UK Chancellor of the Exchequer George Osborne has not spoken out since the historic Leave vote the EU by British voters. Analysts expected some kind of soothing measure for markets, especially given the timing: an hour before trading opens in London. His personal future is also very uncertain. On Friday, PM Cameron announced he would be stepping down while BOE Governor Carney offered some calming worlds to markets.

Update: No mercy for the pound: 3 recent developments and a new 31 year low

Osborne Statement

He began his speech by patting himself on the back. The people have spoken. He fully accepts the results. The British economy will have to adjust. There are three particular challenges:

- Volatility in financial markets: Markets were not prepared but there are contingency plans. We and the PRA have worked closely with everybody in order to get ready for a Leave. The BOE is ready. Carney’s statement was coordinated with Osborne. They are in touch and ready with more contingency plans. In contact with international players. “It will not be plain sailing” but prepared for everything.

- Uncertainty regarding the new relationship: Cameron gave us time with a delay of triggering Article 50. He also supports taking his time. There will be no changes during this period regarding financial rules, travel, work, etc. However, some companies are making decisions based on the results and this could be worrisome. Osborne calls companies to continue investing.

- Long term terms with Europe: Osborne wants to take part in the negotiations. “I don’t want the UK to turn its back on allies”. Osborne is focused on stabilizing markets and does NOT resign.

He will address political issues in the next few days and currently focused on his jobs.

Osborne Q&A

- On an emergency budget, he says that the new PM will have to deal with that. No comments on his “punishment budget” suggested before the referendum. “There would have to be action in the Autumn”.

- Will he serve in a Brexit government? He basically dodges the question.

- Insists that fundamentals are strong. There will be an adjustment.

That’s it. Lots of open questions left.

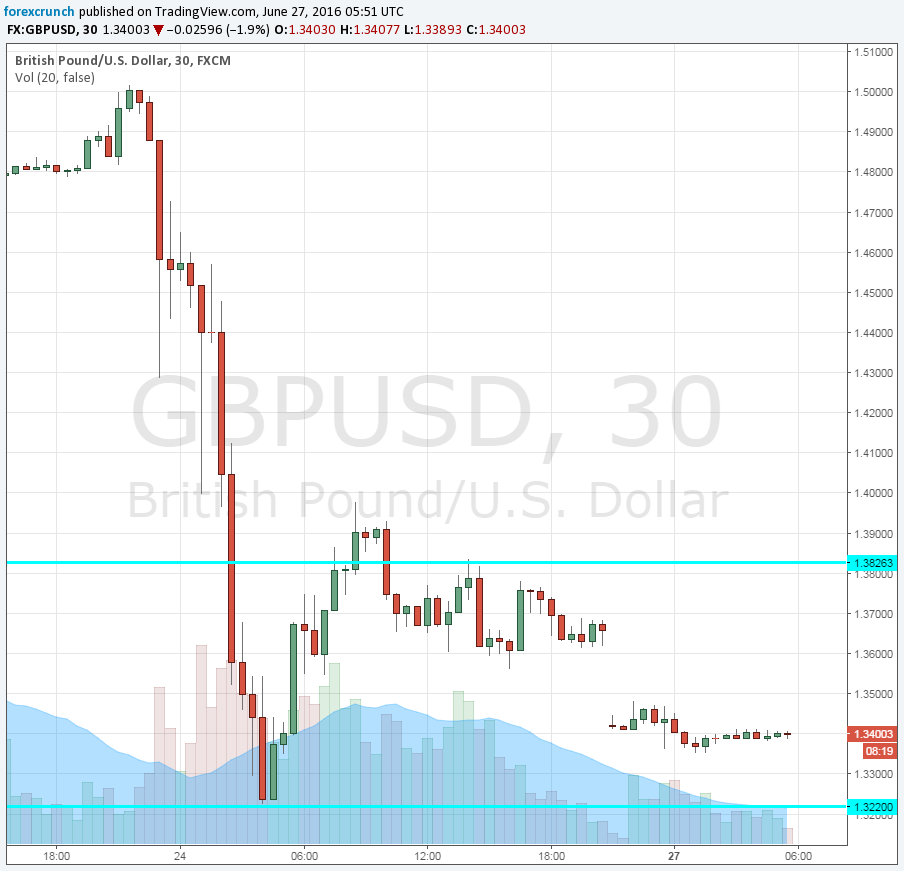

Update: GBP/USD reacts with a rise: the pair advances some 60 pips to 1.3450. In normal days it would have been a big rise, but today this is just a small move.

GBP/USD started the week with another fall – a weekend gap sent cable to as low as 1.3354, trading within a lower range. The weekend’s developments were not favorable at all to say the least. It traded around 1.3385 just before Osborne opened his mouth.

More: Brexit – all the updates in one place