- The US data could bring sharp movements later today.

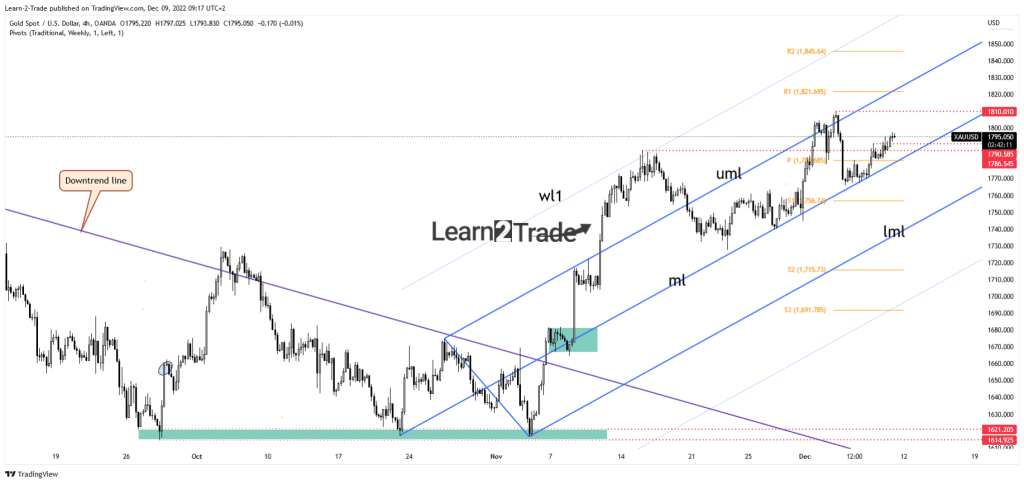

- The bias is bullish as long as it stays above the median line (ml).

- A new higher high activates further growth.

Gold price turned to the upside, trading at $1,795, far above the weekly low of $1,765. The bias remains bullish, so further growth is favored.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

The precious metal jumped higher even though the RBA and BOC increased the interest rates as expected. The US Unemployment Claims came in at 230K last week, matching expectations above 226K in the previous reporting period.

Today, the US is to release high-impact data, so the fundamentals should remain in the driving seat. The PPI is expected to report a 0.2% growth. Core PPI may also report a 0.2% growth versus 0.0% growth in the previous reporting period, while Prelim UoM Consumer Sentiment could increase from 56.8 points to 56.9 points.

In addition, the Final Wholesale Inventories could register a 0.8% growth, while the Prelim UoM Inflation Expectation indicator will also be released.

The US inflation data, FOMC, ECB, SNB, and BOE, could majorly impact XAU/USD next week. Most likely, the price of gold could register sharp movements around these high-impact events.

Gold price technical analysis: Bullish bias remains intact

Technically, the bias remains bullish as long as it stays above the median line (ML) of the ascending pitchfork. It has passed above the 1,786 and 1,790 immediate resistance levels. The $1,810 higher high represents an immediate target for the buyers. An upside continuation could be activated by a new higher high.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The upper median line (UML) represents a dynamic resistance and a potential target. An upside continuation could be invalidated by a valid breakdown below the median line (ML). A valid breakdown may announce a sell-off and bring new shorts. Consolidating above $1,790 and the median line, retesting these support levels could trigger a new upside momentum. As you can see on the 4-hour chart, the median line (ML) rejected the price and stood as strong dynamic support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.