GBP/USD rebounded last week, posting gains of close to 1.0%. The upcoming week has five events, including manufacturing and services PMIs. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

UK unemployment claims dipped to 73.7 thousand, down from 94.4 thousand beforehand. Wage growth declined for a third straight month, falling by 1.0%. However, the unemployment rate rose to 4.1%, up from 3.9%. Inflation slowed to just 0.2% in August, down from 1.0%. The core reading fell to 0.9%, down from 1.8%. The Bank of England maintained rates at 0.10%. There were some jitters in the market as the BoE said it was looking at the option of negative rates, and the pound briefly lost ground as a result. The week ended up with retail sales, which slowed to 0.8%, as expected. This was down considerably from 3.6% beforehand.

In the US, the highlight was the Federal Reserve policy meeting. As expected, the Fed kept interest rates close to zero. Of more interest to investors was the Fed message that it will not raise rates before 2023, under its new inflation target, which allows inflation to overshoot 2% without triggering a rate hike.

US retail sales slowed significantly in August. The headline reading dropped to 0.6%, down from 1.2%. Core retails sales came in at 0.7%, down sharply from 1.9%. This points to weakness in consumer spending, which is a key driver of economic growth.

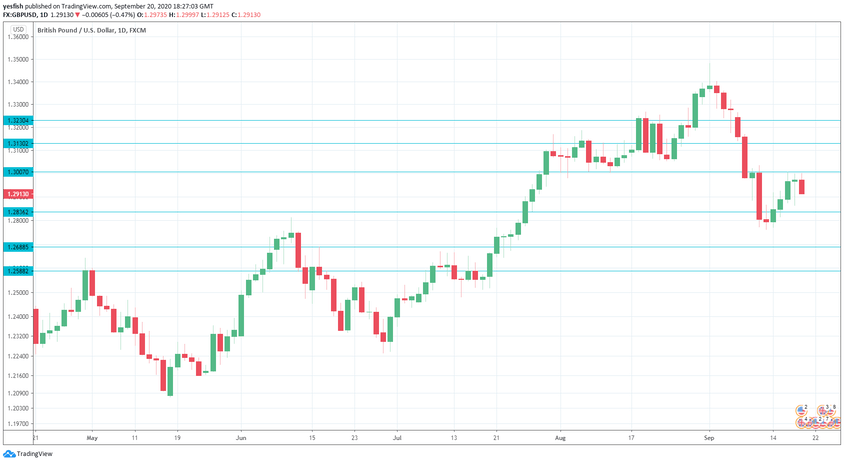

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Public Sector Net Borrowing: Tuesday, 6:00. The UK’s budget deficits have been falling. The July deficit came in GBP 25.9 billion, down from 34.8 billion. However, the deficit is expected to widen to GBP 40.06 billion in August.

- CBI Industrial Order Expectations: Tuesday, 10:00. Manufacturers continue to expect decreasing volume, but the rate of decline has been easing. In July, the indicator improved from -46 to -44, and the forecast for September stands at -32 points.

- Flash Manufacturing PMI: Wednesday, 8:30. The PMI has hovered just above the 55 level for the past two months. This is well above the 50-level, which separates contraction from expansion. The August estimate is 54.3 points.

- Flash Services PMI: Wednesday, 8:30. The index has rebounded in impressive fashion, with a reading of 60.1 in August. Back in April, the index came in at just 12,3, pointing to sharp contraction. The forecast for August stands at 57.1 points.

- CBI Realized Sales: Thursday, 10:00. The Confederation of British Industry’s gauge of sales fell to -6 in August, down from 4 points beforehand. The indicator is projected to fall to -10 in September.

Technical lines from top to bottom:

There is resistance at 1.3230 (mentioned last week).

1.3113 is next.

1.3006 is protecting the symbolic 1.30 level.

1.2835 has switched to resistance after strong gains by GBP/USD last week.

1.2689 is next.

1.2590 was a swing low in September 2017. It is the final support level for now.

I remain bearish on GBP/USD

Tensions over Brexit are again bubbling over as the EU and UK remain at odds over the post-Brexit trade relationship, and this could weigh on the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!