- The GBP/USD started the week with bullish bets but lost momentum

- Demand in US Dollar can help in determining further directional bias

- Technically, the breakout of range (1.3860 – 1.4000) will be decisive to find the next trend

In this week’s GBPUSD forecast we see the the British Pound starting Monday positively, marking a new intraday high a few pips below mid-1.3900 during the earlier London session. The upsurge occurred amid the optimism stemming from the receding pandemic.

Prime Minister Boris Johnson said that the remaining restrictions will be lifted on July 19 and promised to review the data and end the restrictions even as early as July 5.

However, the GBP/USD pair could not retain its gains and declined below the 1.3900 handle as US dollar demand surged across the board.

Fundamental outlook – dovish BoE sends Sterling to April lows

Despite no clear signals on US inflation, investors are cautious whether the Fed will react if price pressure does not stop increasing. It helped US treasury yields to halt the downside and lend some support to the Greenback.

Fed Chair Jerome Powell had said during his testimony before House Select Subcommittee the previous week that inflation is escalating amid unexpressed demand and congestion in supply. He also reiterated that price pressure should settle on its own. However, the Core PCE Price Index rose to 3.4% y/y in May last Friday, the highest level since 1992.

On the other hand, the Bank of England came up with a dovish stance last week that pushed the British Pound towards April lows. However, the recent optimism related to diminishing pandemic and the lifting of restrictions can limit further downside.

In the absence of any major economic release from the UK or the US, the US dollar’s price dynamics will be significant for further directional bias.

Technical outlook – support at 1.3868

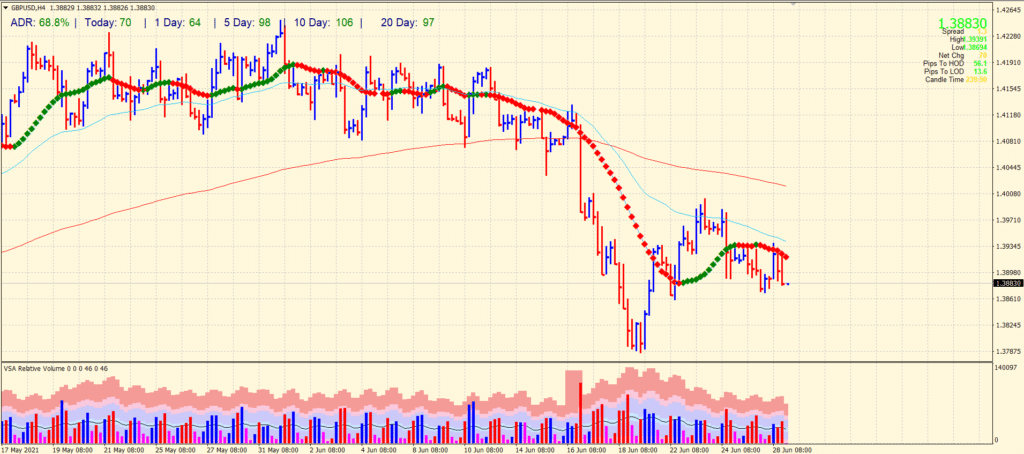

Technically, the price remains capped by the 20-period SMA on the 4-hour chart. The 50 and 200 SMA on the same chart are also pointing towards the downside.

The last two volume bars show an incline above the average line, while the recent price bar is widespread. It shows that the path of the least resistance lies on the downside.

However, a little broader view suggests that the GBPUSD price lies within a large range of 1.3860 to 1.4000, and any breakout of the range will give clear directional bias to the traders.

Immediate support lies around the Friday lows at 1.3868. If the price breaks this level, the next support can be found near 1.3820-30, an order block for the pair.

On the flip side, our GBPUSD forecast sees immediate resistance lies at 1.3940 (today’s high and 50-SMA) ahead of 1.3950. Finally, the price may test the 1.4000 psychological mark ahead of 200-SMA at 1.4020.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.