- The bias remains bearish after failing to stay above the median line.

- The US and Canadian data should move the rate.

- A new lower low activates more declines.

The gold price is trading in the red at $1,921 at the time of writing. It seems undecided in the short term. However, the US and Canadian economic data should bring life to the XAU/USD.

After the manufacturing and services data was disappointing on Friday, the yellow metal stayed above the $1,920 psychological level.

Today, the fundamentals should move the markets. The Canadian Consumer Price Index may report a 0.4% growth in May versus the 0.7% growth in the previous reporting period. Furthermore, Core CPI, Median CPI, Trimmed CPI, and Common CPI data will also be released.

The upcoming US CB Consumer Confidence report is highly anticipated, with expectations for a rise from 102.3 to 103.9 points.

There are a few economic updates to keep an eye on this month. New Home Sales are projected to decrease to 677K from 683K in April, while the Richmond Manufacturing Index may report a score of -12 points.

Additionally, Durable Goods Orders may show a 0.8% decline, but Core Durable Goods Orders could see a 0.0% increase. Based on this economic data, it’s expected that the XAU/USD will likely reach new lows in the short term.

Gold price technical analysis: Distribution phase

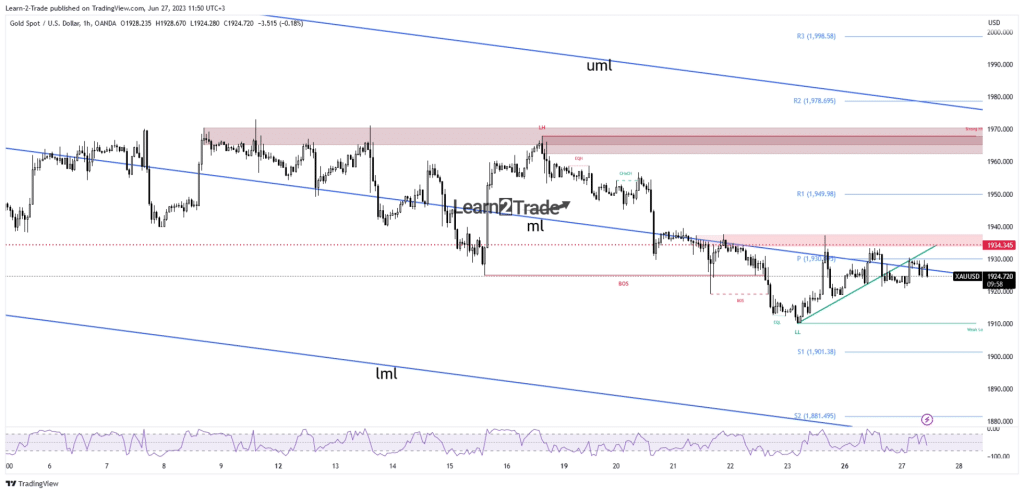

As you can see on the hourly chart, the XAU/USD moves sideways in the short term. It retested the median line (ml) of the descending pitchfork and the weekly pivot point (1,930) and then turned to the downside again.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

The bias is bearish in the short term; the sideways movement could represent a distribution formation. Its failure to stay above the median line (ml) confirmed strong sellers. Only a new higher high will invalidate a larger drop. A new lower low activates further drop ahead.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money