GBP/USD was unchanged last week, as the dollar’s recent rally fizzled out. This week features four events, including Final GDP. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

Manufacturing output volume declined sharply for a second straight month, with a dismal reading of -58 points. This was down from -62 beforehand. Manufacturing PMI improved to 50.1 in June, up from 45.2 in May. The trend was also positive in the services sector, as the PMI climbed from 39.1 to 47.0 points. Retailers reported another steep decline in sales, as the Confederation of British Industry Realized Sales index in June came in at -37 points. In May, the indicator came in at -50 points.

In the U.S., manufacturing improved sharply, as Manufacturing PMI climbed from 39.8 to 49.6 points. The estimate stood at 50.0, which separates contraction from expansion. Durable goods orders sparkled in May. The headline figure climbed 4.0%, rebounding after a decline of 7.4 percent. The core reading surged 15.8%, rebounding from a read of -17.2% beforehand.

Final GDP for the first quarter showed a decline of 5.0%, unchanged from the advance estimate. Unemployment claims dropped from 2.43 million to 2.12 million, which was within expectations. The news was not as good on the consumer front, personal spending declined by 13.6%, after a decline of 7.5% beforehand.

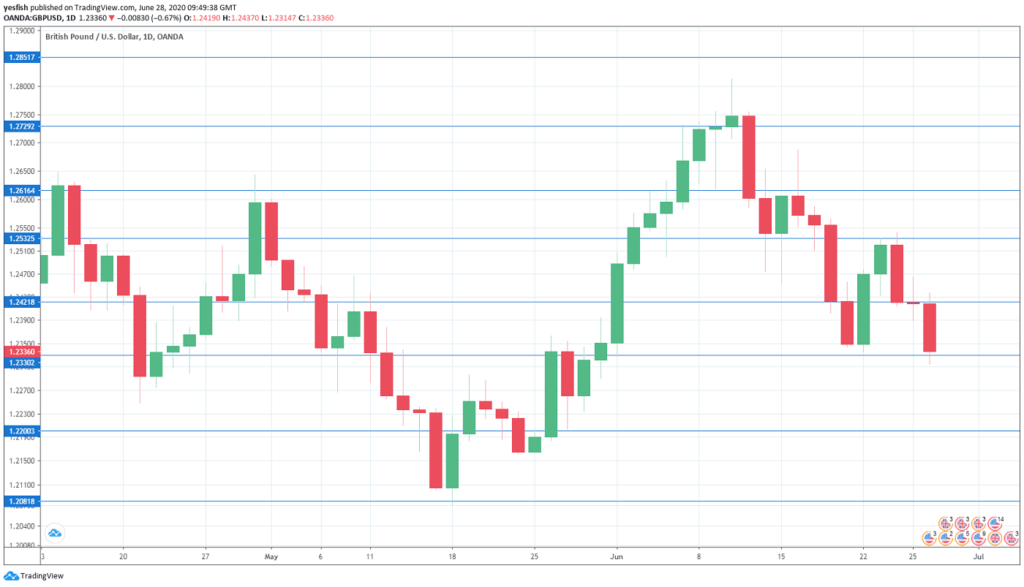

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 8:30. In another sign of weakness in the economy, credit levels fell in April by GBP 6.9 billion, the first decline since 2013. Another decline is projected for May, with an estimate of GBP 4.0 billion.

- Final GDP: Tuesday, 6:00. Second-estimate GDP for the first quarter is expected to confirm the initial read, with a forecast of -2.0 percent. This follows a flat 0.0% in Q4 of 2019.

- Final Manufacturing PMI: Wednesday, 8:30. The final read is expected to be revised upwards from 50.1 to 50.2 points. This is the first time that the index has been in expansion territory since February.

- Final Services PMI: Friday, 8:30. The final read is expected to confirm the initial release of 47.0 points. This is a strong improvement from the previous reading of 29.0 points.

Technical lines from top to bottom:

We start with resistance at 1.2729. 1.2616 is next.

1.2540 has some breathing room in resistance as GBP/USD continues to lose ground.

1.2420 (mentioned last week) is next.

1.2330 is an immediate support line. It could be tested early next week.

The round number of 1.22 has held in support since late May.

1.2080 is protecting the symbolic 1.20 level. It is the final support level for now.

I remain bearish on GBP/USD

The British economy is in recession and the road to recovery will be a long one. The pound is down 6.8% this year and GBP/USD will have difficulty turning the downtrend around.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!