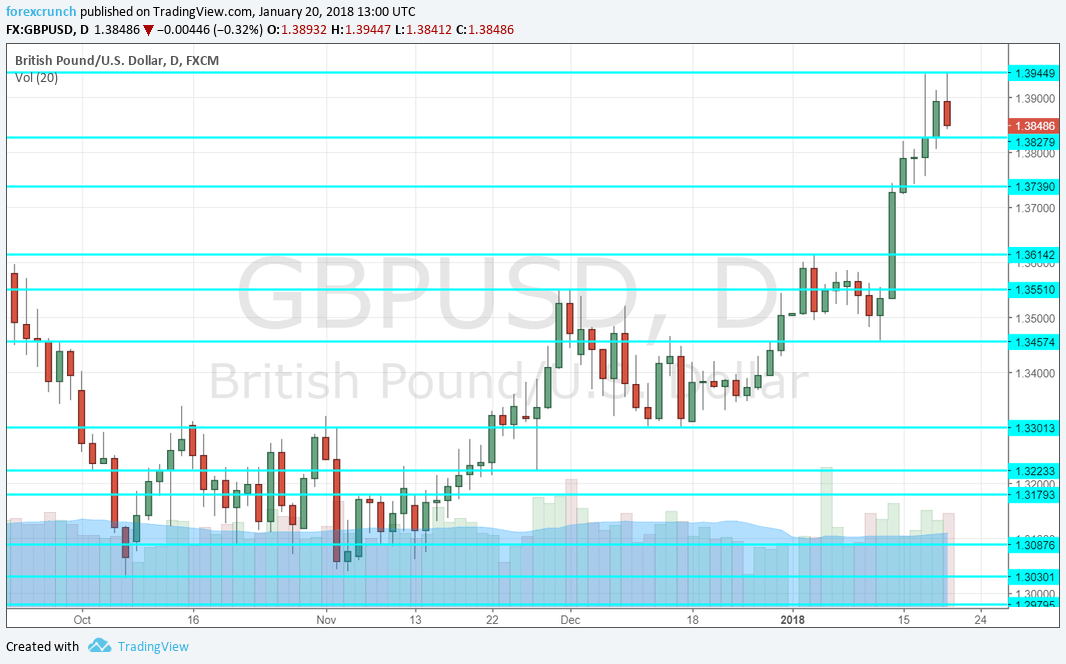

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Public Sector Net Borrowing: Tuesday, 9:30. Borrowing by the government rose to 8.1 billion in November, as expected. A drop to 4.2 billion is expected now and this could give a small boost to the pound.

- CBI Industrial Order Expectations: Tuesday, 11:00. The Confederation of British Industry’s measure for the manufacturing sector surprised to the upside in December by reaching 17 points. A drop back to 13 is projected for January.

- Jobs report: Wednesday, 9:30. The number of jobless rose by 5.9K in November, triggering some worries. In December, a more moderate rise 2.3K is predicted in the Claimant Count Change. The focus remains on the slightly lagging but all-important wage numbers. The Average Earnings Index rose by 2.5% y/y in October, moving higher but still falling short of inflation. Falling standards of living constrain the BOE. A repeat of the same number is on the cards for November. The unemployment rate is expected to remain at 4.3% for November. If wages do not surprise, the Claimant Count Change will likely take center-stage.

- High Street Lending: Thursday, 9:30. This early report on mortgages by the biggest banks dropped below 40K in November, standing at 39.5K. A small rise to 39.7K is on the cards. The construction sector has been somewhat disappointing of late.

- CBI Realized Sales: Thursday, 11:00. The second figure by CBI this week hit 20 points in December. A drop to 11 is on the cards now, implying higher sales volume, but a slower expansion.

- UK GDP: Friday, 9:30. The British economy certainly slowed down in 2017 after enjoying a great 2016. The UK lagged behind other developed economies in the first three quarters of 2017. Growth picked up in Q3 and stood at 0.4% q/q, yet all the forecasts don’t point to an acceleration in growth. We will now get a look at data for Q4 and the total for 2017. This is the first release out of three. An increase of 0.4% q/q is predicted.

- Mark Carney talks Friday, 14:00. The Governor of the BOE will be speaking in the World Economic Forum in Davos and has an opportunity to respond to recent economic figures such as inflation, retail sales, and GDP. Any hint on monetary policy and inflation will shake the pound.

BP/USD Technical Analysis

Pound/dollar kicked off the week with a move on the 1.3830 level (discussed last week). After a pause, the pair continued higher, reaching higher ground.

Technical lines from top to bottom:

We start from higher ground this time. 1.42 is a round number and also served as support a long time ago. 1.4140 is the next level to watch.

The very round level of 1.40 looms above and is a target for many analysts. 1.3945 was a swing high in January 2018.

1.3830 served as support after the break of the financial crisis. 1.3743 is the January 2018 high and should be watched.

The recent cycle high of 1.3620 serves as strong resistance. 1.3550 was the November peak.

1.3460 capped the pair in mid-December and serves as resistance. The round level of 1.33 is a key level of support, working as such around the same period of time.

1.3225 was the high point of September. It is followed by 1.3180, which capped the pair in July.

I remain bearish on GBP/USD

The weakness of the US dollar cannot carry cable higher forever. While the US government shutdown can weigh on the greenback, the economic data coming out of the UK may have a bigger impact in sending the pound lower.

Our latest podcast is titled Oil on a roll and some bitcoin bashing

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!