Goldman Sachs the investment banking giant still do dont consider Bitcoin to be an asset class according to the recent client phone call.

The call was hosted by Sharmin Mossavar-Rahmani, Chief Investment Officer of Goldman Sach’s Investment Strategy Group (ISG).

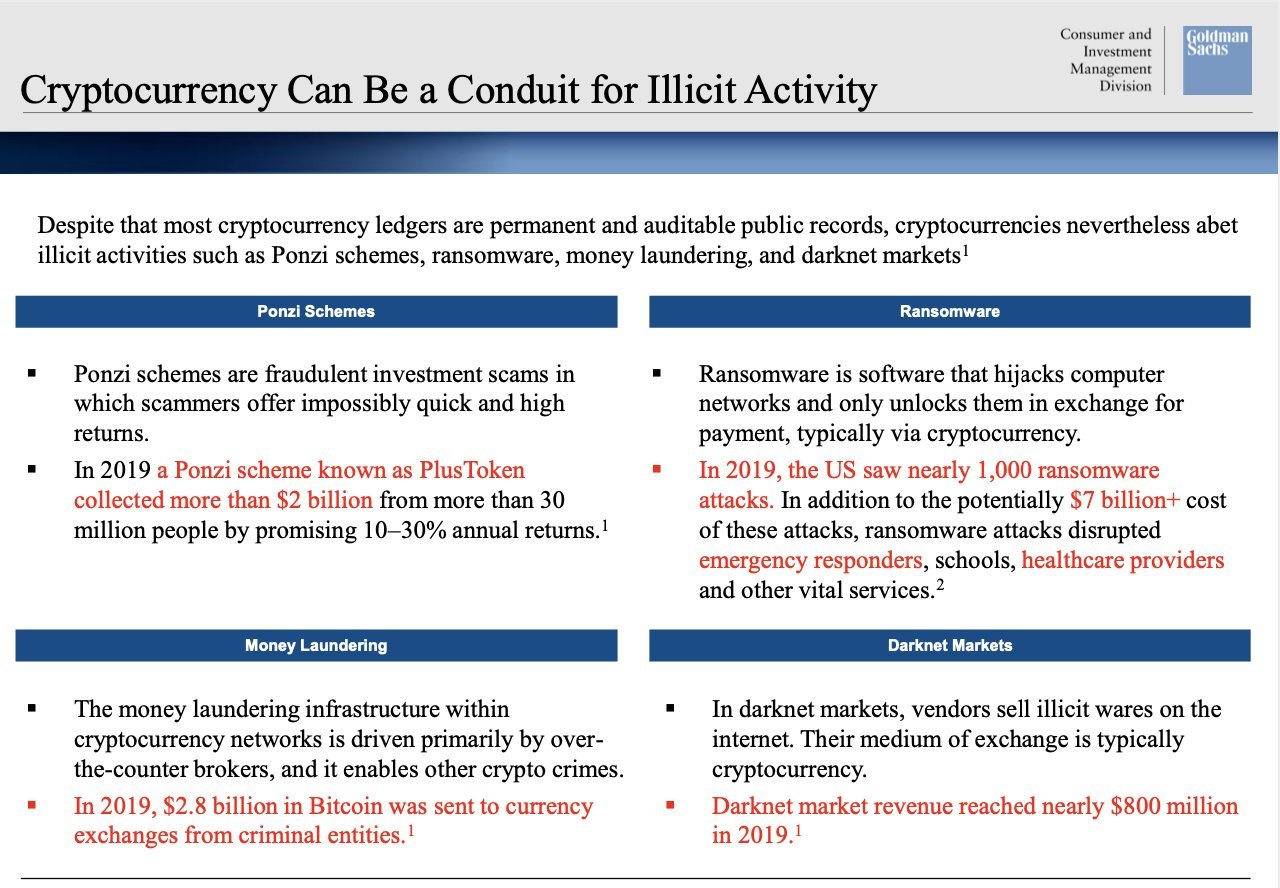

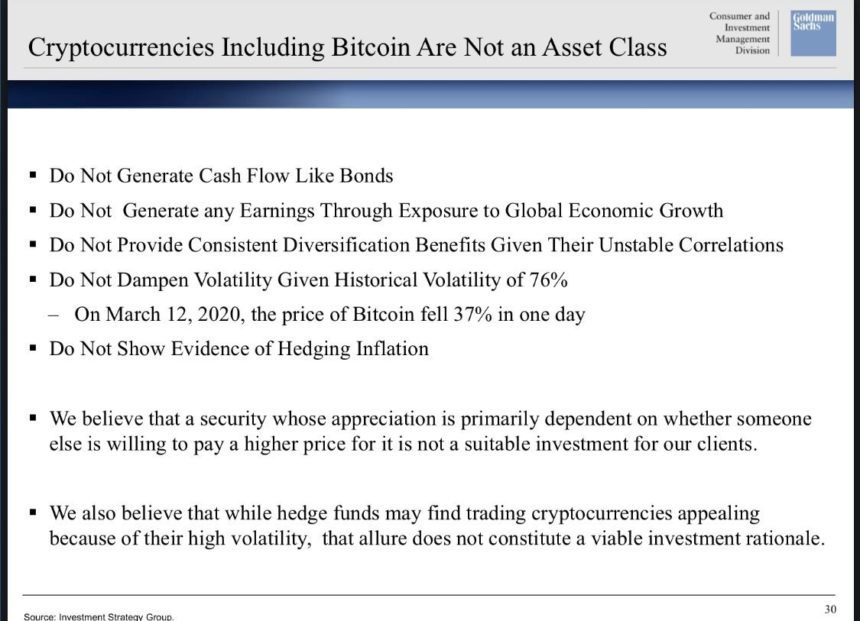

Interestingly, one of the biggest concerns is the fact that Bitcoin is used for illicit activities. This does not make too much sense as normal fiat currencies are used for many illegal transactions. Also, the fact that they do not generate cash flow. There are many asset classes that banks invest in that do not generate cash. For example gold, some banks lease gold but it does not generate a return like bonds or dividends from equities.

It’s clear to see that Goldman Sachs will not be adding BTC to their list of asset classes anytime soon. It must be said that some banks have had a history of putting out negative notes on securities and loading up themselves. Not for one second is that the suggestion here but nothing can be ruled out.

Below are a few key slides from the presentation: