GBP/USD climbed to 9-week highs but was unable to consolidate and posted small losses last week. The pair closed the week at 1.3262. There are nine events this week. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

The ISM Non-Manufacturing PMI sagged to 51.4 points, its worst showing since 2010. In the UK, Services PMI surprised by pointing to expansion, while Manufacturing Production was a disappointment, with a decline of 0.9%.

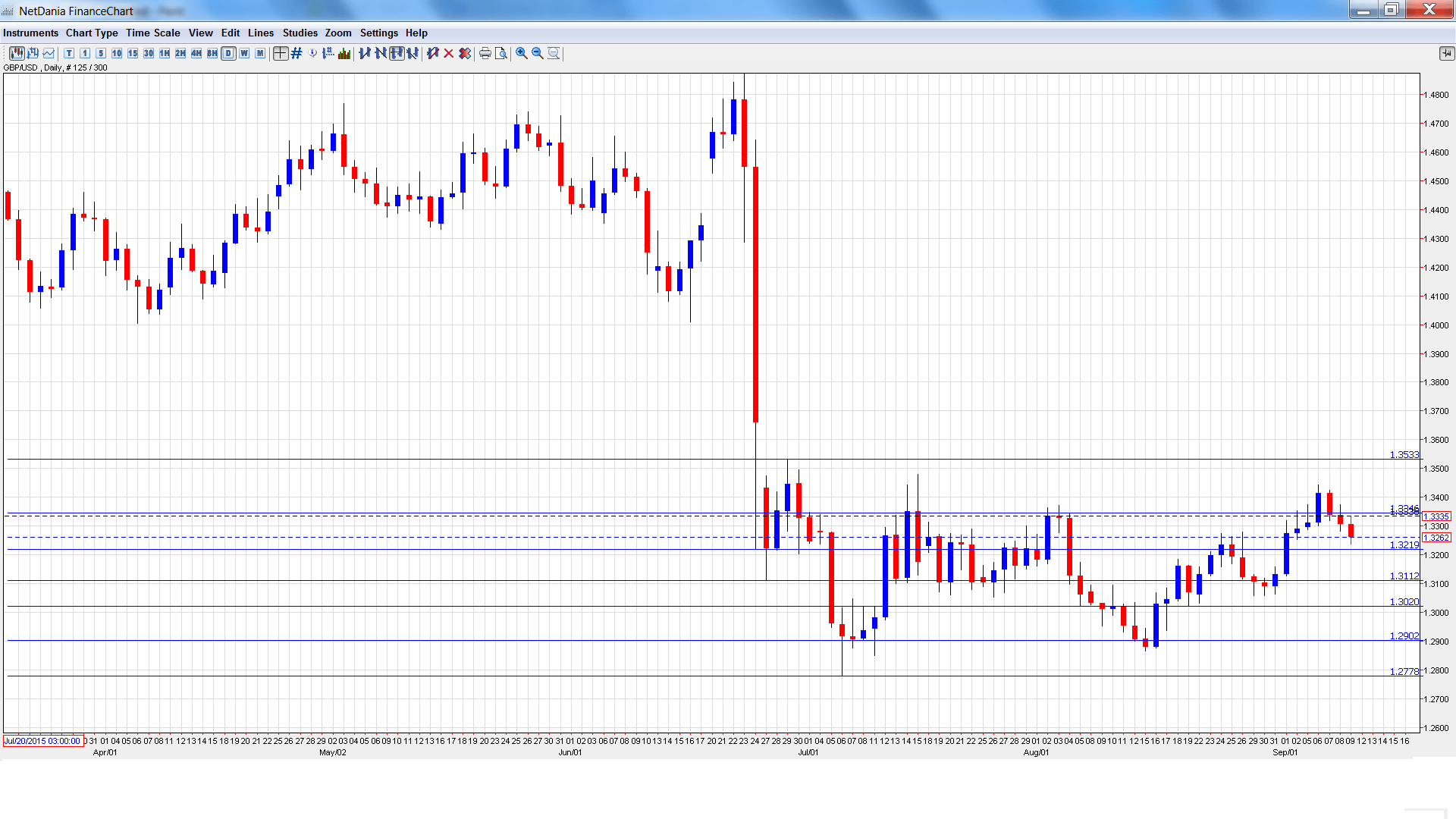

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 13:30. This minor event is based on 7 economic indicators. The past two releases have seen declines, and the markets will be hoping for a change in the July report.

- CPI: Tuesday, 8:30. CPI is the most important consumer inflation indicator. In July, the indicator edged up to 0.6%, above the estimate of 0.5%. The upswing is expected to continue in August, with an estimate of 0.7%.

- PPI Input: Tuesday, 8:30. This manufacturing inflation indicator jumped to 3.3% in July, crushing the forecast of 0.6%. The estimate for the August report stands at 0.6%.

- RPI: Tuesday, 8:30. This index includes housing prices, which are excluded from the CPI report. The indicator improved to 1.9% in July, above the forecast of 1.7%. Another strong reading is expected in August, with an estimate of 1.8%.

- Average Earnings Index: Wednesday, 8:30. This indicator measures wage growth in the UK, a closely watched event. The indicator edged up to 2.4% in June, close to the estimate of 2.5%. A softer reading is expected in July, with a reading of 2.1%.

- Claimant Count Change: Wednesday, 8:30. This indicator is one of the most important indicators and should be treated as a market-mover. In July, jobless claims dropped 8.6 thousand, much better than expected. The estimate for August stands at +1.7 thousand. The unemployment rate is expected to remain at 4.9%.

- Retail Sales: Thursday, 8:30. This event is the primary gauge of consumer spending, a key driver of economic growth. The indicator posted a strong gain of 1.4% in July, much stronger than the estimate of 0.1%. The markets are braced for a downturn in the August report, with an estimate of 0.1%.

- Official Bank Rate: Thursday. 11:00. The markets are still abuzz after the BoE’s historic 1/4 point rate cut in August to 0.25% The BoE is not expected to make a move at the September meeting. The BoE will also release the breakdown of the August vote, which is expected to be unanimous (9-0).

- Asset Purchase Facility: Thursday, 11:00. The BoE took dramatic action in August, expanding the asset-purchase program from GBP 375 billion to GBP 435 billion. No change is expected in the September decision. The BoE will publish the breakdown of the August vote, which is expected to be unanimous (9-0).

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3293 and touched a high of 1.3444. The pair then reversed directions and dropped to a low of 1.3238, as support held firm at 1.3219 (discussed last week). GBP/USD closed at 1.3262.

Live chart of GBP/USD:

Technical lines from top to bottom

We start at 1.3667, which provided a cushion from 2009 all the way to the Brexit crash in June 2016.

1.3533 has been a resistance line since late June.

1.3346 was a cap in August.

1.3219 is currently a weak support line. It held firm last week as the pair retracted after strong gains.

1.3112 marked a low point in June.

1.3020 has provided support since mid-August.

1.2902 is protecting the 1.29 line.

1.2778 was a cushion in mid-July. It is the final support line for now.

I remain neutral on GBP/USD.

British numbers have been generally strong in the third quarter, despite fears of an economic backlash from the Brexit vote. Will the good news continue? In the US, there is a reasonable likelihood that the Fed will press the rate trigger in December, but a final decision will depend on key US numbers.

Our latest podcast explains what really happens on jobs day.

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.