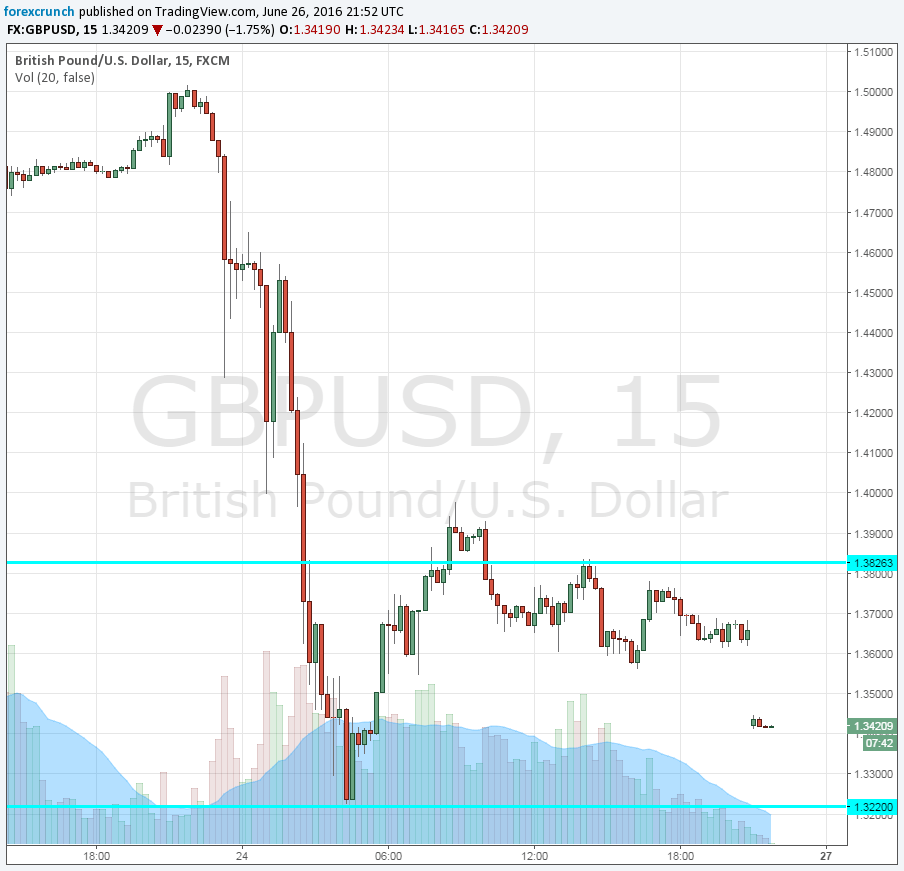

GBP/USD opens the new week with a weekend gap worth 1.75% and trades at 1.3418 at the time of writing. This is plunge of 240 pips. While we may some a bounce once new liquidity comes in, there are good reasons for the fall as Brexit sinks in.

Here are 9 reasons for this fresh fall, all are fallouts from the historic EU Referendum:

- Brexit is a huge event: The scrambling around on Friday, the resignation of Cameron and the words of comfort from the Bank of England all helped some kind of recovery. Traders with red eyes after a sleepless night took profits in a crazy day. After the rush, the magnitude of this huge event sank in, and its quite depressing.

- Moody’s negative outlook: A credit rating cut for the UK’s perfect AAA rating is on the cards following the Brexit. This may be echoed by other agencies.

- Banks Brexit: London is one of the biggest financial centers in the world. While the stock exchange is not the world’s No. 1, in terms of forex trading, London is The Capital. With reports like this, of banks moving out, the big boys of FX trading also have to think about their personal future. This does not improve the mood, to say the least.

- Uncertainty about Scotland: The Scottish government is beginning to negotiate its staying in the EU, regardless of the Brexit. And in addition and as expected, a second independence referendum is on the cards, as they have always said after the 2014 referendum.

- Tory civil war: Cameron stepped down and it seemed that Boris Johnson will inherit Cameron as PM and implement Brexit. However, there is a new Never Johnson camp promoting Theresa May, the pro-Remain Interior Minister. More uncertainty.

- Labour civil war: And if the Tories fail, the opposition is totally torn. A Corbyn Coup is emerging but no one is really ready to lead instead.

- Bregret: Many voters suddenly do not understand why they voted Leave. They thought it would not matter and some did not understand the consequences. Searches such as “what is the EU” surged on Google, but after the vote. In addition, some 3 million pro-Remain voters have signed a petition for having a different referendum.

- Brexit, how exactly?: Cameron left the hot potato of triggering the exit via Article 50 to the next PM. This is a dirty political bomb and Boris Johnson seemed very depressed in his first public appearance after the vote. He cannot really celebrate as the Brexit blame could swiftly move from Cameron to Johnson. And it’s unclear if Johnson really wanted a Brexit, or just an address in Downing street.

- Europe’s mixed response: France and EU officials want the UK to immediately trigger Article 50 and end uncertainty as soon as possible. The crashes in financial markets and the prospects of a recession are scaring them. However, Germany seems to go with the UK’s flow to take its time. Some thought that the EU would get its act together after this gigantic wake-up call, but so far, it isn’t happening.

Here is the chart: