- Uncertainty clouds Bitcoin market as the Chinese New Year draws nigh.

- The Chinese New Year tends to hurt Bitcoin year in, year out.

- Bitcoin struggles to overcome the hurdle at the 200 SMA on the 4-hour chart, adding credence to the bearish outlook.

The Chinese New Year also referred to as the Lunar New Year, is coming up on February 12. It is celebrated based on the traditional Chinese calendar. The holiday day stands out for its impact on Bitcoin, leading to a drop in the leading cryptocurrency price. This year’s event is just around the corner, and this article explores the trend and what to expect in the days preceding the holiday.

Why Bitcoin tends to correct with the Chinese New Year

The 2021 New Year celebrations will begin on Friday, February 12, and culminate on Tuesday, February 15. An unusual situation over the three days is that most Over-the-Counter (OTC) services will be closed in China, consequently creating high volatility in the cryptocurrency market.

In addition to the OTC desks closing, most businesses, factories and plants close during the holiday to give employees time to travel and be with their families. In addition to China, Hong Kong, which is among the biggest crypto hubs globally, Korea and Singapore celebrate the New Year.

How has the Chinese New Year impacted Bitcoin price in the past

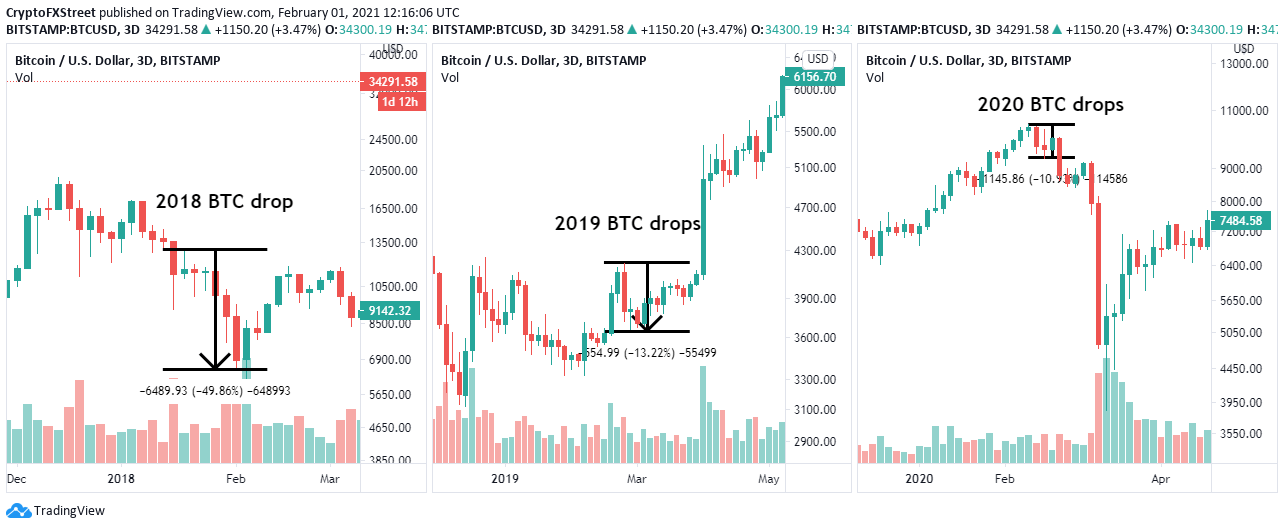

Every year, Bitcoin has posted a substantial dip in the price in the days leading to the Chinese New Year. For instance, a massive 50% downswing took place in 2018, with BTC plummeting from $12,000 to $6,000.

A similar drop took place in 2019, but the impact was not as significant as the one in the preceding year. Bitcoin tanked from levels around $4,200 to the support at $3,650.

In 2020, Bitcoin rallied on the first day of the Chinese year, breaking above the then stubborn resistance at $9,000 to highs around $10,500. However, the holiday’s impact came into the picture on the second day, which led to a correction to levels slightly above $9,000. Consequently, Bitcoin continued with the downtrend as the pandemic (COVID-19) struck global financial markets in March 2020.

BTC/USD 3-day chart

Critical takeaway points

The annual drop in the price of Bitcoin before or during the Chinese New Year could is due to the merrymakers’ cashing out’ for the holidays. Investors prefer to sell some of their holdings to fit the holiday budget.

Interestingly, Bitcoin mining remains unaffected during the New Year celebrations. Mining remains uninterrupted because the hashrate always holds steady. Note that Bitcoin mining requires less workforce; therefore, it makes sense to leave the plants operational.

Bitcoin price recovery encounters massive barrier

Bitcoin retreated sharply following last week’s tremendous upswing to $38,000. Support at $32,000 remained intact, halting the losses. Recovery has been steady, but BTC seems to have run into an immense barrier at the 200 SMA on the 4-hour chart.

As overhead pressure increases below the moving average, Bitcoin might break down further. Holding above $32,000 remains critical to the uptrend to $40,000. However, if broken, BTC could slump to $30,000 and perhaps embark on a massive gains-trimming exercise toward $22,000.

BTC/USD 4-hour chart

It is worth mentioning the bullish outlook will be validated if BTC closes the day above the 200 SMA. This will encourage more buyers to join the market, thereby building the tailwind behind the pioneer crypto asset. A confirmed breakout past $38,000 will sabotage the pessimist outlook.

%20-%202021-02-01T154642.052-637477812708448613.png)