- During the Fed/BOE week, the GBP/USD trended downward.

- In response to the Bank of England’s warnings, cable prices fell to a 22-month low.

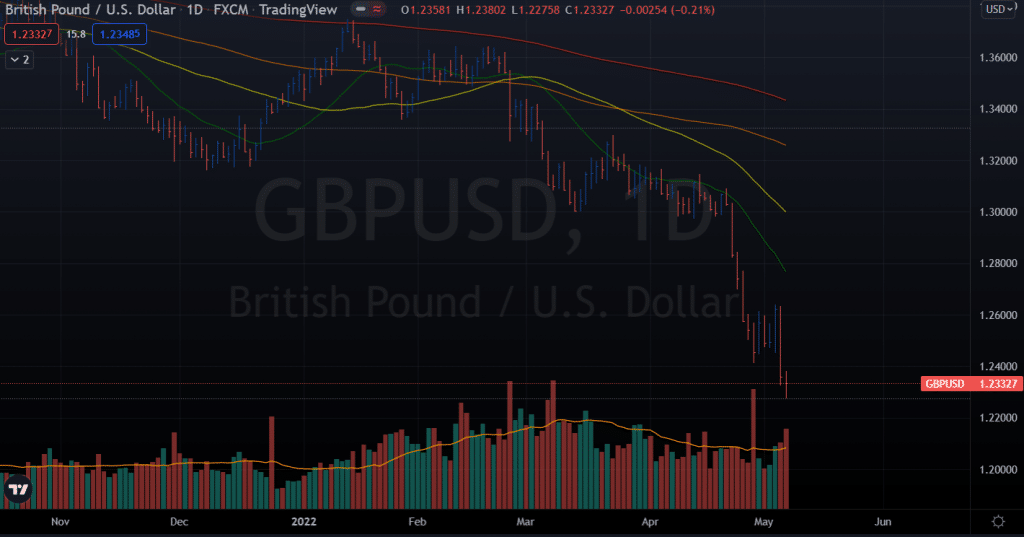

- A bearish flag on the daily chart indicates that US and UK GDP inflation will continue to rise.

The weekly forecast for the GBP/USD remains strongly bearish after the BoE/Fed divergence and upbeat US NFP data. As the UK’s bleak economic outlook deepened the economic divergence and monetary policy, the contrast between the Fed and the Bank of England remained strong.

–Are you interested in learning more about STP brokers? Check our detailed guide-

As a result, GBP/USD remained fairly stable throughout the week before falling to a fresh 22-month low below 1.2300. However, with attention now focused on US inflation and the UK GDP quarter-end, the pair posted a third consecutive week of losses.

During the first half of the week, GBP/USD fell to 1.2411, the lowest level since July 2020. US dollar bulls took control of the market in May due to a public holiday in the UK and the lack of risk. However, continuing quarantine measures in China led to a decline in business activity.

Cable buyers bought on a dip below 1.2500 as risk sentiment improved, putting pressure on the safe-haven dollar. As a result, sterling supporters were able to find some comfort in the dollar’s repositioning ahead of the Fed meeting. However, the dollar fell on disappointing US ISM data and the S&P Global Manufacturing PMI. In addition, Reuters reported that markets now expect a stronger-than-expected Bank of England rate rise on Thursday of 50 basis points, especially after the Reserve Bank of Australia (RBA) raised rates on Tuesday by 25 basis points.

As the dollar corrected and the drop in US Treasury yields after the Fed’s less aggressive tightening policy on Wednesday, the GBP/USD rally only strengthened. The world’s most powerful central bank has been less hawkish than expected, casting doubt on expectations of a 75-basis point rate increase in June. Instead, with an expected 0.5% increase in the federal funds rate, the Fed began cutting balance sheets at $47.5 billion per month starting June 1, with plans to reach $95 billion in three months.

As the Bank of England sees a recession in the UK economy in 2022 after a 25-basis point increase in interest rates, the pair failed to sustain bearish pressure above 1.2600 on Thursday. According to BoE, inflation will peak at around 10% in the third quarter, compared to 7.5% in April. An increase in global growth fears has triggered a new flight to safety and revitalized the dollar’s safe-haven status. It fell 300 points on Super Thursday to a 22-month low of 1.2325.

Cable hit a 22-month low during the European session on Friday below 1.2300. Before the weekend, the dollar remained strong as the US jobs report confirmed tight labor market conditions and prevented the pair from significantly recovering. In April, the US Bureau of Labor Statistics reported a 428,000 increase in nonfarm payrolls, beating market expectations of 391,000. Additionally, the labor force participation rate decreased to 62.2% from 62.4% in March. Wage growth continued to be 5.5% in April.

Week ahead for the GBP/USD

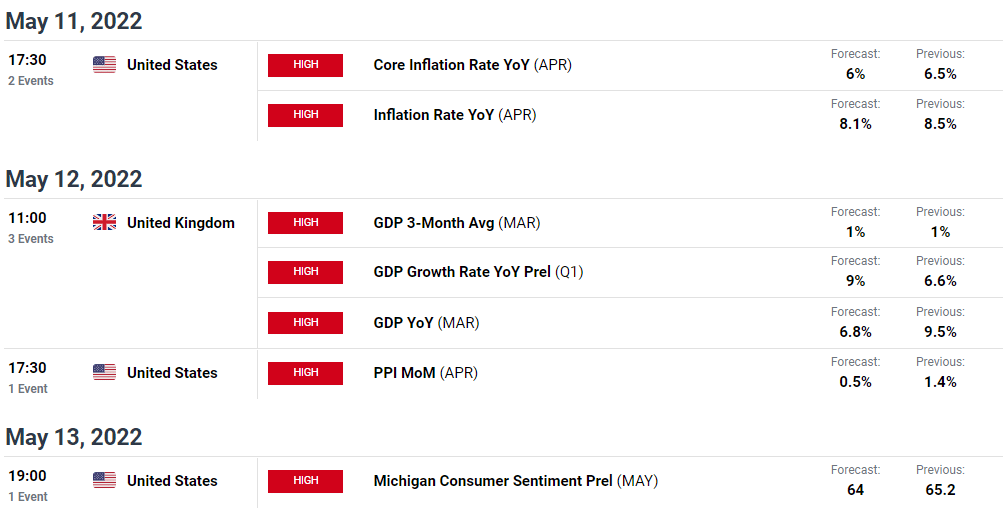

Markets are gearing up for US inflation, and UK GDP data stand out in a relatively light week, following a week dominated by central bank events. In the meantime, the cable will continue to be driven by the dollar’s momentum and the divergence between the Fed and the Bank of England.

On Monday, Bank of England politician Michael Saunders will deliver a speech. Saunders voted for a 50-basis point increase with Katherine Mann and Jonathan Haskell at last Thursday’s meeting of the BoE.

On Tuesday, there were no top-notch economic reports on either side of the Atlantic, though Fedspeak may draw some attention. Wednesday’s US consumer price index (CPI) will provide new insights into the economy.

–Are you interested in learning more about making money with forex? Check our detailed guide-

GBP/USD weekly technical forecast: Mounting bearish pressure

The daily chart of GBP/USD shows an extremely dismal scenario. The price lies well below the key SMAs. The volume for the bearish bars is on the rise. The price can further plunge to 1.2250 ahead of 1.2050. The bullish reversal is too far to occur now.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money