GBP/USD was down this week, dropping 150 pips, to close at 1.5860. The upcoming week has five releases. Here is an outlook for the upcoming events, and an updated technical analysis for GBP/USD.

Despite a mixed bag of employment figures coming out of the US, the dollar staged a strong rally against the pound. The markets gave a thumbs up to the dollar last week, after the FOMC March meeting minutes indicated that the Fed will not launch a third round of quantitative easing unless the rate of growth falters or inflation drops below the central bank’s 2% targeted rate.

Updates: GBP/USD is up slightly, trading at 1.5875. The markets are waiting for the release of RICS House Price Balance later today. RICS House Price Balance came in at -10%, better than the market forecast of -12%. CB Leading Index rose to 1%, the best reading since May 2010. GBP/USD is trading at 1.5837. BRC Retail Sales Monitor came in with a strong performance, up 1.3%. This was the indicator’s highest reading since January. The pound rebounded, as GBP/USD climbed over the 1.59 level. The pair is trading at 1.5922. Trade Balance, disappointed, coming in at -8.8B, a five-month low. The markets had forecast a reading of -7.7B. GBP/USD continues to move upwards, trading at 1.5956.

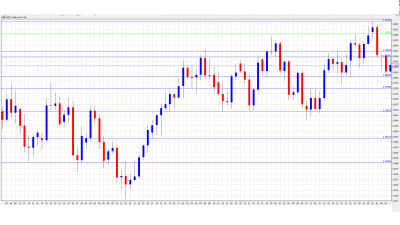

GBP/USD graph with support and resistance lines on it. Click to enlarge:

-

RICS House Price Balance: Monday, 23:01. This diffusion index is based on surveyed property surveyors. The index has been steadily climbing – the March reading of -13% was actually the index’s best reading since August 2010. The market forecast calls for a slight improvement, to -12%.

-

CB Leading Index: Tuesday, 9:00. This composite index, based on seven economic indicators, jumped 0.9% in March, the highest increase since May 2010. Another strong reading would be bullish for the pound.

-

BRC Retail Sales Monitor: Tuesday, 23:01. After starting the year well, the indicator sagged, posting two straight readings of -0.3%, indicating weakness in the retail sales sector. Will the indicator bounce back and climb into positive territory this month?

-

Trade Balance: Thursday, 8:30. The UK posted a trade balance deficit of 7.5B in March. The market forecast calls for little change in April.

-

PPI: Friday, 8:30. The Producer Price index jumped 2.1% in March, its highest reading since May 2011. The market forecast for April is a lower reading of 1.3%.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.6011. The pair climbed as high as 1.6062, but was unable to break the resistance line of 1.6065 (discussed last week).The pair then dropped sharply, staying just above the 1.58 level, at 1.5805. The pair recovered slightly, closing the week at 1.5858.

Technical levels from top to bottom

We begin with 1.6356, which has provided GBP/USD with strong resistance since August 2011.This is followed by the resistance line of 1.6265, which was last tested in July and August 2011.

Below, 1.6132 has provided resistance since November 2011, and has strengthened as the pound has sagged. The next line of resistance is at 1.6065, which was last tested in November of last year. This is followed by the psychologically important line of 1.60, which was again breached this week, as the dollar pushed hard against the pound.

This is followed by 1.5923, which just last week, was providing support to the pair, It has now changed to a resistance line. Close by is the support level of 1.5892, which was breached the pair this week, and is a line of weak resistance.

Next, 1.5805 is providing GBP/USD with weak support. It could fall if the pair continues to move in a downward direction Close below, 1.5750 is the next resistance line. It has provided the pair with support since mid-March. This is followed by 1.5639, which has been in a support level for the past several weeks.

Below is 1.5520, which has provided strong support since January. We conclude for now with the round number of 1.54, which has acted in a support role going back to September 2011.

I remain neutral on GBP/USD.

After taking a beating from the British pound for much of 2012,the dollar managed to push back and rallied against the pound, and the pair is now trading in the mid-1.58 range. Is this a short-lived correction, or will we again see the important 1.60 level under attack? With the US economy sending out mixed signals, the sentiments of traders and investors as to the health of the US economy may be a key factor in the direction taken this week by GBP/USD.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss franc, see the USD/CHF forecast.