- The dollar weakness experienced last week pushed the pair higher.

- Investors expect nonfarm payrolls to go GBP/USD higher.

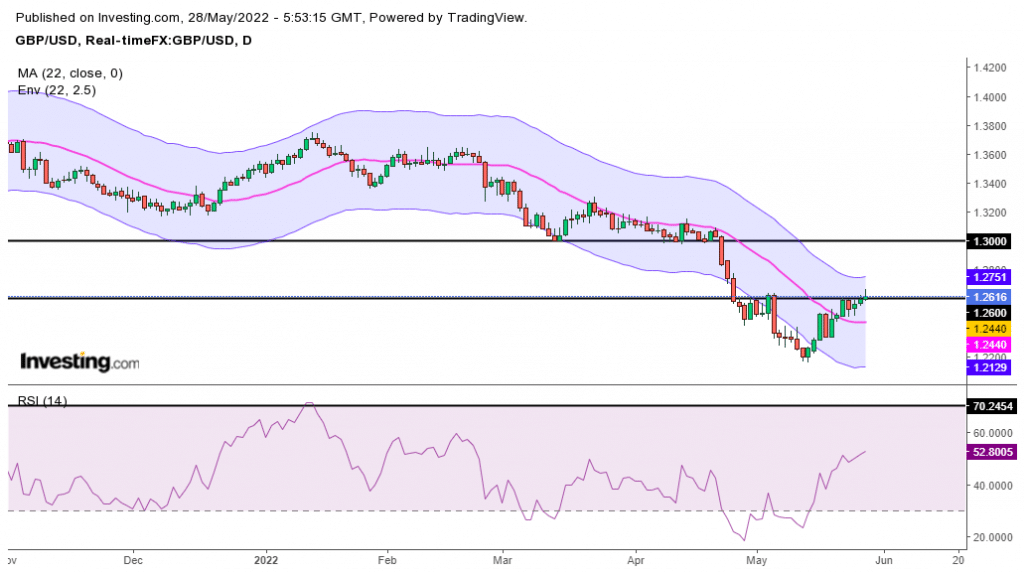

- The technical scenario also remains bullish for the pound.

The weekly forecast for GBP/USD for the coming week is up as the gains experienced this week could continue. This was brought on mainly by the weakness experienced by the dollar after the FOMC minutes pointed to the Fed possibly pausing rate hikes later in the year.

-Are you interested in learning about forex indicators? Click here for details-

Ups and downs of GBP/USD

The GBP/USD pair had experienced much in the past week, starting on Monday when Governor Bailey spoke. He mainly hit back at critics who accused him of sleeping on the job while inflation rose. The Bank of England governor insisted that interest rate hikes would only damage a recovering economy.

Tuesday saw the release of PMI data from the UK, which came in lower than expected, and the market pushed lower for the day. On Wednesday, investors mostly reacted to the FOMC meeting minutes, which saw the dollar push lower and GBP/USD close the day up.

Dollar weakness extended to Thursday as GDP (QoQ) for the first quarter in the US came in lower than investors expected. This also saw GBP/USD close higher for the day. Friday was a quiet day across the board as not much happened in the markets.

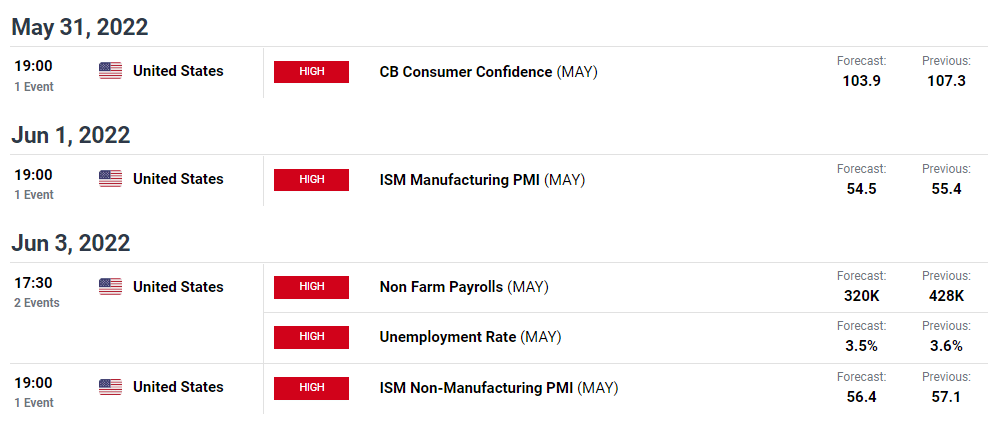

Next week’s key events for GBP/USD

The coming week has holidays in both the US and the UK, affecting volatility. Memorial Day in the US will be on Monday, while the bank holiday will be on Thursday and Friday in the UK. The biggest thing investors will be looking out for next week will be the nonfarm payrolls, which could cause a lot of volatility on Friday.

-Are you interested in learning about the forex signals telegram group? Click here for details-

GBP/USD weekly technical forecast: Short-term Bulls dominating

However, the break of the SMA is not enough to change the long-term bias for GBP/USD, which is down. The market will need to show a lot more bullish momentum to change the trend to a bullish one. The short-term bias is bullish.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money