GBP/USD Technical Analysis

GBP/USD reversed directions last week, as the pair declined by one percent. The upcoming week has six events, including inflation and PMI reports. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

British consumers opened their wallets in September, as BRC Retail Sales improved to 6.1%, up from 4.7%. Employment numbers were a mix. Jobless claims fell to 28.1 thousand, which was much better than the estimate of 78.8 thousand. The unemployment rate climbed to 4.5%, up from 4.1%. Wage growth improved to 0.0%, after three successive declines.

US consumer inflation slowed in September, as inflation levels remain at low levels. Both the headline and core readings dropped to 0.2%, down from 0.4% beforehand. The Philly Fed Manufacturing Index jumped to 32.3 in October, up from 15.0 points. This was the highest level since February. Unemployment claims climbed to 898 thousand, the highest level in seven weeks. Retail sales rebounded in September. The headline figure rose 1.9% and the core reading showed a gain of 1.5%.

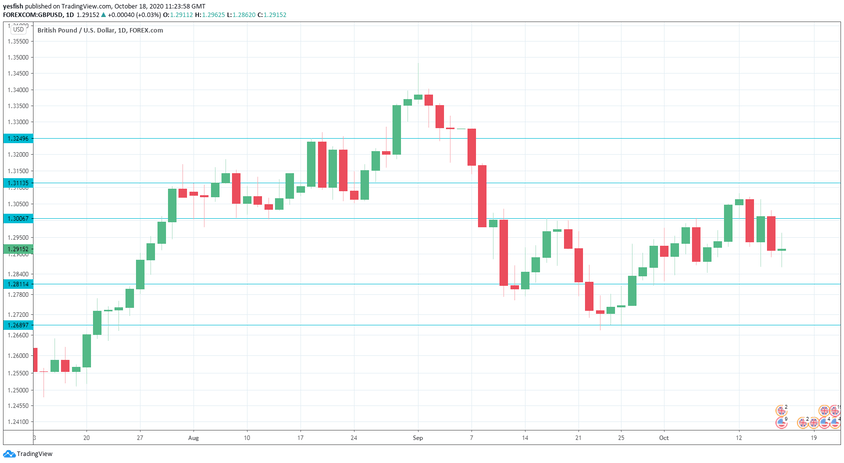

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Inflation Report: Wednesday, 6:00. Consumer inflation slowed to 0.2% in August, but is expected to improve to 0.4% in the September release. Core CPI is projected to rise to 1.3%, up from 0.9% in August.

- CBI Industrial Order Expectations: Thursday, 10:00. Manufacturers remain pessimistic about economic conditions and fell to -48 in September, compared to the estimate of -32 points.

- GfK Consumer Confidence: Thursday, 23:01. Consumers remain pessimistic about the economy and the indicator remains mired in negative territory. The indicator came in at -25 in August and the September release stands at -28 points.

- Retail Sales: Friday, 6:00. Retail Sales slipped to just 0.8% in August, matching the estimate. The downturn is expected to continue in September, with a forecast of 0.0%.

- Manufacturing PMI: Friday, 8:30. Manufacturing remains in expansive territory, as the PMI shows readings above the neutral 50-level. The PMI came in at 54.1 in August and is expected to dip to 53.2 in September.

- Services PMI: Friday, 8:30. The August PMI was revised upwards to 56.1, up from 55.1. The forecast for September is 53.1, above the 50-level which separates expansion from contraction.

.

Technical lines from top to bottom:

We start with resistance at 1.3249, an important monthly line.

1.3113 (mentioned last week) is next.

1.3006 has switched to a resistance role after sharp losses by GBP/USD last week.

1.2914 is an immediate support level.

1.2811 is next.

1.2689 is the final support line for now.

I remain bearish on GBP/USD

With the UK imposing further lockdowns due to Covid-19, the economy’s downturn could be significant. As well, the UK and the EU remain far apart on a deal over Brexit, which could weigh on the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!