GBP/USD posted sharp losses for a second straight week, dropping 1.5 percent. This week features four events, including services and manufacturing PMIs. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In a widely expected move, the Bank of England expanded its quantitative easing program, from GBP 645 billion to 745 billion. Policymakers did not lower interest rates into negative territory, as the official rate remained pegged at 0.10 percent. Unemployment rolls swelled by 528. 9 thousand in May, after soaring 856.5 thousand beforehand. However, the unemployment rate remained pegged at 3.9%, surprising analysts, who had expected a rate of 4.7 percent. Consumer inflation dropped in May to 0.5%, down from 0.8% in April. The week ended on a bright note, as retail sales rebounded with a gain of 12.0% in May, after a staggering decline of 18.1% beforehand.

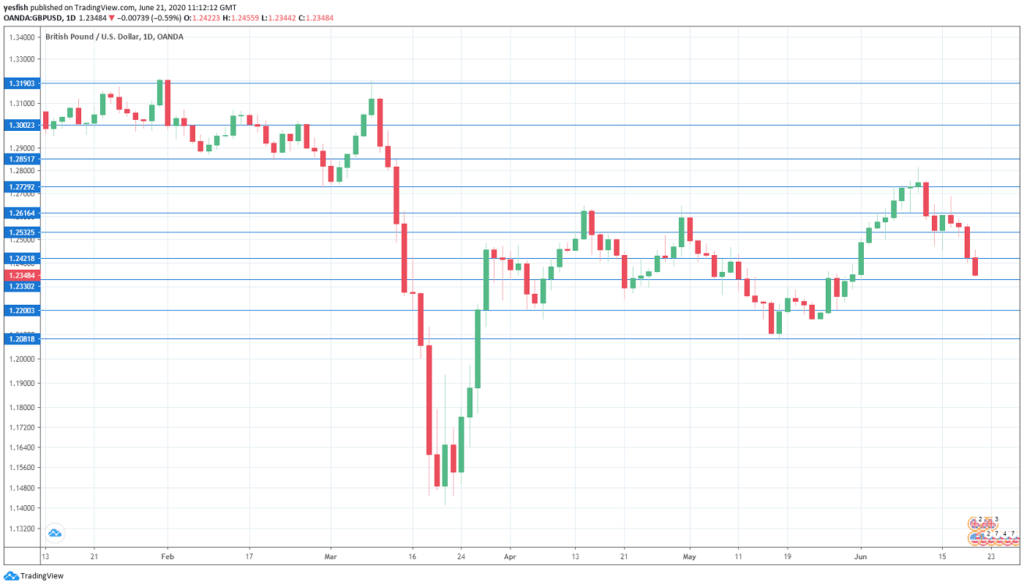

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 10:00. The Confederation of British Industry’s measure for the manufacturing sector has been in free-fall. The indicator slipped to -62 in May, down from -56 beforehand. Another soft reading is projected for June, with an estimate of -50 points.

- Flash Manufacturing PMI: Tuesday, 8:30. The manufacturing sector has been in contraction mode, as factories have been forced to shut down or operate at limited capacity in the wake of the Covid-19 pandemic. In May, the PMI came in at 40.7 and the initial read for June stands at 45.2 points.

- Flash Services PMI: Tuesday, 8:30. The services sector has been hit hard as much of the UK economy has ground to a standstill. The Services PMI improved to 29.0 in May, up from 13.4 beforehand. Analysts are projecting a strong improvement in the initial June release, with an estimate of 39.1 points.

- CBI Realized Sales: Wednesday, 10:00. The indicator is pointing to a strong decline in sales volume. The indicator came in at -50 in May and another sharp drop is projected for June, with a forecast of -35 points.

Technical lines from top to bottom:

We start with resistance at 1.2729. 1.2616 is next.

1.2540 has some breathing room in resistance as GBP/USD continues to lose ground.

1.2420 (mentioned last week) is next.

1.2330 is an immediate support line. It could be tested early next week.

The round number of 1.22 has held in support since late May.

1.2080 is protecting the symbolic 1.20 level. It is the final support level for now.

I remain bearish on GBP/USD

The British economy is in recession and the road to recovery will be a long one. The pound is down 6.8% this year and GBP/USD will have difficulty turning the downtrend around.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!