- Traders raised their bets on higher Bank of England interest rates.

- Most Fed policymakers still prioritize the fight against inflation.

- Volatility could arise from a speech by Fed Chair Powell at the Jackson Hole Symposium.

The GBP/USD weekly forecast is slightly bullish as investors raise bets on BOE rate hikes amid upbeat UK economic data.

Ups and downs of GBP/USD

The pound experienced wild fluctuations in the last week and ended slightly higher. The pound experienced a slight increase against the dollar as traders adjusted their predictions of higher Bank of England interest rates. Recent data on inflation and wages prompted this adjustment.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Notably, interest rate expectations have risen following the revelation of record-high British wage growth on Tuesday. Moreover, there was a report on unexpectedly higher core inflation on Wednesday.

Meanwhile, the Federal Reserve’s meeting minutes, released later, revealed a split among central bank officials regarding the necessity of further interest rate hikes.

As indicated in the minutes, most policymakers still prioritize the fight against inflation. This adds to the uncertainty among investors concerning the future course of interest rates.

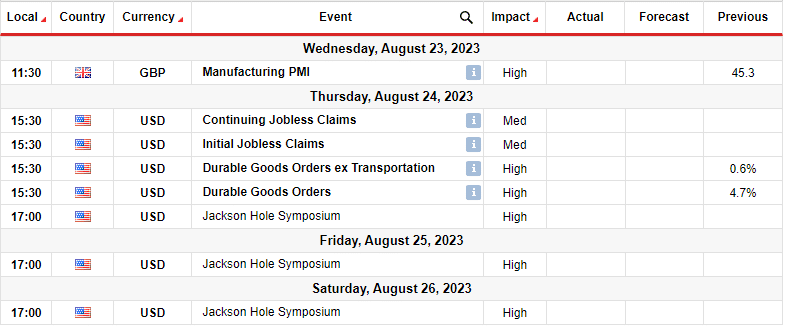

Next week’s key events for GBP/USD

The market will focus on US employment data and the manufacturing PMI report from the UK. Additionally, volatility could arise from a speech by Fed Chair Powell at the Jackson Hole Symposium.

The US initial jobless claims report will emphasize the labor market’s condition. Recent reports have indicated a persistently tight labor market, which could continue. Additionally, investors will focus on the durable goods orders report from the US. This report will give a picture of the economy.

Meanwhile, the manufacturing PMI report from the UK will show the sector’s business activity level.

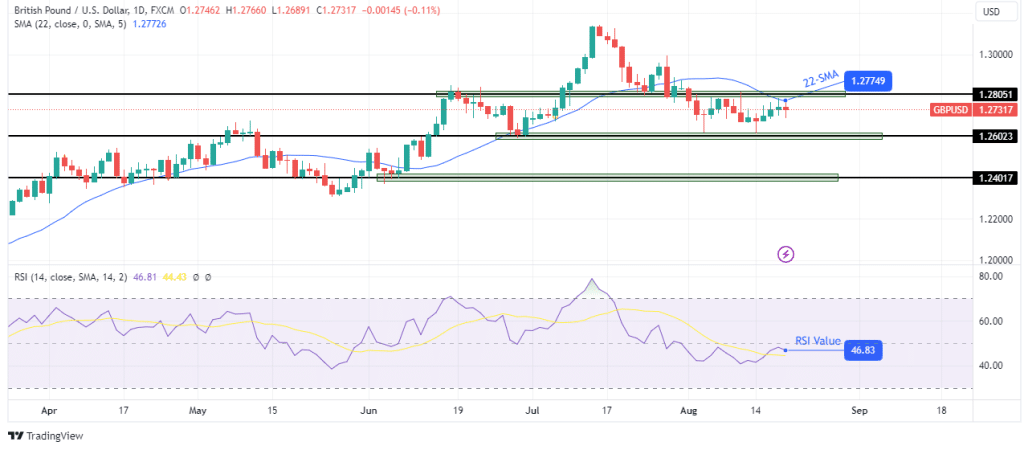

GBP/USD weekly technical forecast: A likely price retreat towards 1.2602 support.

On the daily chart, the pound has recovered to retest the 22-SMA and 1.2805 resistance zone. The price recently broke below this zone as bears took control from bulls. There was a shift in sentiment that saw the RSI drop below 50. The bearish bias is still strong, as bulls have not shown much strength in the recovery.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Moreover, the price trades below the 30-SMA, and the RSI has stayed below 50, supporting bears. Therefore, we might see the price bounce lower in the coming week to retest the 1.2602 support level. A break below this level would likely lead to a retest of the lower support at 1.2401.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.