GBP/USD soared last week, climbing 2.0 percent. The upcoming week has four events. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, the sole event, CBI Realized Sales fell to -6 in August, indicative of lower sales volume. The indicator has managed only gain in the past six months. This points to prolonged weakness in the retail sector.

Over in the US, Conference Board Consumer Confidence slipped to 84.8, down from 91.7 beforehand. Durable Goods Orders were mixed – the headline reading accelerated 11.2%, up from 7.3% in the previous release. However, the core release slowed to 2.4%, down from 3.3% beforehand. US second-estimate GDP was upwardly revised to 31.7%, compared to 32.9% in the initial release.

The market-mover of the week was a speech from Federal Reserve Chair Jerome Powell at the Jackson Hole meeting. Powell said that the Fed would allow inflation to overshoot its inflation target of 2.0%. This dramatic shift in policy means that interest rates will likely stay very low for the foreseeable future. This resulted in broad losses for the US dollar last week.

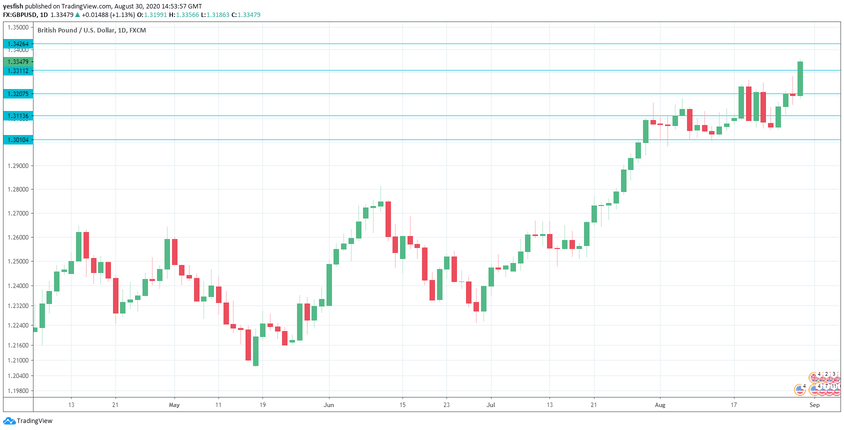

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 8:30. The index posted a strong gain of 55.3 in August, which points to expansion. The second estimate is expected to confirm the initial reading.

- BRC Shop Price Index: Tuesday, 23:01. The inflation index has failed to muster a gain in over two years, as inflation remains at low levels. The index declined by 1.3% in July and we now await the August data.

- Services PMI: Thursday, 8:30. The services sector continues to accelerate and climbed from 47.1 to 56.5 in July. The upswing is expected to continue in August, with an estimate of 60.1 points.

- Construction PMI: Friday, 8:30. The index came in at 58.1 in July, pointing to expansion. The estimate for August stands at 58.9.

Technical lines from top to bottom:

1.3615 has held in resistance since December 2018.

1.3513 is the 52-week high for the pair.

1.3426 is next.

1.3312 has switched to support for the first time in 2020.

1.3207 is next.

1.3113 has some breathing room in support.

1.3009 (mentioned last week) is protecting the key 1.3000 level. This is the final support level.

I remain neutral on GBP/USD

The pound jumped on the bandwagon this week as the US dollar showed broad losses. With both the UK and the US struggling with Covid-19, investors do not appear to be attracted to either currency.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!