XAU/USD has caught a bid following the testimony of US Federal Reserve Chairman Jerome Powell, where he rebalanced last week’s comments which were interpreted as hawkish, with a more dovish tone.

Gold is currently priced at $1783 against the US dollar, although attempts to break through $1790 have proved a bridge too far for now.

The yellow metal dropped its most in 15 months last week after expectations increased that the Fed would bring forward rate increases in order to ward off inflation.

Going into the testimony yesterday gold fell further as the US dollar firmed, but today it has arrested that decline.

Powell affirms Fed in dovish mode

In this testimony Powell reaffirmed that the Fed was taking an “as long as it takes” approach to the economy, with a bias towards repairing the employment situation, stressing that that could take time.

On inflation he also indicated that the central bank would be taking a wait and see approach in terms of the data and still expected heightened inflation to be transitory and the result of the bounce back from the pandemic and related supply bottlenecks.

“We will not raise interest rates pre-emptively because we think employment is too high [or] because we fear the possible onset of inflation,” Powell said in his testimony to the House committee. “Instead, we will wait for actual evidence of actual inflation or other imbalances.”

Market participants are now waiting for clues from the US Markit PMI reading today as to the progress of the US economy.

The dovish stance from Powell notwithstanding, XAU/USD upside appears to be capped by weak Treasury yields and the strengthening dollar.

Inflation is a curse for gold and other non-yielding asset classes, but Powell more dovish tone has certainly helped gold today as it reinforces the belief that inflation will indeed be transitory.

Gold price forecast: XAU/USD technical analysis

US dollar strength will be the key determinant of the gold price in the near term. As the dollar increases in value , it means currencies priced in the dollar but bought with non-dollar currencies will become more expensive, thus weakening demand.

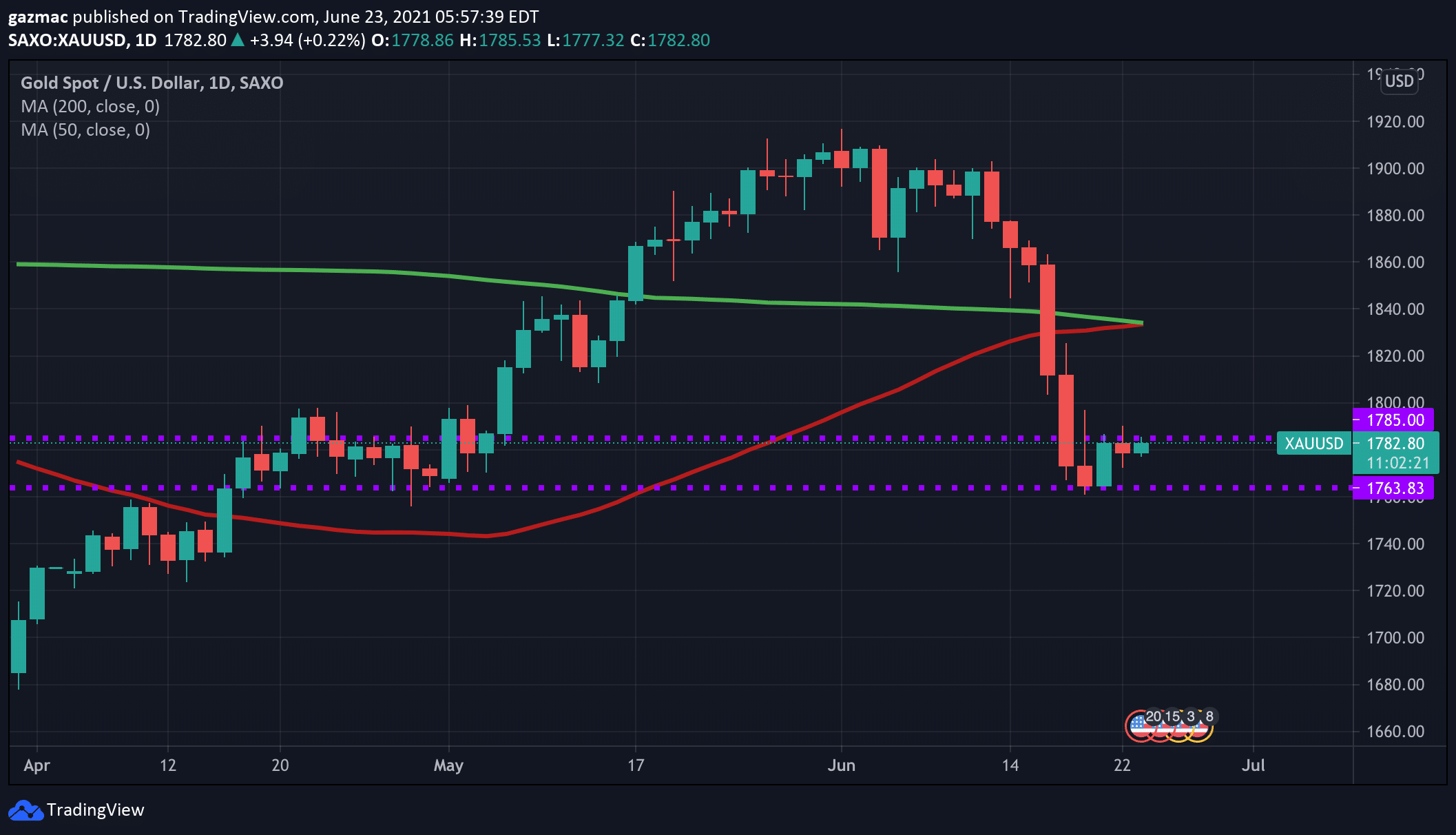

Zooming in to the 4-hour chart, XAUUSD needs to break above 1785 to make further progress. Rejection at that level will likely signify a period of rangebound trading, with 1785 the upper end and 1763 the lower end of the band.

Gold is being lifted by the Powell dovishness and setbacks in controlling the pandemic in Asia.

The failure on 16 June to hold above the 50-day MA at 1823 on the daily chart proved decidedly bearish for gold, but conversely a successful challenge would

Forex traders will be keeping a watching brief on the eurozone and the US preliminary Manufacturing and Services PMI data this week in order to assess the extent of the global recovery.

Looking to buy or trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.