Talk of a Hard Brexit weighed heavily on the British pound – a quicker, nastier exit of the European Union with less trade between the island nation and the continent pushed sterling lower. An accident was waiting to happen, and eventually, the pound collapsed, with GBP/USD dipping under 1.20.

The seismic movement, that happened before the Tokyo open, was also felt against the Japanese yen. GBP/JPY flash-crashed under 125 to 124.85 before bouncing back, trading at the 128 handle at the time of writing.

While the crash was a result of extremely low liquidity, thin trading volume and perhaps a fat finger, the fundamental reason for the fall of the pound is very real and not only the fault of the algorithms. A bad breakup between Britain and the EU is negative also for the whole world.

And when things go sour, where do you go to? Safe haven assets. The Japanese yen is the ultimate safe haven currency. So, this flash move may not be the end. An extension of the plunge could manifest itself in a more rational manner: GBP/JPY could fall on parallel sterling selling and a flow in the safe haven yen. This could be rolled out within several days or weeks, but it certainly isn’t over.

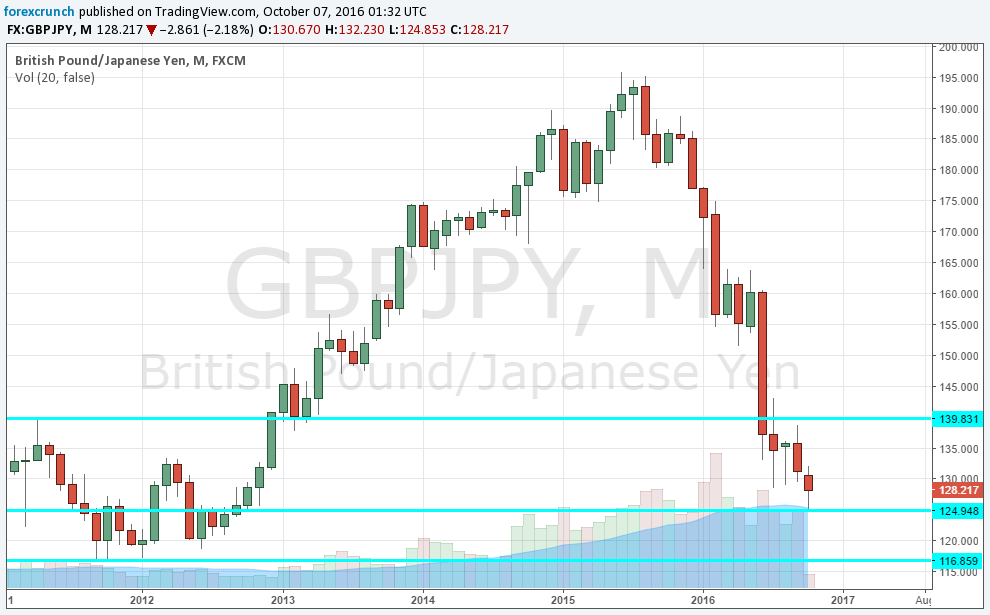

Looking at the chart of Geppy or “The Dragon” as this cross is called, we can see that contrary to cable, we are not in uncharted territory: in 2011 and 2012, GBP/JPY dropped under 117 during several occasions. A repeat of this scenario is not out of question. 125 may not be the end of it.

Here is the monthly chart of GBP/JPY. Can it extend its falls?