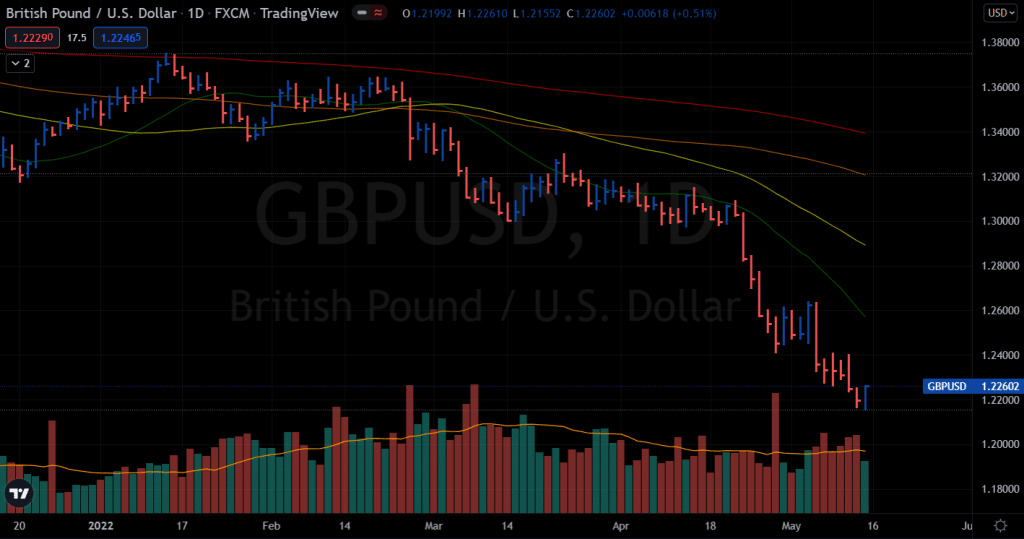

- GBP/USD pair printed fourth consecutive weekly red candle.

- The pair ended the week with a rebound above 1.2200.

- With a decision on Northern Ireland Protocol expected this week, the pair may see more downside.

As the London session ended on Friday, the price pulled back and surged over 1.2200, which improved the weekly forecast of the GBP/USD pair.

–Are you interested in learning more about forex robots? Check our detailed guide-

GBP/USD fundamental analysis

The pair is still trading about 200 pips lower from the weekly highs. The most recent price action appears to be pushed by traders taking profits ahead of the weekend.

Bears calm down a bit.

The GBP/USD exchange rate entered a stability phase just over 1.2200 earlier on Friday, amid the good economic outlook maintaining the dollar’s rise in line.

The 1.2250 price level provides the pair with a serious challenge, and if it continues to hold, the pair may have a tough time gaining pace in the positive direction.

Dark clouds over GBP

Thursday was a difficult day for the pound due to the poor data reports from the United Kingdom and the ongoing uncertainty regarding Brexit.

On the other hand, an uncertain global market environment and hostile comments from the Federal Reserve official offered a lift to the dollar’s value, which dragged the pair to fresh 2-year lows around 1.2165.

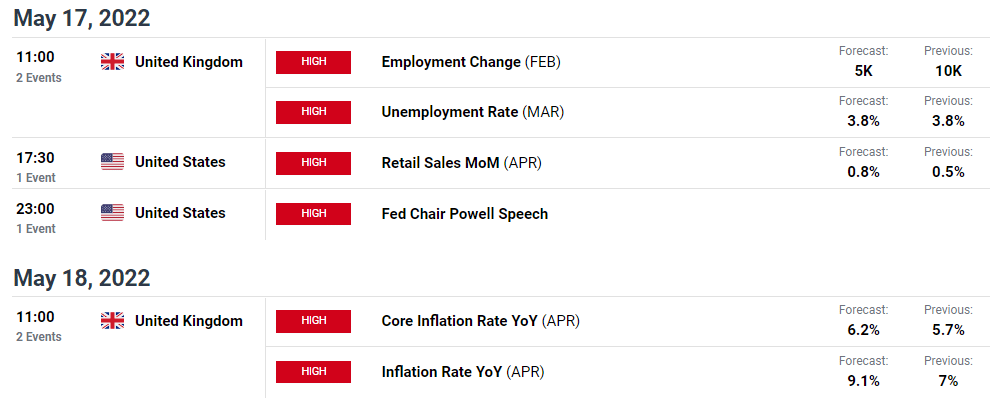

GBP/USD data and events ahead

The Unemployment rate is to be announced in the coming week. The forecast says that it would be around 3.8%. Beating the forecast will help the bulls steer beyond the previous weekly highs.

The core inflation rate is also to be announced, and the forecast says that it would be around 6.2%. This could be another decisive indicator that may make or break the situation for the sterling.

We have Fed Chairman Powell’s all-important speech from the US on May 17. In addition, we have the Retail Sales for April, which we can expect to be around 0.8%.

GBP/USD weekly technical forecast: Bulls making a recovery?

The GBP/USD price continues to trade lower than the falling trend pattern that began around May 5. Suppose the pair successfully breaks this resistance and begins to use it as a support. In that case, it may aim for 1.2300 (a psychological level) and 1.2350 (a static level) as its next two targets (static level, 50-day simple moving average).

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

However, the pair maintains a broader bearish trend. The temporary rebound may provide a lofty opportunity for the sellers around 1.2300 to 1.2350. The bears may force the price to fall towards a 2-year low at 1.2165 ahead of 1.2000.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money