GBP/USD suffered its worst week in 2017, losing 175 points. The pair closed the week at 1.2364. This week’s key events are the CPI and Claimant Count Change. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

In the US, employment data provided a mixed bag. The Non-Farm Payrolls report disappointed with only 98K jobs gained, but wage growth was steady and unemployment claims dropped sharply. The Fed minutes were slightly hawkish, leaving room for additional hikes. In the UK, PMI reports were mixed, with Services PMI beating the estimate, while Manufacturing Production posted a second straight decline.

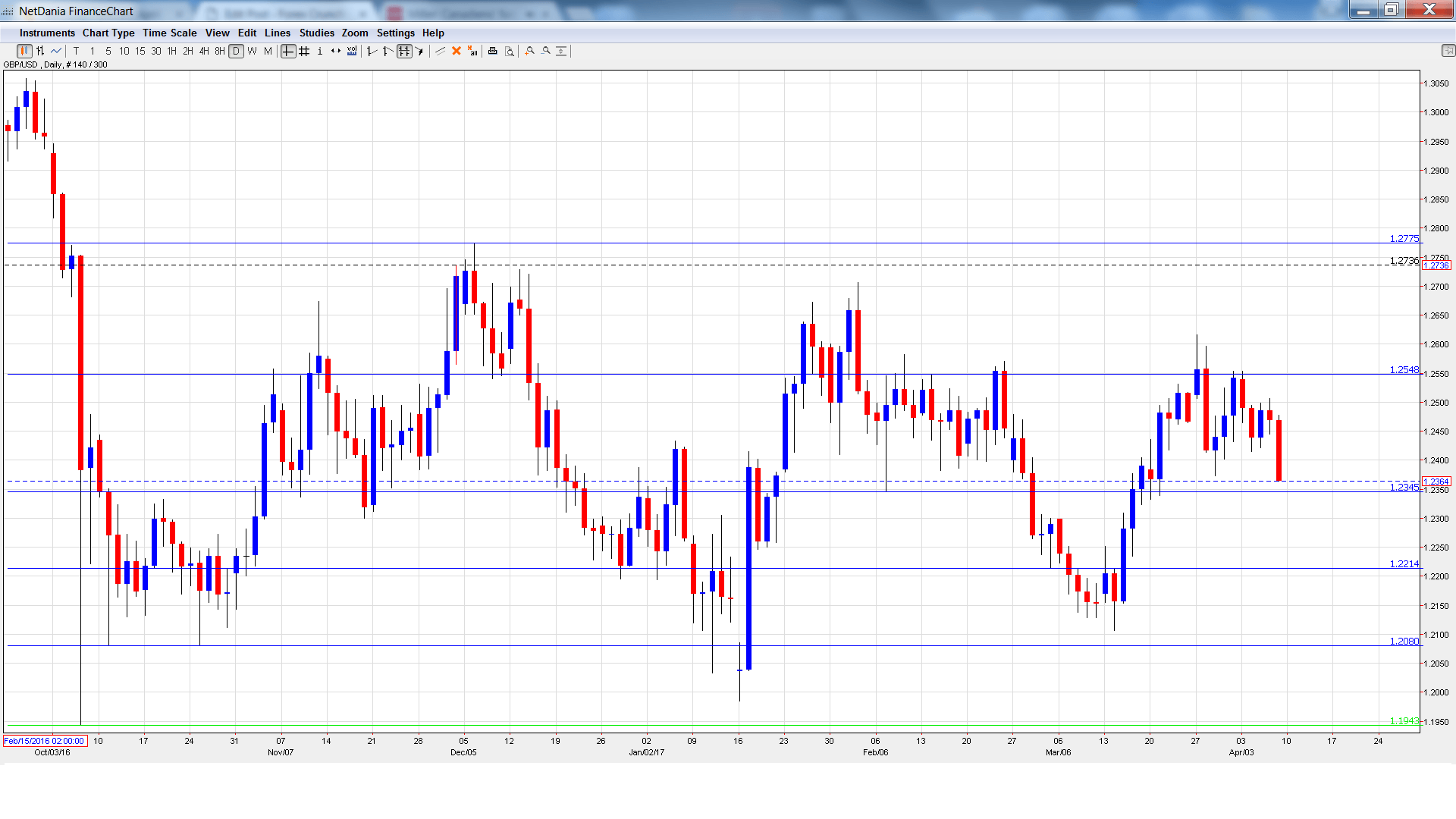

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:01: The indicator dipped to 54.6 in February, shy of the forecast of 55.7 points. The indicator is expected to rebound in March, with an estimate of 55.1 points.

- CPI: Tuesday, 8:30. CPI continues to move higher, The index climbed 2.3% in February, above the forecast of 2.1%. The upswing is expected to continue in March, with an estimate of 2.2%.

- PPI Input: Tuesday, 8:30. This indicator measures inflation in the manufacturing sector. The index disappointed in February with a decline of -0.4%, short of the forecast of +0.2%. The markets are expecting another decline, with an estimate of -0.5%.

- RPI: Tuesday, 8:30. RPI includes housing costs, which are excluded from CPI. The index continues to move upwards and improved to 3.2% in February, above the estimate of 2.9%. The forecast for the March release is 3.1%.

- Average Earnings Index: Wednesday, 8:30. Wage growth has been slipping, and dropped to 2.2% in January, shy of the estimate of 2.4%. The downswing is expected to continue in February, with an estimate of 2.1%.

- Claimant Count Change: Wednesday, 8:30. This is one of the most important indicators and should be treated as a market-mover. Unemployment rolls have dropped three straight months, beating the estimate each time. Another decline is expected in March, with a forecast of -10.2 thousand. The unemployment rate edged lower to 4.7% in February, shy of the forecast of 4.8%. The rate is expected to remain at 4.7% in March.

- RICS House Price Balance: Wednesday, 23:01. This indicator provides a snapshot of the health of the housing sector. The indicator edged lower to 24% in February, within expectations. The downward trend is expected to continue in March, with an estimate of 22%.

- BoE Credit Conditions Survey: Thursday, 8:30. This report is released each quarter. Credit levels are closely watched, as they are linked to consumer and business spending.

- CB Leading Index: Thursday, 13:30. The index is based on 7 economic indicators. In January, the indicator improved to 0.4%, its strongest gain in over a year. Will the upward trend continue in the February release?

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2539 and quickly climbed to a high of 1.2554. Late in the week, the pair dropped to a low of 1.2364, as support held at 1.2345 (discussed last week). GBP/USD closed the week at 1.2364.

Live chart of GBP/USD:

Technical lines from top to bottom

With GBP/USD dropping sharply, we start at lower levels:

1.2775 has held in resistance since December 2016.

1.2548 is next.

1.2345 was a low point in February.

1.2213 is protecting the 1.22 level.

1.2080 is protecting the symbolic 1.20 level.

1.1943 is the final support level for now.

I am bearish on GBP/USD.

The US economy remains solid and the markets have circled June for the next Fed rate hike. Britain finally triggered Article 50, and tough negotiations between the UK and the EU could weigh on the pound.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.