The US dollar traded higher against most major currencies, but looks like GOLD managed to climb higher. There is a nice bullish trend formed for GOLD, which if continues to hold might take the yellow metal prices higher in the near term. The recent releases in the US were not that great, which kind of helped the US dollar to some extent. There is a major release lined up today during the late NY session, as the FOMC meeting minutes will be published. It has been always a market mover and might cause a lot of moves in GOLD moving ahead. If there is even a slight disappointment, then GOLD might surge higher.

More: EUR/USD crashes below 1.1830 on EZ deflation, Paris attack

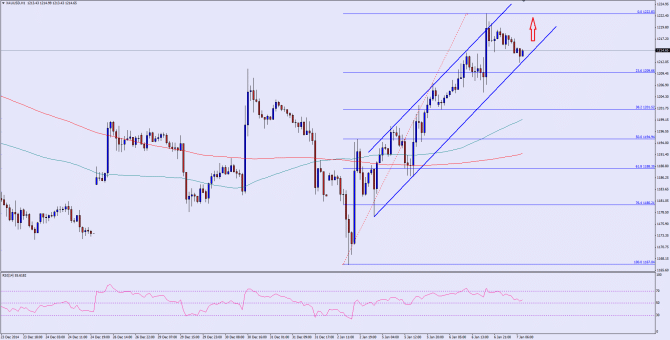

There is a nice ascending bullish channel formed on the hourly chart of GOLD, which is acting as a catalyst for more upside. Currently, GOLD is testing the channel support area, which is protecting a break in GOLD. The 23.6% fib retracement level of the last leg from the $1167 low to 1222 high is just below the channel support area. So, there is a chance that GOLD might hold the downside and trade back higher in the near term. If sellers manage to clear the channel support, then it might open the doors for more downsides in the near term. GOLD might head towards the 100 hour moving average in that situation.

On the upside, initial resistance is around the last high of 1222. A beak above the same might call for a move towards the 1250 level.

Overall, one might consider buying dips as long as GOLD is trading above the channel support area.

————————————-

Posted By Simon Ji of IKOFX