GBP/USD showed modest losses during the week, falling below the 1.33 level. The upcoming week has four events. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, the Manufacturing PMI came in at 55.2, very close to the initial reading of 55.3. Construction PMI slowed to 54.6, down from 58.1. Still, the fact that the manufacturing, services and construction sectors all posted readings in expansion territory points to a deeper recovery. The 50-level separates contraction from expansion.

Consumer credit demand increased, as Net Lending to Individuals climbed to GBP 3.9 billion, up from GBP 1.8 billion beforehand. Services PMI continued to accelerate, with a read of 58.8, up from 56.5.

In the US, last week’s numbers were solid. Manufacturing PMI improved to 56.0, up from 54.2. The Services PMI also pointed to expansion, but slowed to 56.9, down from 58.1 beforehand. Unemployment claims dropped below the 1-million mark with a reading of 886 thousand. Nonfarm payrolls slowed to 1.371 million, but was very close to the estimate of 1.374 million. The unemployment rate fell sharply to 8.4%, down from 10.2%. This marked the first single-digit reading since April, prior to the Corvid-19 pandemic. There was more good news from wage growth, which rose from 02% to 0.4%.

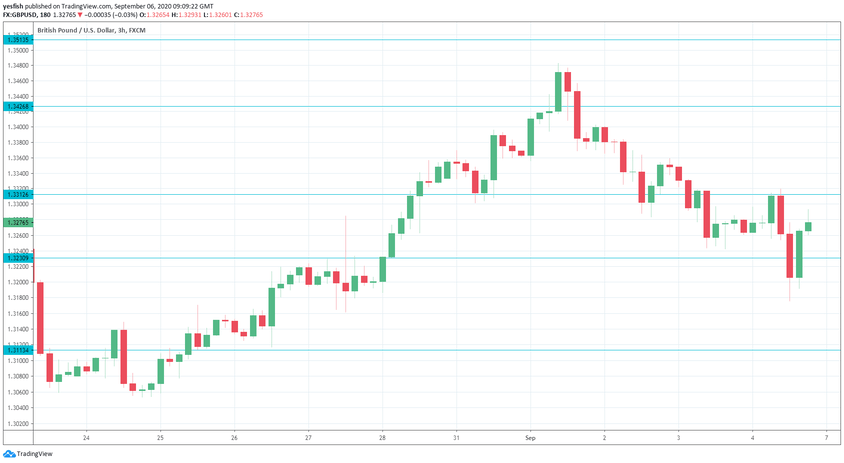

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Tuesday, 23:01. This indicator shows retail sales numbers for BRC shops. In July, retail sales rose 4.3%, after a gain of 10.9% beforehand. Will we see another gain in the August data?

- RICS House Price Balance: Wednesday, 23:01. The indicator improved in July, showing 12% more surveyors reported a price increase over those reporting a price decrease. This was the first gain in three months. The estimate for August stands at 23%.

- CB Leading Index: Thursday, 13:30. This tier-2 indicator is based on 7 economic indicators. In June, the indicator declined by 2.4%. Will we see an improvement in July?

- GDP: Friday, 6:00. GDP has rebounded nicely since a disastrous plunge of 20.4% in April, which reflected the severe economic slowdown due to Covid-19. In June, GDP climbed 8.7% and the forecast for July is a solid gain of 6.6%.

- Manufacturing Production: Friday, 6:00. The manufacturing sector continues to recover since a plunge of 24.3 in April. The June reading came in at 11.0% and July is projected to show a gain of 5.0%.

Technical lines from top to bottom:

1.3615 has held in resistance since December 2018.

1.3513 (mentioned last week) is the 52-week high for the pair.

1.3426 is next.

1.3312 has switched to a support role after losses by GBP/USD last week.

1.3230 is the first line of support.

1.3113 is next.

1.2951 is the final support level for now.

I am bearish on GBP/USD

The US posted some good job numbers last week, pointing to a stronger recovery. This could improve sentiment towards the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!