GBP/USD managed to recover on some political calm but the moves were quite rocky, as Brexit negotiations are stuck. What’s next? Cable faces top-tier events: inflation, employment, and retail sales in a busy week. Here are the key events and an updated technical analysis for GBP/USD.

Brexit talks are in a deadlock over Britain’s divorce bill. That was the verdict from Michel Barnier, the EU’s top negotiator, that sent the pound lower. However, talk about a 2-year transition offer by the EU sent the pound higher. In the UK, the manufacturing sector is doing well but the trade deficit widened. Some Fed officials are becoming more worried about low inflation. Is it really transitory?

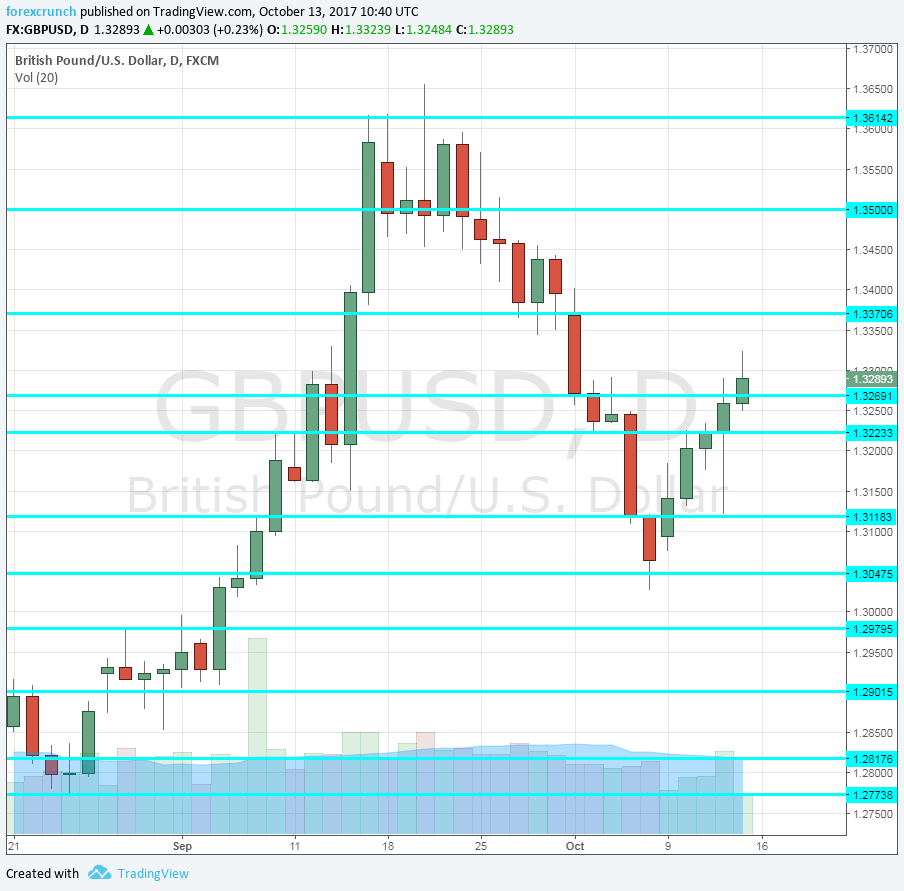

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This early report on house prices has shown two consecutive months of declines, with a drop of 1.2% in September.

- David Ramsden and Silvana Tenreyro talk: Tuesday, 8:15 for Ramsden and 9:15 for Tenreyro. These two members will appear in parliament for their confirmation hearings. Tenreyro is designated to be an external member of the MPC while Ramsden is designated as the deputy governor. These hearings provide an opportunity for them to express their opinions on monetary policy. Are they doves or hawks? In the recent rate decision, two members voted for an early rate hike while the rest opposed it. While a rate hike in November is priced in, future moves also depend on the composition of the Monetary Policy Committee.

- Inflation report: Tuesday, 8:30. Inflation is rising in the UK due to the weaker pound and also due to other reasons. In August, the annual level of headline CPI hit 2.9%, just under the 3% maximum target for the BOE. It is now expected to rise to 3%. Another acceleration can prompt further rate hikes. Core CPI is not lagging that much behind: 2.7% y/y and is now predicted to remain unchanged. The Retail Price Index has reached 3.9% and a small rise to 4% is projected now. The HPI cooled down 5.1% and is expected to rise to 5.4% now.

- Mark Carney talks: Tuesday, 10:15. The Governor of the Bank of England will also testify before the Treasury Select Committee. Markets will want to hear if the BOE intends to raise rates also after the expected hike in November. He tends to send mixed messages and change his mind quite frequently.

- Jobs report: Wednesday, 8:30. The number of jobless claims surprised with a drop of 2.8K in August. We now get the Claimant Count Change for September which is expected to show a rise of 3.2K. The unemployment rate in the UK hit record lows of 4.3% in July. and the same number is forecast for August Earnings remain the most important component: they stabilized at 2.1% in July and the same number is on the cards for August. Any rise implies higher inflationary pressures, while the drops dampen these expectations.

- Retail Sales: Thursday, 8:30. UK consumers exceeded expectations in the past three months, with retail sales jumping by 1% in August. This came after a slump beforehand. The publication triggers strong volatility, but it is usually short-lived. A drop of 0.1% is predicted now.

- Public Sector Net Borrowing: Friday, 8:30. Higher levels of borrowing by the government are frowned upon, but borrowing has been lower than expected in August, at 5.1 billion. A net borrowing of 5.7 billion is on the cards.

GBP/USD Technical Analysis

Pound/dollar failed to break above 1.3270 (mentioned last week) and dropped from there.

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.35 was the post-Brexit high and remains the top level.

It is followed by 1.3370 which capped the pair several times in 2016. The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

Uncertainty about Brexit continues weighing on the pound and a November hike is already priced in. Any miss on the data could imply that the hike is a “one off”. The US has its own troubles, but Brexit remains worse than Trump.

Our latest podcast is titled Good, bad and ugly NFP, Catalan crisis update

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!