GBP/USD gained 1.1% last week, marking its first weekly gains in a month. The upcoming week features four events. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The UK economy contracted in Q2 by 2.2 percent. This was a downward revision from the initial estimate of 2.0 percent. This was the worst quarterly fall since 1979, as the coronavirus has had a huge negative impact on economic activity. In the manufacturing sector, the Final PMI came in at 50.1, close to the initial estimate of 50.2 points. The Final Services PMI came in at 47.1, just above the initial estimate of 47.0. This still indicates contraction, but was a much-improved figure over the previous reading of 29.0 points.

In the U.S., manufacturing improved sharply, as Manufacturing PMI climbed from 39.8 to 49.6 points. The estimate stood at 50.0, which separates contraction from expansion. Durable goods orders sparkled in May. The headline figure climbed 4.0%, rebounding after a decline of 7.4 percent. The core reading surged 15.8%, rebounding from a read of -17.2% beforehand. The Conference Board consumer confidence index jumped from 85.9 to 98.1 and easily beat the estimate of 91.6 points. Nonfarm payrolls shot up in June, with a gain of 4.80 million. This comes after a May release of 2.509 million. Unemployment claims dropped from 1.48 million to 1.42 million, higher than the estimate of 1.35 million.

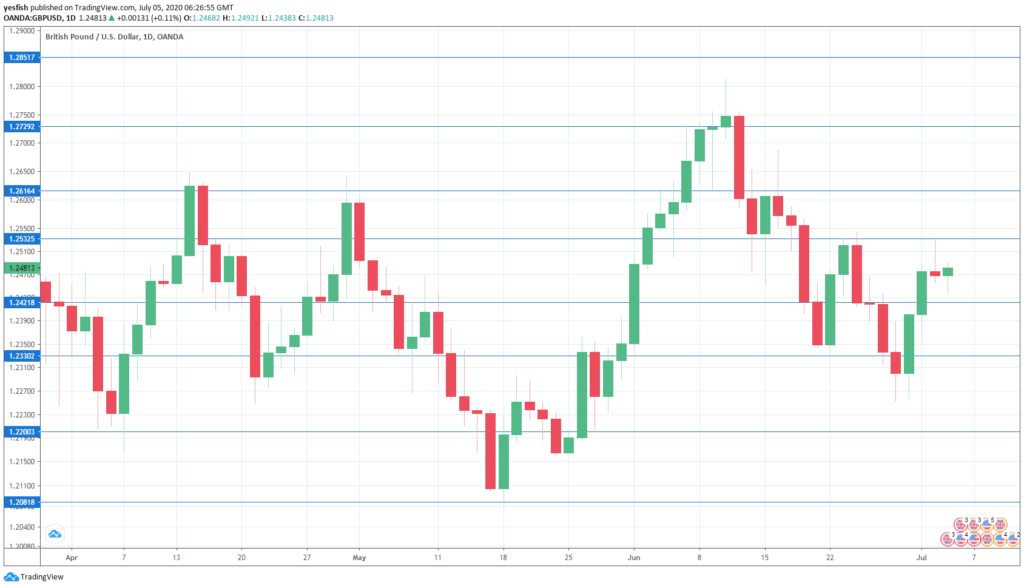

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Construction PMI: Monday, 8:30. Construction activity was close to rock-bottom in April, with an abysmal reading of 8.2 points. The PMI improved to 28.9 in May, and is expected to climb to 46.0 in the upcoming release. The 50-level separates contraction from expansion.

- Halifax HPI: Tuesday, 7:30. The housing inflation index has not posted a gain since February. The index declined by 0.2% in May and the estimate for June stands at -0.6%.

- RICS House Price Balance: Wednesday, 8:30. The Royal Institution of Chartered Surveyors survey in June showed 32% more surveyors reported a decrease in prices over those reporting an increase. This points to weakening conditions in the housing market. June is expected to be slightly better, with 25% more surveyors reporting a decrease in prices.

- CB Leading Index: Friday, 1:30. The Conference Board Index slipped 2.9% in April, reflecting weak economic conditions in the UK. Will we see an improvement in the May data?

Technical lines from top to bottom:

We start with resistance at 1.2850.

1.2729 has held as resistance since mid-June.

1.2616 is next.

1.2540 is under pressure and could be tested early in the week.

1.2420 (mentioned last week) is the first line of support. 1.2330 follows.

The round number of 1.22 has held in support since late May.

1.2080 is protecting the symbolic 1.20 level. It is the final support level for now.

I am bearish on GBP/USD

The British economy continues to struggle with the effects of Covid-19, and the lack of clarity on Brexit will make investors hesitant towards the British currency.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!