GBP/USD rose for a third straight week, as the pair gained 160 points. GBP closed slightly below the 1.33 line. This week’s key events are Services PMI and the Manufacturing Production. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

The pound received a boost from strong numbers in the manufacturing sector. British Manufacturing PMI improved sharply in August, pointing to expansion and easily beating expectations. GBP/USD also took advantage of a weak NFP in the US, as the indicator plunged to 151 thousand, well short of the forecast of 180 thousand.

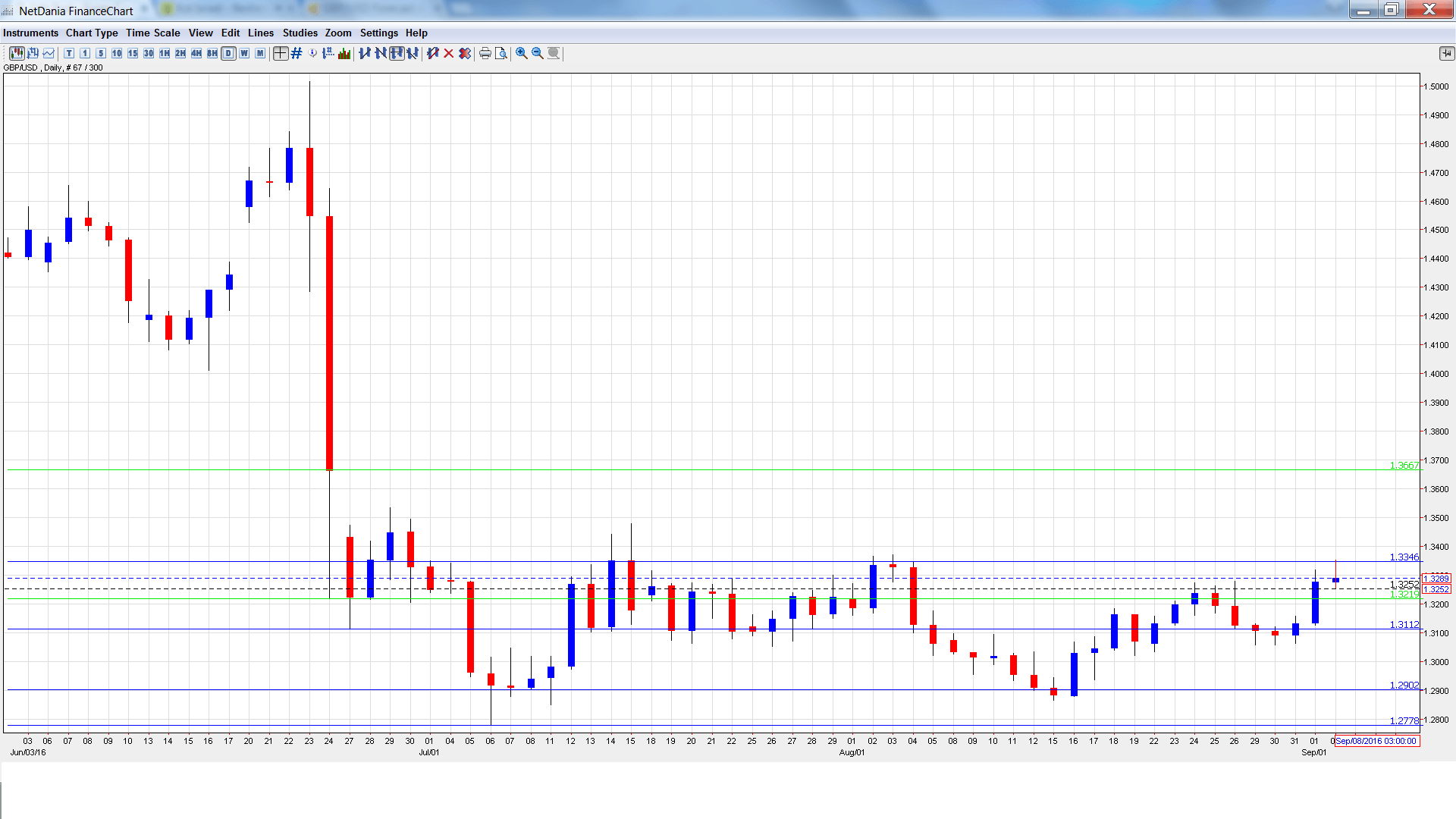

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Services PMI: Monday, 8:30. Services PMI has posted two straight readings of 47.4 points, pointing to contraction in the services sector. The indicator is expected to improve to 49.1 points in the August release. Will the indicator follow last week’s PMI reports and beat the estimate?

- BRC Retail Sales Monitor: Monday, 23:01. This indicator gauges retail sales in BRC shops. The indicator rebounded in July with a gain of 1.1%.

- 10-year Bond Auction: Tuesday, Tentative. The yield on 10-year bonds dropped sharply to 0.91% in July, down from 1.66% in May. Will the indicator rebound in the September release?

- BRC Shop Price Index: Tuesday, 23:01. The BRC Shop Price Index continues to post declines and came in at -1.6% in the June release. This indicator precedes the official CPI reading by one week.

- Halifax HPI: Wednesday, 7:30. This indicator provides a snapshot of the level of activity in the housing sector. In July, the index posted a sharp decline of 1.0%, well short of the forecast of -0.1%. The estimate for the August release is -0.3%.

- Manufacturing Production: Wednesday, 8:30. This key indicator has posted two straight declines, and another drop of -0.4% is expected in July, with a forecast of -0.4%. Will the indicator surprise the markets with a reading in positive territory?

- BOE Deputy Governor Jon Cunliffe Speaks: Wednesday, 9:15. Cunliffe will speak at an event in Brussels. A speech which is more hawkish than expected is bullish for GBP/USD.

- Inflation Report Hearings: Wednesday, 13:15. BoE Governor Mark Carney will testify on inflation and the UK’s economic outlook before a parliamentary committee. The markets will be listening closely for hints regarding the BoE’s future monetary policy.

- NIESR GDP Estimate: Wednesday, 14:00. This monthly indicator helps analysts predict GDP, which is released every quarter. In July, the indicator slipped to 0.3%, marking a 3-month low.

- RICS House Price Balance: Wednesday, 23:01. This housing inflation indicator dropped to just 5% in July, well short of the forecast of 19%. The downward trend is expected to continue, with an estimate of 2%.

- Goods Trade Balance: Friday, 8:30. This indicator is closely watched as it is closely linked to currency demand. The goods trade deficit widened to GBP 12.4 billion in June, higher than the estimate of a deficit of GBP 9.6 billion. The estimate for the deficit in July stands at GBP 11.7 billion.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3125 and touched a low of 1.3058, as support held firm at 1.3053 (discussed last week). The pair then reversed directions and climbed to a high of 1.3289.

Live chart of GBP/USD:

Technical lines from top to bottom

We start at 1.3667, which provided a cushion from 2009 all the way to the Brexit crash in June 2016.

1.3514 has been a resistance line since late June.

1.3346 was a cap in August.

1.3222 is next.

1.3112 marked the low point in June.

1.2902 is protecting the 1.29 line.

1.2778 was a cushion in mid-July.

1.2680 is the final support level for now.

I am neutral on GBP/USD.

British numbers have been solid in the third quarter, despite fears of an economic backlash from the Brexit vote. In the US, the timing of the next move remains unclear but, the direction is clear: a rate hike.

Our latest podcast is titled Ready your rate radar

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.