GBP/USD rallied for a fourth straight week, gaining over a cent. The pair closed the week at 1.6362. This week’s key releases are the PMIs and the BOE’s QE and Official Bank Rate decisions. Here is an outlook for the main events moving the pound, and an updated technical analysis for GBP/USD.

[do action=”autoupdate” tag=”GBPUSDUpdate”/]

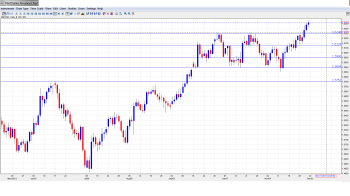

GBP/USD graph with support and re

- Manufacturing PMI: Monday, 9:30. Manufacturing PMI continues to hover in the mid-50 range, pointing to steady expansion in the manufacturing sector. The index came in at 56.0 points last month, and the November estimate stands at 56.5.

- BRC Retail Sales Monitor: Tuesday, 00:01. This indicator looks at retail sales in stores belonging the BRC chain. The indicator posted a gain of 0.8% last month, and the markets are hoping for another respectable gain in this week’s release.

- Halifax HPI: Tuesday, 3rd-6th. This housing price index is an important gauge of activity in the UK housing sector. The index posted a gain of 0.7%, last month, beating the estimate of 0.4%. The markets are expecting a gain of 0.8% in November.

- Construction PMI: Tuesday, 9:30. Construction PMI looked very strong in October, coming in at 59.4 points. This beat the estimate of 58.9 points. Little change is expected in the November release.

- BRC Shop Price Index: Wednesday, 00:01. This indicator measures inflation in goods purchased from the BRC chain. The index continues to post readings in negative territory, and the October release pointed to a decline of 0.5%.

- Services PMI: Wednesday, 9:30. Services PMI has looked very strong, with recent readings above the 60-point level. Last month’s release came in at 62.5 points, and the estimate for this November stands at 62.1 points.

- Autumn Forecast Statement: Thursday, 23:15. This release is issued annually. The statement looks at the economic outlook in the UK and previews the government’s budget for the coming year.

- Asset Purchase Facility: Thursday, 12:00. With the UK economy continuing to expand, some policymakers feel a case can be made to reduce QE. However, the markets are expecting QE to remain at the current level of 375 million pounds.

- Official Bank Rate: Thursday, 12:00. The benchmark interest rate has remained at 0.50% for almost five years, and the BOE has been quite clear that it does not intend to raise rates in the near future. The Bank will announce the December rate through its Rate Statement.

- Consumer Inflation Expectations: Friday, 9:30. This quarterly indicator helps analysts track actual inflation in the UK. The indicator dropped to 3.2% last month, a four-month low. If the indicator drops below the 3% level, this would mark the first time this has happened in almost four years.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.6231. The pair dropped to a low of 1.6133, but then reversed directions and climbed sharply, rising all the way to 1.6384. The pair closed at 1.6362, breaking through resistance at 1.6343 (discussed last week).

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We begin with resistance at 1.6990, which is protecting the key 1.70 level. This line has remained intact since October 2008.

Next is resistance at 1.6705, which has held firm since May 2011. This is followed by the round number of 1.6600.

1.6475 has held firm since August 2011. This is followed by 1.6343, which was breached last week for the first time since August 2011.

We next encounter resistance at 1.6247. This was a key resistance line in October and November 2012. It has reverted to support role as the pound continues to move higher.

1.6125 is providing the pair with support. This line has strengthened as GBP/USD trades at higher levels.

1.60, a key psychological barrier, is providing strong support. Next is 1.5893 which saw action earlier in November.

1.5752 is the final support line for now. It was breached in mid-September by the surging pound but has provided solid support since then.

I am neutral on GBP/USD.

The pound continues to fire on all engines and has gained over 400 points in the past four weeks. If this week’s British PMIs look good, the pound could post further gains. For its part, the dollar could flex some muscle if this week’s employment releases look sharp, as this would fuel speculation about QE tapering, which is a dollar-positive event.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.