GBP/USD slipped by one percent last week, after three consecutive weekly gains. This week features four events – the BoE rate decision, employment, inflation and retail sales. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, April GDP was in free-fall, with a huge drop of 20.4 percent. This followed a drop of 5.8% beforehand. The manufacturing sector is sputtering, as manufacturing production sank by 24.3 percent. This was worse than the estimate of -15.0 percent.

In the U.S., consumer inflation posted a third consecutive decline, as the weak U.S. economy is not generating any inflation. Both the headline and core figures came in at -0.1%. The Fed made no change to the benchmark rate and indicated that it has no plans to alter rates from their ultra-low levels prior to 2022. Producer Price Inflation numbers were a mix. The headline read gained 0.4%, while the core figure fell by 0.1 percent. Unemployment claims continue to ease, falling to 1.54 million last week, down from 1.87 million beforehand.

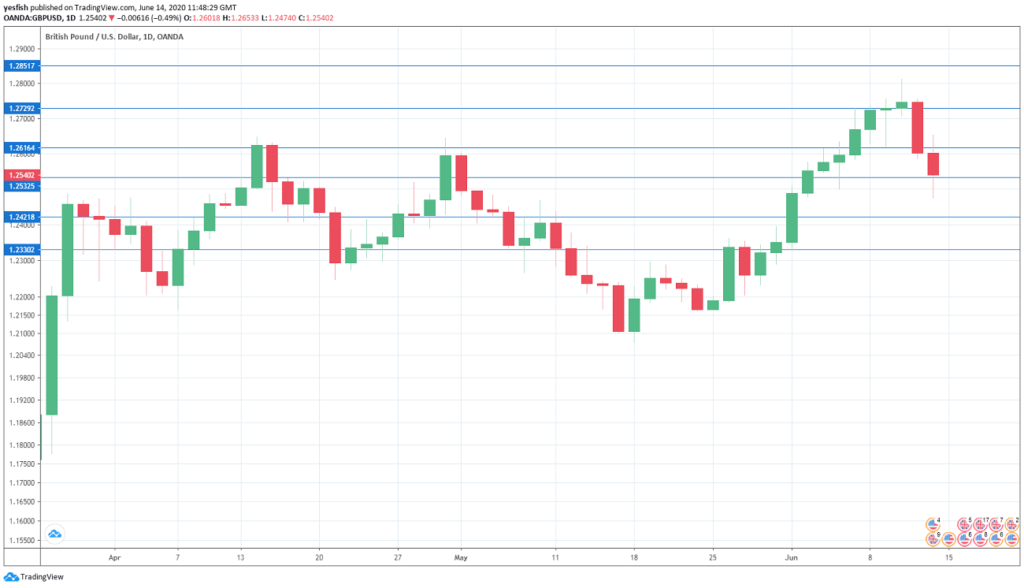

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- UK Jobs Report: Tuesday, 6:00. Unemployment claims soared to a staggering 856.5 thousand, up from 12.1 thousand beforehand. Wage growth headed lower for a second successive month in March. The indicator slipped to 2.4%, down from 2.8% beforehand. Analysts are braced for wage growth to fall to 1.4 percent. The unemployment rate, which has been hovering around 4%, is projected to climb to 4.7 percent.

- UK Inflation: Wednesday, 6:00. Consumer inflation fell to 0.8% in April, down sharply from 1.5% a month earlier. The May estimate stands at 0.5 percent. Core CPI dipped from 1.6% to 1.4% in April, and the downturn is expected to continue, with an estimate of 1.3 percent.

- BoE Decision: Thursday,11:00. The bank lowered interest rates close to zero in March and has maintained rates in order to support the sputtering economy. No change is expected at the upcoming meeting. The tone of the policy summary could affect the direction of the pound.

- Retail Sales: Friday, 6:00. Retail sales sank in April, falling by 18.1 percent. A strong rebound is expected, with a forecast of 6.3 percent.

Technical lines from top to bottom:

1.2851 has been a resistance line since early March.

1.2729 was tested in resistance late in the week. 1.2616 is next.

1.2540 is fluid. GBP/USD starts the upcoming week at this level.

1.2420 (mentioned last week) has some breathing room in support following losses by GBP/USD last week.

1.2330 is next.

The round number of 1.22 is the final support level for now.

I remain bearish on GBP/USD

The British economy contracted by one-fifth in April, as the economic conditions remain severe. If the U.S. economy shows signs of improvement, the dollar could make inroads against the pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!