- Boris Johnson’s resignation rekindled hope in GBP/USD investors as the pair went up.

- A positive US jobs report shows the economy might not be heading for a recession.

- RSI shows weakness in the bearish move.

The weekly GBP/USD forecast is bearish as the UK faces political turmoil, which might weigh on the pound along with Brexit jitters.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Ups and downs of GBP/USD

GBP/USD had a choppy week, with the price closing lower at the end of the week. The pair was under a lot of pressure, with the UK facing political uncertainty.

The Boris Johnson administration was falling apart due to the growing number of scandals and the high cost of living in the UK, which was partly blamed on the administration. Boris Johnson held on to power till the last day on Thursday, when he finally resigned. The pound went up after his resignation.

Next week’s key events for GBP/USD

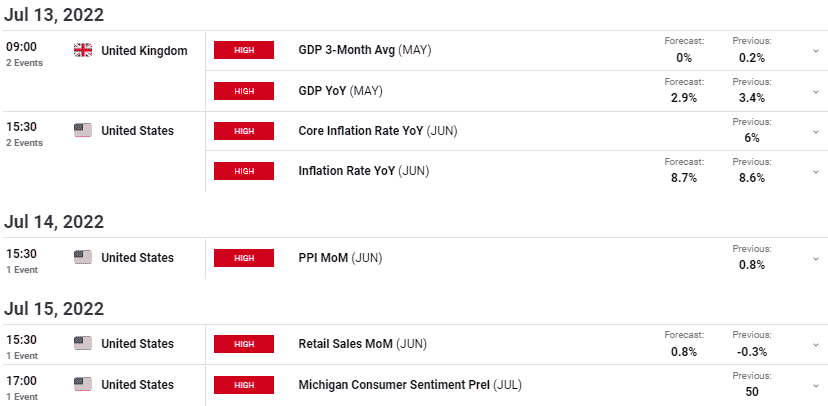

GBP/USD investors expect to see a GDP contraction in the UK. The United States will release data showing whether the Federal Reserve has tamed inflation. The recent jobs report shows the economy is in good shape, giving the Fed more room to raise interest rates.

“There has been a lot of doom and gloom recently, so a strong labor market read may assuage some fear of a recession and show the resilient nature of our economy with a robust labor market in the face of hot inflation. The Fed is committed to raising rates aggressively to cool it, which will likely result in continued volatility,” said Mike Loewengart, managing director at E*TRADE from Morgan Stanley.

If the inflation data shows rising inflation, we might be in for a tighter Fed. However, if inflation comes in lower, it will be a sign that the Fed’s current monetary policy is succeeding in bringing inflation down.

GBP/USD weekly technical forecast: Bullish divergence in RSI

Looking at the daily chart, we see the price making lower lows and trading below the 22-SMA. It shows that bears are in charge. However, RSI shows weakness in the bearish move as there is a bullish divergence.

–Are you interested to learn about forex robots? Check our detailed guide-

The bears would have to come back stronger next week to push the RSI lower and bring back strong bearish momentum. If bulls come in, we might see the price breaking above the 22-SMA and heading for the next hurdle at 1.26392.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money