GBP/USD made the most of low liquidity in holiday markets last week, gaining about 150 points. The pair closed at 1.6476. This week’s highlights are Manufacturing and Construction PMIs. Here is an outlook for the main events moving the pound, and an updated technical analysis for GBP/USD.

The pound managed to post sharp gains last week despite strong US numbers. Unemployment claims fell sharply and New Home Sales beat the estimate, but this wasn’t enough to keep the dollar from taking a tumble.

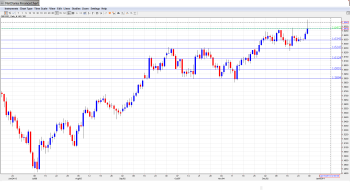

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Housing Equity Withdrawal: Monday, 9:30. This quarterly indicator helps gauge demand and activity in the UK housing market. The indicator slumped to -15.4 billion pounds in Q2, a multi-year low. The markets are expecting an improvement in Q4, with an estimate of -7.2 billion.

- Manufacturing PMI: Thursday, 9:30. Manufacturing PMI continues to rise, and the index hit 58.4 points last month, its highest level since February 2011. Little change is expected in the November reading.

- Nationwide HPI: Friday, 7:00. This housing price index measures inflation in the housing sector, which is an indication of the amount of activity in the UK housing market. The index dropped to 0.6% in October down from 1.0% a month earlier. This matched the forecast. The markets are expecting an improvement in the upcoming release, with the estimate standing at 0.8%.

- Construction PMI: Friday, 9:30. Construction PMI continues to point to impressive expansion in the construction sector, as the index jumped to 62.6 points last month, a multi-year high. The markets are expecting another excellent reading for November, with an estimate of 62.3 points.

- BOE Credit Conditions Survey: Friday, 9:30. The BOE releases this survey on a quarterly basis, which magnifies the importance of each release. Analysts are interested in data on debt levels of consumers and businesses, as rising debt means more spending which translates into stronger economic growth.

- Net Lending To Individuals: Friday, 9:30. This indicator looks at the amount of credit issued to individuals. Higher debt levels mean that consumer confidence and spending is on the rise. The indicator dropped to 1.7 billion pounds in October, short of the estimate of 2.1 billion. The estimate for the November release stands at 2.0 billion.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.6329. The pair dropped to a low of 1.6322, but then reversed directions and barreled past the 1.64 line, climbing to a high of 1.6578, as resistance at 1.6600 (discussed last week) held firm. The pair then retracted, closing the week at 1.6428.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We begin with resistance at 1.6990, which is protecting the key 1.70 level. This line has remained intact since October 2008.

Next is resistance at 1.6705, which has held firm since May 2011. This is followed by the round number of 1.6600. This line was under pressure as the pound jumped on Friday but remained intact.

1.6475 continues to be busy and was breached for the second straight week. GBP/USD ended the week at 1.6476, so this line could see some activity early in the week.

This is followed by 1.6343, which was breached for a fifth straight week. It has some breathing room as GBP/USD trades at higher levels.

1.6247 continues to provide the pair with support. This was a key resistance line in October and November 2012.

1.6125 is the next support level. This line has held steady since late November.

The round number of 1.60, a key psychological barrier, is providing strong support.

The final support level for now is 1.5893, which last saw action in November.

I am neutral on GBP/USD.

The pound rally continues, as the currency has climbed close to the 1.65 line. If British PMIs continue to improve, the pound could post further gains. At the same time, the Fed finally announced a QE taper and with the markets anticipating more tapering in the near future, we could see the dollar move higher.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.