Good news from the US: the services sector is on the move. the ISM Non-Manufacturing PMI jumps to 56.5 points, showing solid growth rather than mediocre growth. The employment component advanced from 49.7 to 52.7 points – rise from slight contraction into growth area. This is a good sign for the jobs report. This rebound could imply a rebound in jobs, so needed after May’s terrible report.

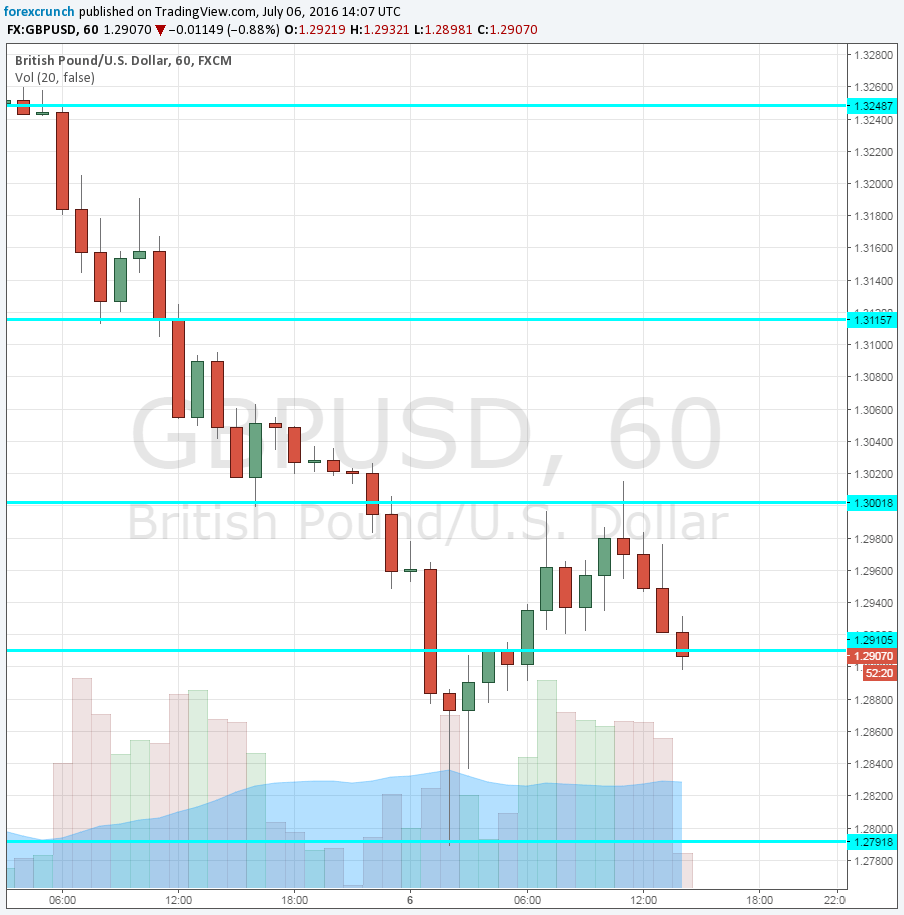

The USD is slightly stronger with a 10 pip gain against EUR/USD. USD/JPY makes a bigger move to 101.10.. GBP/USD struggles at low ground.

New orders, the forward looking component, jumped from 54.2 to 59.9 points. Prices paid are stable at 55.5.

The ISM Non-Manufacturing Purchasing Managers’ Index was expected to rise to 53.3 points in June from 52.9 in May. The services sector is the largest in the US. The survey and especially the employment component both serve as a hint towards Friday’s Non-Farm Payrolls report.

Earlier, Markit’s Services PMI was revised up to 51.4 points, 0.1% above the initial publication by 0.1% below expectations.

Ahead of the publication, EUR/USD traded around 1.1080, GBP/USD around 1.2950 and USD/JPY at 100.80. Among commodity currencies, USD/CAD was around 1.3020, AUD/USD at 0.7490 and NZD/USD at 0.7110. All in all, there is a clear “risk off” mood in markets.

The ISM Manufacturing PMI slightly surprised to the upside, with the employment component rising above the 50 point mark separating growth and contraction. The survey may have been influenced by Brexit, the dominating theme in markets in the past two weeks.

Tomorrow’s we’ll get the ADP Non-Farm Payrolls report, yet another hint towards the NFP.

A second significant round of selling has sent GBP/USD below 1.30. However, after the initial slide to 1.2791, we had a recovery and the pair remains relatively close to this round level.