The recovery in the UK was led by the housing sector. For long months, the construction PMI was the leader of the PMI pack, climbing above 60 for a few months, reflecting very strong growth. Prices of homes in London not only recovered but also passed their pre-crisis levels.

Things have cooled down recently, with more stable and widespread growth. And ahead of the referendum, the UK economy had already slowed down: some of it is related to the uncertainty around the referendum and some related to a slowdowns in other places in the world. Brexit cannot be blamed for everything.

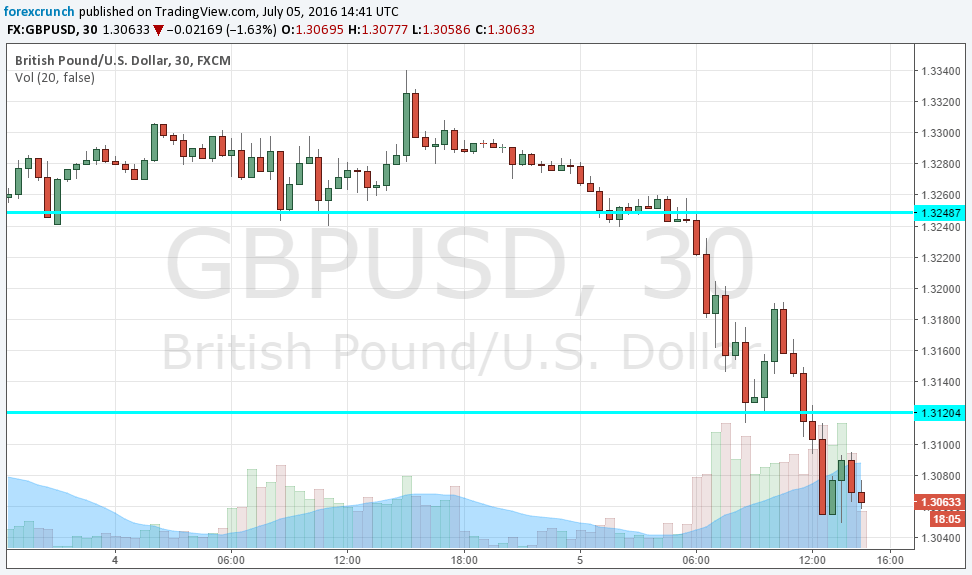

Update: GBP/USD bounces off 1.3000 – New post-Brexit low

Aviva joins Standard Life in Fund Freeze

Yet after Brexit became reality, the housing sector could be back in the limelight for bringing the economy down. Construction PMI has tumbled down to 46 points, the lowest since 2009. Both Standard Life and Aviva have announced a moratorium on withdrawals from property funds. Investors seeking to cash out from these funds just cannot do it.

This is a reaction to a stampede: investors are rushing to the exits in these funds. The other way of dealing with this kind of move is to sell properties quickly. Real estate does not work quickly and having to sell commercial and residential properties quickly means selling them at “firesale” terms, very low prices, making the losses worse for investors.

What’s worse: getting some money out now or being unable to get hold of the locked cash while you hope for calm?

There’s no clear answer in these unclear times.

35 billion pounds are invested in these property funds. So far, a small part has been affected yet there is fear of a domino effect.

It is quite uncommon to see such moves from funds use emergency measures. When Standard Life made their announcement, it could have been seen as a one-off: one specific fund suffering from quick withdrawals and perhaps some mismanagement. When it’s two, the amount of noise rises.

It already leads to a slide in property shares are sliding. And so is the pound.

Will other funds halt withdrawals? It’s quite probable. Is some of the move irrational? Of course, but Brexit is a huge event and cycles can be vicious.

And the fall is not limited to the housing sector. There is a good correlation between housing and the wider economy, not just in the UK.

More: Brexit – all the updates in one place