A better than expected inflation read from Germany: annual inflation is now 1.8%, a jump from 1.5% in October. Month over month, prices are up 0.3%. We have the same numbers in both the national and HICP measures.

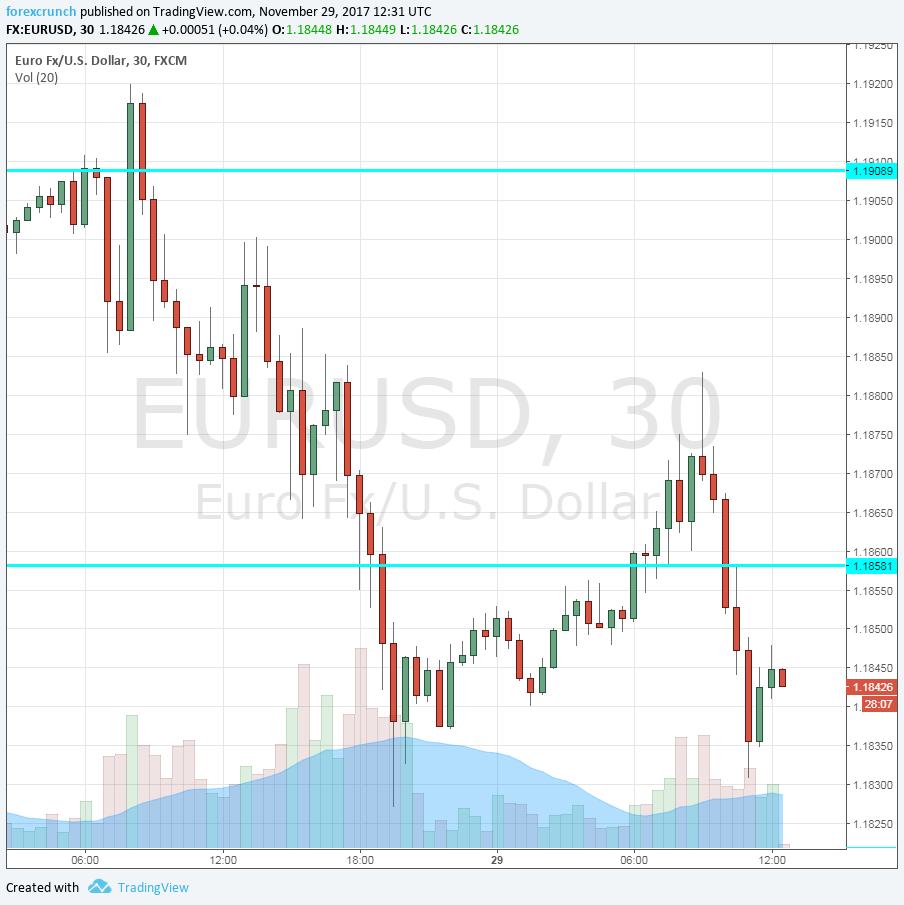

EUR/USD is not really enjoying it, extending the slide and reaching 1.1825. Perhaps it was the early data from the German states that changed expectations. Yet there is a better chance that the strength of the US dollar just has the upper hand.

Support is close, at 1.1820. Further support awaits at 1.1780, followed by 1.1720.

Germany was expected to report a rise in the HICP from 1.5% in October to 1.7% in the preliminary read for November. Month over month, an increase of 0.3% was predicted after 0% beforehand. HICP is the European standard. The national figure was also predicted to increase to 1.7% y/y and by 0.2% m/m.

EUR/USD stabilized around 1.1850 ahead of the publication. Earlier in the week, it lost some ground and this can mostly be attributed to the rise of the US dollar. The greenback enjoyed Powell’s confirmation that the Fed is set to raise rates in December and the upbeat data from the US, especially new home sales.

Earlier, Spain reported a lower-than-estimated inflation of 1.6%, worse than 1.7% predicted. We will soon receive an update on US GDP, which is expected to see an upgrade from 3% to 3.3% in Q3.

More: EUR/USD shows signs of exhaustion – technical analysis