GBP/USD dipped below the 1.29 line for the first time in a month, as the pair dropped 160 points last week. The pair just above the 1.209 level. This week’s key events are CPI and Claimant Count Change. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

It was another rough week for the pound, which lost ground as British data disappointed. Manufacturing Production posted a decline of 0.3% and the NIESR GDP estimate dipped to 0.3%. Over in the US, key numbers were dismal as retail sales and wholesale prices missed their estimates.

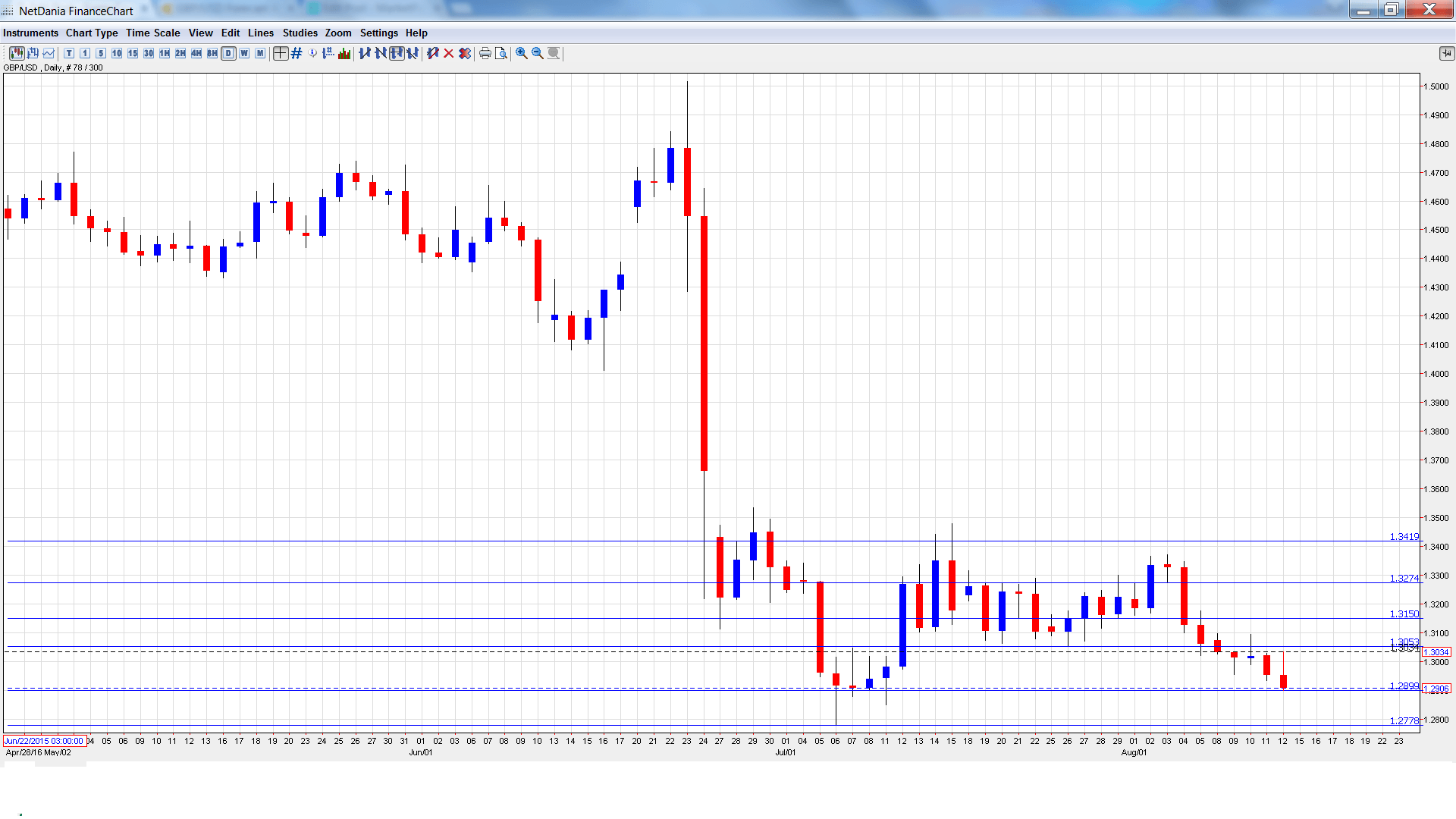

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This indicator provides a snapshot of the strength of the housing sector. The index posted a sharp drop of 0.9% in July, its first decline in 7 months. Will the indicator rebound into positive territory in August.

- CPI: Tuesday, 8:30. CPI is the most important consumer inflation indicator. In June, the indicator improved to 0.5%, edging above the estimate of 0.4%. An identical reading of 0.5% is expected in the July release.

- PPI Input: Tuesday, 8:30. This manufacturing inflation indicator dropped to 1.8% in June, but this was well above the forecast of 0.9%. The downward estimate is expected to continue in July, with a forecast of 0.6%.

- RPI: Tuesday, 8:30. This index includes housing prices, which are excluded from the CPI report. The indicator rose to 1.6% in June, above the forecast of 1.4%. The upward trend is expected to continue, with an estimate of 1.7%.

- Average Earnings Index: Wednesday, 8:30. This indicator measures wage growth in the UK, a closely watched event. The indicator improved to 2.3% in May, matching the forecast. The markets are expecting another strong reading, with an estimate of 2.5%.

- Claimant Count Change: Wednesday, 8:30. This indicator is one of the most important indicators and should be treated as a market-mover. In June, the indicator posted a negligible gain of 0.4 thousand, beating the forecast of 4.1 thousand. The estimate for July stands at 5.2 thousand. The unemployment rate is expected to remain at 4.9%.

- Retail Sales: Thursday, 8:30. This event is the primary gauge of consumer spending, a key driver of economic growth. The indicator declined 0.9% in June, worse than expected. The markets are expecting a small gain of 0.1% in the July release.

- Public Sector Net Borrowing: Friday, 8:30. The public sector deficit narrowed to GBP 7.3 billion in June, easily beating the forecast of GBP 9.3 billion. The markets are anticipating a rare surplus in July, with an estimate of -2.3 billion.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3072 and touched a high of 1.3096. The pair then reversed directions and dropped all the way to 1.2899, testing support at 1.2902 (discussed last week). GBP/USD closed the week at 1.2906.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We begin at 1.3419, which has held as resistance since mid-July.

1.3276 is next.

1.3149 has some breathing room following losses by GBP/USD.

1.3053 is protecting the symbolic 1.30 level.

1.2902 was tested and is a weak support line. It could see further action early in the week.

1.2778 was a cushion in mid-July.

1.2680 is the final support level for now.

I am bearish on GBP/USD.

The British economy has taken a hit from Brexit and the markets are bracing for more weak economic data out of the UK as we get additional third quarter numbers. The US economy is doing relatively well, despite last week’s hiccup from retail sales.

Our latest podcast is titled Carney King of Governors, Small in Japan

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.